Horizontal Analysis of Financial Statements

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 13, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Horizontal analysis: definition.

Horizontal analysis is an approach to analyzing financial statements .

It compares historical data, which includes ratios and line items, over a series of accounting periods. The accounting period can be a month, a quarter, or a year.

This method of analysis is also known as trend analysis .

The horizontal method of analysis is used to identify changes in financial statements over time and assess those changes.

A base year is initially selected as a benchmark. Either the data of the rest of the years is expressed as a percentage of the base year or an absolute comparison is performed. The base year comparison is known as base year analysis .

This method of analysis makes it easy for the financial statement user to spot patterns and trends over the years.

An absolute comparison involves comparing the amount of the same line of the item to its amounts in the other accounting periods. For example, comparing the accounts receivables of one year to those of the previous year. Any changes are analyzed then.

In percentage comparison, the increase or decrease in amounts is expressed as a percentage of the amount in the base year.

For example, if the base year amount of cash is $100, a 10% increase would make the current accounting period’s amount $110, whereas a 10% decrease would be $90.

Different ratios, such as earnings per share (EPS) or current ratio , are also compared for different accounting periods.

Horizontal Analysis: Explanation

Horizontal analysis focuses on the dollar and percentage changes that occur in specific accounts from year to year.

Determining the percentage change is important because it links the degree of change to the actual amounts involved. In this way, percentage changes are better for comparative purposes with other firms than are actual dollar changes.

For example, a $1 million increase in General Motors' cash balance is likely to represent a much smaller percentage increase than a corresponding $1 million increase in American Motors' cash balance.

To calculate percentage changes, you can use the following formula:

Percentage change = (Amount of dollar change / Base year amount) x 100

The base year is always the first year in the comparison.

For example, suppose that Safeway's total current assets were $1,729,146,000 in 2018 and $1,861,389,000 in 2019. This represents a dollar increase of $132,243,000 and a percentage increase of 7.65%, which is calculated as follows:

Percentage change = ($1,861,389,000 - $1,729,146,000 / 1,729,149,000) x 100

You can also use horizontal analysis in conjunction with both the balance sheet and the income statement .

In the example shown below, comparative balance sheets and income statements are given for Safeway Stores. The tables show the dollar and percentage changes.

Several interesting balance sheet changes are apparent in the tables below. In 2019, Safeway Stores increased its operating of fixed assets. There were rises of more than 12% in all categories of property other than transport equipment.

This increase in capital expenditures is also reflected on the liability side of the balance sheet. In particular, notes and debentures increased by over 53%.

In this discussion and analysis of operations, Safeway's management noted that the increase was due to a growing trend toward mortgage financing.

Comparative Balance Sheets With Horizontal Analysis

Comparative Income Statements With Horizontal Analysis

Horizontal analysis of income statements also produces worthwhile information.

For example, in Safeway Stores' balance sheets, both sales and the cost of sales increased from 2018 to 2019.

However, the percentage increase in sales was greater than the percentage increase in the cost of sales. This led to an increase in gross profit from 2018 to 2019.

Operating and administrative expenses also increased slightly and interest expense increased by over 12%. This resulted in only a slight increase in net income for 2019 over 2018.

The Usefulness of Horizontal Analysis

Consistency and comparability are generally accepted accounting principles (GAAP) .

Consistency is important when performing horizontal analysis of financial statements. When the same accounting standards are used over the years, the financial statements of the company are easier to compare and trends are easily analyzed.

Comparability means that a company’s financial statements can be compared to those of another company in the same industry.

Horizontal analysis enables investors, analysts, and other stakeholders in the company to see how well the company is performing financially.

A company’s financial performance over the years is assessed and changes in different line items and ratios are analyzed. Negative changes and trends are further investigated.

Horizontal analysis also makes it easier to detect when a business is underperforming.

For example, if a company starts generating low profits in a particular year, expenses can be analyzed for that year. This makes it easier to spot inefficiencies and specific areas of underperformance.

Ratios such as asset turnover, inventory turnover, and receivables turnover are also important because they help analysts to fully gauge the performance of a business.

For example, a low inventory turnover would imply that sales are low, the company is not selling its inventory, and there is a surplus. This could also be due to poor marketing or excess inventory due to seasonal demand .

Ratios such as earnings per share , return on assets , and return on equity are similarly invaluable. These ratios make problems related to the growth and profitability of a company evident and clear.

Liquidity ratios are needed to check if the company is liquid enough to settle its debts and pay back any liabilities . Horizontal analysis makes it easy to detect these changes and compare growth rates and profitability with other companies in the industry.

Let’s take a look at this simple example before we discuss any further.

Each item in a financial statement is compared to the base year. In this case, if management compares direct sales between 2007 and 2006 (the base year), it is clear that there is an increase of 3.2%.

This result would be concerning for the company's management. They would investigate this if they expected at least a 10% increase.

To provide another example, consider an investor who is seeking to invest and finds company C. Company C’s figures for the previous year are as follows: net income $2m and retained earnings $10m.

The current year's details are the following: net income $4m and retained earnings $12m. Net income has grown by 100% and retained earnings have increased by only 20%.

The investor now needs to make a decision based on their analysis of the figures, as well as a comparison to other similar figures.

Criticisms of Horizontal Analysis

Regardless of how useful trend analysis may be, it is regularly criticized.

One reason is that analysts can choose a base year where the company's performance was poor and base their analysis on it. In this way, the current accounting period (or any other accounting period) can be made to appear better.

Another problem with horizontal analysis is that some companies change the way they present information in their financial statements. This can create difficulties in detecting troublesome areas, making it hard to spot changes in trends.

Horizontal Analysis: Discussion

To conclude, it is always worth performing horizontal analysis, but it should never be relied upon too heavily. Other factors should also be considered, and only then should a decision be made.

Horizontal Analysis of Financial Statements FAQs

What is horizontal analysis.

Horizontal analysis is the use of financial information over time to compare specific data between periods to spot trends. This can be useful because it allows you to make comparisons across different sets of numbers.

How is the horizontal analysis performed?

By looking at the numbers provided by a company, you should see whether there are any large differences between one year and the next. It is also possible to perform this analysis with time series data to make direct comparisons with other companies.

When should the horizontal analysis be performed?

When Financial Statements are released, it is important to compare numbers from different periods in order to spot trends and changes over time. This can be useful in checking whether a company is performing well or badly, and identify areas where it may improve.

What does horizontal analysis involve?

Horizontal analysis involves looking at Financial Statements over time in order to spot trends and changes. This can be useful in identifying areas of concern for a business, as well as improving the performance of companies that are struggling.

Why is horizontal analysis important?

Horizontal analysis is important because it allows you to compare data between different periods and makes it easier to identify changes in trends. This can be helpful in making decisions about whether to invest in a company or not.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

All Subjects

Financial Information Analysis

Study guides for every class, that actually explain what's on your next test, horizontal analysis, from class:.

Horizontal analysis is a financial analysis technique that compares historical financial data over a series of periods to identify trends and growth patterns. This method helps in understanding how a company’s financial position and performance have changed over time, providing insights into its operational effectiveness and financial stability.

congrats on reading the definition of horizontal analysis . now let's actually learn it.

5 Must Know Facts For Your Next Test

- Horizontal analysis allows for both absolute and percentage changes to be evaluated, making it easier to spot significant trends in financial performance.

- This analysis is especially useful for investors and analysts in assessing the company’s growth trajectory and making informed decisions.

- By comparing multiple periods side-by-side, horizontal analysis helps identify anomalies or fluctuations that may require further investigation.

- This method is often used in conjunction with vertical analysis to provide a more comprehensive view of financial statements.

- Horizontal analysis can be applied to various financial statements, including the income statement, balance sheet, and cash flow statement.

Review Questions

- Horizontal analysis enhances the understanding of expense classification and analysis by allowing users to observe how expenses have changed over multiple periods. This technique highlights trends such as increasing or decreasing costs associated with specific categories, which can provide insights into operational efficiency. By comparing expense categories over time, stakeholders can better assess which areas require attention or improvement.

- Horizontal analysis contributes to effective financial statement preparation and presentation by providing a clear visual representation of changes in key financial metrics over time. This comparison makes it easier for preparers to highlight significant fluctuations that could impact decision-making. Additionally, presenting horizontal analysis alongside traditional financial statements allows stakeholders to quickly grasp performance trends, ultimately enhancing transparency and communication.

- Horizontal analysis can be utilized alongside financial ratios to enhance the assessment of an organization's short-term liquidity measures by revealing how liquidity metrics have evolved over time. For instance, while current ratios provide a snapshot of liquidity at a single point in time, horizontal analysis shows whether these ratios are improving or declining over several periods. This combined approach offers deeper insights into cash flow trends and the company's ability to meet its short-term obligations, highlighting areas that may need attention for better financial health.

Related terms

A technique used to evaluate changes in financial data over time, focusing on identifying patterns and predicting future performance.

Common-Size Financial Statements : Financial statements that present all line items as a percentage of a base figure, allowing for easier comparison across different periods or companies.

Vertical Analysis : A method of analyzing financial statements by expressing each line item as a percentage of a base amount within the same period, typically used for comparing different companies or different segments of the same company.

" Horizontal analysis " also found in:

Subjects ( 21 ).

- Accounting for Mergers, Acquisitions, and Complex Financial Structures

- Advanced Financial Accounting

- Business Decision Making

- Business Fundamentals for Public Relations

- Business Valuation

- Business and Economics Reporting

- Corporate Finance

- Corporate Finance and Financial Statement Analysis

- Corporate Strategy and Valuation

- Financial Accounting II

- Financial Statements: Analysis and Reporting Incentives

- Intermediate Financial Accounting 2

- International Accounting and Financial Reporting

- Intro to Business

- Introduction to Investments

- Investor Relations

- Operating and Financial Reporting Issues in the Financial Services Industry

- Predictive Analytics in Business

- Principles of Finance

© 2024 Fiveable Inc. All rights reserved.

Ap® and sat® are trademarks registered by the college board, which is not affiliated with, and does not endorse this website..

Horizontal Analysis: Metrics, Methods, and Applications

Discover how horizontal analysis can enhance financial decision-making through key metrics, methods, and practical applications.

Horizontal analysis is a crucial tool in financial statement analysis, offering insights into the performance and trends of an organization over time. By comparing historical data across multiple periods, stakeholders can identify patterns, growth trajectories, and potential red flags that may not be immediately apparent from a single set of figures.

This method allows for a more dynamic understanding of financial health, making it indispensable for investors, managers, and analysts alike.

Key Metrics in Horizontal Analysis

When conducting horizontal analysis, several metrics stand out as particularly informative. Revenue growth is often the first metric examined, as it provides a clear picture of how a company’s sales are evolving over time. By comparing revenue figures from different periods, analysts can gauge whether the company is expanding its market presence or facing challenges in maintaining its sales levels. This metric is especially useful for identifying seasonal trends or the impact of market conditions on the company’s performance.

Another important metric is the change in operating expenses. This helps in understanding how efficiently a company is managing its costs relative to its revenue. A significant increase in operating expenses without a corresponding rise in revenue could indicate inefficiencies or escalating costs that need to be addressed. Conversely, a decrease in operating expenses might suggest improved operational efficiency or cost-cutting measures that are bearing fruit.

Net income growth is also a critical metric in horizontal analysis. It reflects the company’s profitability after accounting for all expenses, taxes, and other deductions. By examining net income over multiple periods, stakeholders can assess the company’s ability to generate profit and sustain its operations. This metric is particularly valuable for investors who are interested in the long-term viability and profitability of the business.

In addition to these, changes in asset and liability levels are also scrutinized. An increase in assets might indicate growth and expansion, while a rise in liabilities could signal potential financial stress or increased borrowing. By analyzing these metrics together, a more comprehensive picture of the company’s financial health emerges.

Types of Horizontal Analysis

Horizontal analysis can be conducted using various methods, each offering unique insights into a company’s financial performance over time. Two primary types are Comparative Financial Statements and Trend Analysis.

Comparative Financial Statements

Comparative financial statements involve juxtaposing financial data from different periods side by side. This method allows stakeholders to easily spot changes in key financial metrics such as revenue, expenses, and net income. By presenting figures from multiple periods in a single view, it becomes straightforward to calculate the percentage change for each line item. This approach is particularly useful for identifying year-over-year growth or decline, making it easier to pinpoint specific areas of improvement or concern. For instance, if a company’s revenue has increased by 10% while its operating expenses have only risen by 5%, this could indicate improved operational efficiency. Conversely, if expenses are growing faster than revenue, it may signal potential issues that need to be addressed.

Trend Analysis

Trend analysis extends beyond simple period-to-period comparisons by examining data over a longer timeframe to identify consistent patterns or trends. This method is particularly valuable for understanding the long-term trajectory of a company’s financial performance. By plotting financial metrics over several years, stakeholders can discern whether the company is on a growth path, experiencing stagnation, or facing decline. Trend analysis can also help in forecasting future performance based on historical data. For example, if a company has shown steady revenue growth of 5% annually over the past five years, it might be reasonable to project similar growth in the near future. This method is especially useful for strategic planning and long-term investment decisions, as it provides a broader context for evaluating financial health.

Calculating Horizontal Analysis

Calculating horizontal analysis involves a systematic approach to comparing financial data across different periods. The process begins with selecting the financial statements to be analyzed, typically the income statement and balance sheet. These documents provide a comprehensive view of a company’s financial activities and position, making them ideal for horizontal analysis. Once the relevant financial statements are chosen, the next step is to identify the specific line items to be compared. Commonly analyzed items include revenue, operating expenses, net income, assets, and liabilities. By focusing on these key metrics, analysts can gain a deeper understanding of the company’s financial dynamics.

The actual calculation involves determining the absolute and percentage changes for each line item over the selected periods. To calculate the absolute change, subtract the earlier period’s figure from the later period’s figure. For instance, if a company’s revenue was $1 million last year and $1.2 million this year, the absolute change would be $200,000. The percentage change is then calculated by dividing the absolute change by the earlier period’s figure and multiplying by 100. In our example, the percentage change in revenue would be ($200,000 / $1,000,000) * 100, resulting in a 20% increase. This percentage change provides a clear and easily interpretable measure of growth or decline.

It’s also important to consider the context in which these changes occur. External factors such as economic conditions, industry trends, and competitive dynamics can significantly influence a company’s financial performance. For example, a rise in revenue might be attributed to favorable market conditions rather than internal improvements. Conversely, a decline in net income could be due to external economic downturns rather than operational inefficiencies. By contextualizing the numerical changes, analysts can derive more meaningful insights and avoid misleading conclusions.

Interpreting Horizontal Analysis Results

Interpreting the results of horizontal analysis requires a nuanced understanding of both the numbers and the broader context in which they exist. The first step is to look at the percentage changes in key financial metrics. A significant increase in revenue, for instance, might initially seem positive, but it’s essential to examine whether this growth is sustainable. If the revenue spike is due to a one-time event, such as a large contract or seasonal demand, it may not indicate long-term growth. Similarly, a decline in operating expenses could be a sign of improved efficiency, but it might also result from cost-cutting measures that could impact future operations.

The interplay between different financial metrics is another critical aspect to consider. For example, if revenue is growing but net income is declining, this could indicate rising costs or inefficiencies that are eroding profitability. Conversely, if both revenue and net income are increasing, it suggests that the company is not only growing but also managing its costs effectively. This holistic view helps stakeholders understand the underlying drivers of financial performance and make more informed decisions.

External factors also play a significant role in interpreting horizontal analysis results. Economic conditions, industry trends, and competitive pressures can all impact a company’s financial performance. For instance, a company operating in a booming industry might show impressive growth figures, but these results need to be weighed against industry benchmarks to assess true performance. Similarly, a company facing economic headwinds might show declining figures, but a closer look could reveal that it is outperforming its peers under the same conditions.

Applications in Financial Decision-Making

Horizontal analysis serves as a powerful tool in financial decision-making, providing valuable insights that can guide strategic planning, investment decisions, and operational improvements. For instance, by identifying trends in revenue and expenses, management can make more informed decisions about resource allocation. If the analysis reveals consistent revenue growth, the company might decide to invest in expanding its operations or entering new markets. Conversely, if the analysis shows rising expenses without a corresponding increase in revenue, management might focus on cost-control measures to improve profitability.

Investors also benefit significantly from horizontal analysis. By examining a company’s financial performance over multiple periods, investors can assess its growth potential and financial stability. For example, a company with steadily increasing net income and controlled expenses might be seen as a good investment opportunity. On the other hand, a company with fluctuating or declining financial metrics might be viewed as a higher risk. This detailed understanding helps investors make more informed decisions about buying, holding, or selling their shares.

Horizontal analysis is also invaluable for benchmarking purposes. Companies can compare their financial performance against industry peers to identify strengths and weaknesses. For example, if a company’s revenue growth is lagging behind industry averages, it might indicate a need for strategic changes. Similarly, if a company’s operating expenses are higher than those of its competitors, it might highlight areas where efficiency improvements are needed. This comparative approach helps companies stay competitive and align their strategies with industry best practices.

Weighted Average Cost Method: A Comprehensive Guide

Understanding net income: key factors and financial implications, you may also be interested in..., boosting cpa firm profit margins: strategies and trends, key components and methods in manufacturing cost accounting, understanding and addressing negative shareholders equity, the role and impact of international accounting standards.

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

Horizontal Analysis

By Victoria Collin |

September 23, 2021

What is “Horizontal Analysis”?

Horizontal Analysis is an analytical method used to compare financial statements – primarily the balance sheet and income statement – based on historical data, in order to uncover the financial performance of a company or companies over a specified period of time. To conduct horizontal analysis i.e. evaluate underlying trends, it’s essential to compare financial statements of a company or companies over two or more accounting periods.

Carrying out horizontal analysis of the income statement and balance sheet helps investors and creditors to determine the current financial position of a company. By looking at past performance, it can help assess growth rates, spot trends (by comparing changes from period to period), generate forecasts, or project the insights gained into the future. Horizontal analysis can help evaluate a company’s financial standing or position vis-à-vis its competitors.

Key Learning Points

- Horizontal analysis compares the financial performance of a company (or companies) over a given period of time by looking at the historical financial statements

- In horizontal analysis, the year-over-year changes (or alternative) in the line items of the financial statements of a company or between the base year (year 1) and year 3 or more are expressed in absolute terms ($) and in percentages (%)

- It is useful for uncovering trends in the financial performance of a company

- Horizontal analysis is used by investors to help decide whether or not to invest in a particular company

Horizontal Analysis – Formula

In horizontal analysis, the changes in specific items in financial statements i.e. net debt on the balance sheet or revenue on the income statement– are expressed as a percentage and in a specific currency – for example, the U.S. dollar.

The horizontal analysis involves two types of formulas – one to compute percentage change and the other to calculate the absolute change in a specific currency. For example, take the income statement of a company and we can select a line item, e.g. net income. The formula for horizontal analysis will be:

Historical analysis (%) = net income in year 2 – net income in the base year (year 1) / net income in a base year * 100

Note, year 2 is the comparison year. If the comparison year is year 3, then we will input the net income of year 3 and compute the percentage change between year 3 and year 1 (base year).

Horizontal Analysis (US$) = Net income in year 2 – Net income in the base year (year 1)

We use the same formula for other items in the income statement and balance sheet.

These formulas are used to evaluate trends which can either be quarter-on-quarter or year-on-year depending on the accounting period from which the data is sourced. For horizontal analysis, it’s best to take several years of historical data to gain useful insights into how a company is performing. This can help determine what is a clear trend and what may be a one-off event.

Horizontal Analysis – Percentage Change

To perform horizontal analysis vis-à-vis either the income statement or the balance sheet, we will have to first compare the financial results i.e. the change in the line items from one accounting period to the other in order to discern if the change from one period to the other is positive or negative and how strong is the growth or decline.

For example, let’s take the case of the income statement – if the gross profit in year 1 was US$40,000 and in year 2 the gross profit was US$44,000, the difference between the two is $4,000. Here the change is positive and we can calculate the percentage change.

When we use percentage change, it is very useful to carry out a more in-depth analysis and identify trends. In the example above, the percentage change in the gross profit from year 1 to year 2 is calculated as 4,000/40,000 * 100 = 10%.

Using Horizontal Analysis for Forecasting

If we take historical data of the financial statements of a company for year 1 and year 2, then one can compare each item and how it has changed year-over-year. We can use this trend to project the line items for future years.

In other words, one can take year-on-year or quarter-on-quarter growth rates of all the items of the income statement or the balance sheet – based on the historical data. Thereafter, one can make assumptions about the future growth rates. For example, in the income statement, we can, based on historical data and trends, make assumptions about sales growth and then forecast the sales growth rates through the forecast periods.

Horizontal Analysis Example

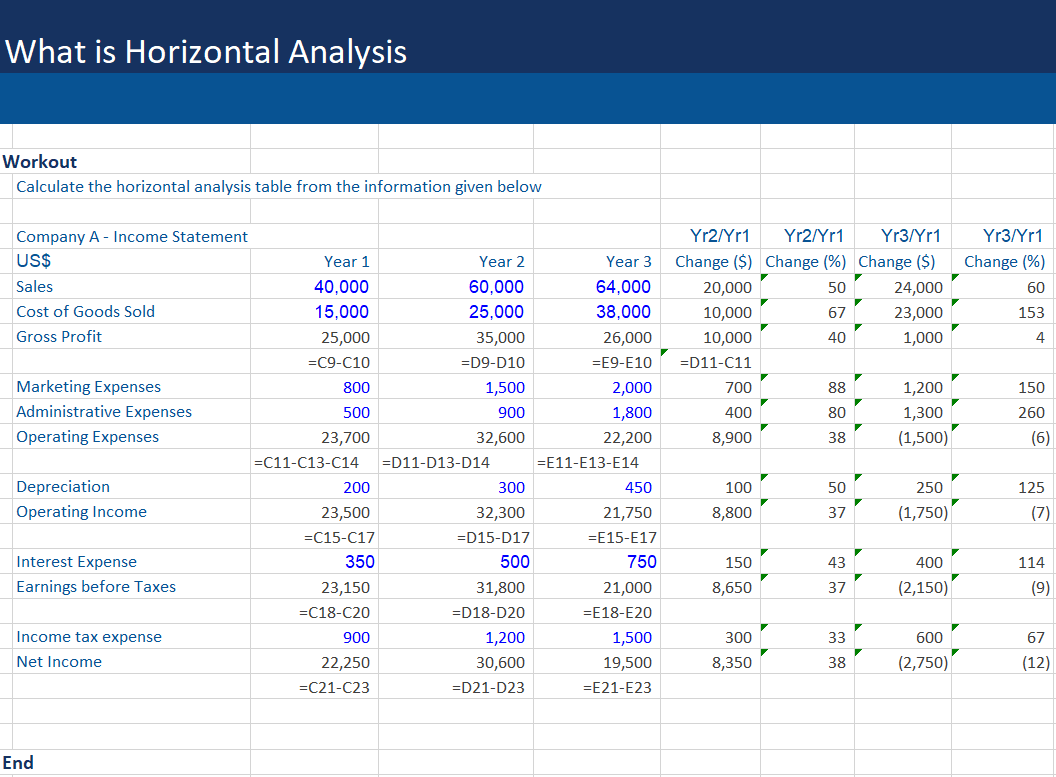

Given below is a horizontal analysis in excel of a comparative income statement (i.e. year 1 – base, year 2, and year 3). Using the aforesaid formulas, we have computed the absolute change (in US$) and percentage change (%) of all line items in the income statement between year 1 (base year and year 3. This can be viewed from the last two columns and the formulas can be viewed in the Excel spreadsheet. This is the first type of horizontal analysis. This Excel sheet is available in our free downloads.

We can now see how much any item, such as net income, increased or decreased from year 1 (base year) to year 3 in absolute and percentage terms. In other words, we can calculate how much net income increased or decreased from year 1 to year 3 (or for that matter any year). Here net income has decreased by $2,750 or 12% in year 3 when compared to year 1.

Secondly, in the second type of horizontal analysis, we are interested in knowing about the underlying trends in the line items of the income statement. For this, we compare the absolute change ($) and percentage change (%) in all the line items from one period to the other. One should ideally take three or more accounting periods/years to identify trends and how a company is performing from one year/accounting period to the next year/accounting period.

Here, for the sake of illustration, we have shown the absolute change (in US$) and percentage change (%) of all line items in the income statement between year 1 and year 2 only. The computations of the same have been done in columns F and H.

Such analysis provides valuable insights into why any of these line items rose or fell sharply or markedly in year 2, compared to year 1. For example, net income could fall sharply in year 2, despite a rise in sales, due to a marked rise in the cost of goods sold, marketing expenses, administrative expenses, and/or depreciation expenses.

This type of analysis is also very useful if an investor wants to determine the performance of a company prior to investing in the same. For example, an investor may want to evaluate the performance of a company over the past year– relative to the base year in order, to decide whether it is worthwhile investing in this company or not.

Additional Resources

Financial Modeling Course

Financial Forecasting

Financial Model Formatting

Financial Model Formatting – Numbers

Share this article

Test yourself.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Featured Online Resource

IMAGES

VIDEO

COMMENTS

Horizontal analysis is used in financial statement analysis to compare historical data, such as ratios, or line items, over a number of accounting periods. Horizontal analysis can either use absol…

What is Horizontal Analysis? Horizontal analysis is an approach used to analyze financial statements by comparing specific financial information for a certain accounting period with …

Horizontal analysis is an approach to analyzing financial statements. It compares historical data, which includes ratios and line items, over a series of accounting periods. The accounting period can be a month, a …

What is Horizontal Analysis? Horizontal Analysis measures a company’s operating performance by comparing its reported financial statements, i.e. the income …

Definition. Horizontal analysis is a financial analysis technique that compares historical financial data over a series of periods to identify trends and growth patterns.

Horizontal analysis can be conducted using various methods, each offering unique insights into a company’s financial performance over time. Two primary types are Comparative …

What is “Horizontal Analysis”? Horizontal Analysis is an analytical method used to compare financial statements – primarily the balance sheet and income statement – based on historical data, in order to uncover the …