- No category

me Monitor-Deloitte-Case-Study-Example-Footloose

Related documents

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

Deloitte Case: Footloose

To begin with, some consulting colleagues developed a 20 minute quantitative telephone survey that was conducted among 500 randomly dialed consumers across the country’s 6 primary regions. In addition, the consultants completed some internal cost and pricing analysis for Duraflex’s work and casual boot lines. The market pricing analysis showed Duraflex competing at the premium end of the market for both its casual and work boot lines.

Case Prompt

Duraflex is a German footwear company with annual men’s footwear sales of approximately €1 b.

They have always relied on the boot market for the majority of their volume. In this market they compete with three other major competitors.

In the fall of 2019, Badger – one of Duraflex’s competitiors – launched a new line of aggressively priced work boots . The strong success of this line has caused Duraflex’s management to re-evaluate their position in work boots.

With limited additional resources , the management must now decide if they should focus their efforts on competing with Badger in the work boot sector, or allocate their resources on further strengthening their position with casual boots . The management team approached you and asked for your advice. In order to advise them on their future work boot strategy please prepare first some insights regarding market size and competitive landscape .

Overview of all exhibits

Sample Structure

The following structure provides an overview of the case:

1. Background

Information that can be shared if inquired by the interviewee:

- Casual boots

- Field and hunting boots

- Winter boots.

- Work boots is the largest sub-category and is geared to blue-collar workers who purchase these boots primarily for on-the-job purposes.

- Casual boots is the fastest-growing sub-category and is geared more towards white-collar workers and students who purchase these boots for weekend / casual wear and light work purposes.

- Blue collar workers : Wage earners who generally work in manual or industrial labour and often require special work clothes or protective clothing which are replaced approximately every 6 months.

- White-collar workers : Salaried employees who perform knowledge work , such as those in professional, managerial, or administrative positions

- These four brands represent approximately 72% of the €5 b German men’s boot market .

Competitors

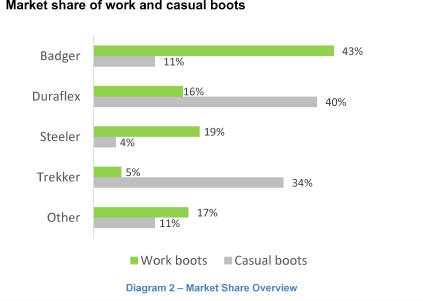

- Badger and Steeler are both well-established work boot companies, having a long history and strong brand recognition and credibility among blue-collar workers . At the other extreme is Trekker , a strong player in the casual boot market but a very weak player in work boots. Duraflex , however, is a cross between the other competitors, having a significant share in both work boots and casual boots.

- Historically, Duraflex had an even stronger position in the work boot sector. However, since 2016 , when the company began selling casual shoes and focusing on the growth opportunity in casual boots, sales of the Duraflex work boot line have steadily declined . Also, around the same time Duraflex shifted its emphasis, Badger became a much more assertive competitor in the work boot market, increasing its market share to 43% in just three years.

Note for Interviewer

Share Diagram 2 with an overview of the market shares if inquired.

The interviewee should ask general questions about the company and its competitors to gain an understanding of the overall situation.

Share Diagram 3 with an overview of the propensity to buy boots by male population segments.

Avg #boots purchased per year

- For work boots , we know that blue-collar workers purchase an average of 2 pairs per year .

- White-collar workers and students who buy work boots probably use them less rigorously and less frequently, therefore probably only purchase 1 pair per year.

- For casual boots , we can make a reasonable assumption, knowing that casual boots are purchased primarily for weekends and light wear (from text), so the average number of pairs should be no more than work boots from Exhibit 1 (i.e. 1 pair per year)

Avg price per pair of boots

- Work boots cost more (compare Blue Collar vs. Student) so the average price should be higher than €140 for all ( €150 is reasonable); casual should be lower than the student ( €100-110 is reasonable).

Share Table 1 with an overview of the working boot market calculations.

Share Table 2 with an overview of the casual boot market calculations

Market Size

Market size = (avg.boot price)* (% of male population buying boots) * (total population in segment) * ( # pairs bought per year).

Diagram 3 shows us the population for each segment and the share thereof that bought boots . We therefore need to find the number of boots sold and the average price of each pair. For this question, the candidate will need to make some assumptions.

Market Size work boot market

= €150 * [(60% * 11m *2) + (25% *12m *1) + (15% * 7m *1)]

As a next step, the interviewee should find out whether Duraflex gets more of its revenue from work boots or casual boots. For this, the interviewee has to calculate the casual boot market.

Market Size casual boot market

= €100 * [(20% * 11m * 1) + (35% *12m *1) + (55% * 7m *1)]

Conclusions

- Duraflex’s revenue from the work boot market = 16% * €2,588 m = €414m

- Duraflex’s revenue from the casual boot market = 40% * €1,025 m = €410 m

- So Duraflex gets most of its revenue from work boots, even though the revenues are almost evenly split.

- The size of the work boot market is ~€2.6 b . The casual boot market is ~€1.0 b large. Duraflex generates €414 m from work boots and €410 m from casual boots. Depending on the assumptions taken, work may be slightly larger but the two should be relatively close.

III. Competitors

Share Diagram 4, 5, 6 & 7 with market data with the interviewee.

The interviewee should now analyze why Badger is outperforming Duraflex in the work boot market. According to the data we have and what we know as industry dynamics, the analysis can be split into 4 main areas that would demand further study:

Distribution

- Buyer Purchase Criteria by Brand (BPC)

Cost Analysis

- Duraflex is barely sold where work boots are being purchased. Diagram 4 shows that Badger’s and Steeler’s boots are often purchased in safety/work channels , whereas Duraflex does not have a significant presence in them

- Therefore, Duraflex will need to broaden distribution if it is to increase its share; it needs to get shelf space in the relevant channels

Buyer Purchase Criteria by Brand (BPCs)

- Diagrams 5 & 6 show us that Badger’s top two associated criteria are: “ Quality / Durability ” (45%) and “ Comfort ” (39%). The same holds true for Steeler . Thus, these seem to be critical criteria for the work boot market

- However, Duraflex’s top criteria are “ Styling ” (45%) and “Qu ality / Durability ” (37%), with “ Comfort ” being a distant 3rd at 19%, far from its competitor’s figures

- Duraflex is NOT meeting the key needs of blue-collar workers and will need to strengthen its “ Comfort ” perception

- Additionally, we should note that Badger has built up a loyal customer base: “ past experience ” as criteria represents 30% and is 3rd on its list of associated criteria

- We know that Badger is launching an “ aggressively priced ” work boot line. Duraflex can alter its pricing strategy , e.g. lower its own boot price

- However, looking at Diagrams 5 & 6 , among the stronger work boot market competitors, we see that only Steeler shows the price as a top BPC (and then it is the lowest one) – potentially because they are the lower cost option in this market

- Given that price does NOT appear to be important criteria for work boot consumers, Duraflex will likely not realize great benefits from this strategy , and will also lower its profits in doing so

- We know from the case that Duraflex has a premium price positioning, hence, lowering its price may lead to the perception of lowering quality

- Comparing Badger to Duraflex work boots, from Diagram 7 , there is one key area where Badger proportionately and absolutely spends more than Duraflex: “ Materials ”. This supports their perception of “ Quality / Durability ” and “ Comfort ” among their consumers. Also, they spend more on “ labor ”

- Retailer margin is lower for Badger – due to significant presence in safety/work channel

- Sales & Marketing spend is lower for Badger – potentially driven by lower marketing requirements in safety/work channel as well as the established brand name among blue-collar workers. Also, Badger has built a loyal customer base , and it is less costly to maintain existing customers than attract new ones

Badger has lower margins (both absolute and relative); given already higher market price, Duraflex has limited flexibility to raise its boot prices; Duraflex may lower its margin somewhat and shift emphasis to labor and materials.

- Duraflex is barely sold where work boots are being purchased

- Duraflex is not meeting the key needs of blue-collar workers , as it is weaker than competitors on the critical “Comfort” dimension

- Badger prices its boots more competitively , which is likely to be particularly appealing to the large work boot market ; this has helped develop a large and loyal consumer base

- Badger has lower retailer margins (both absolute and relative) and spends less on Sales & Marketing

IV. Conclusion

The company can either:

- Focus on increasing its work boots activities

- Emphasize casual boots

Each option has its own justifications and implications.

Increased Work Boot Market Focus

Justification

- The work boot market with its higher margin of 22% is responsible for approximately 40% of Duraflex’s profits , making it very difficult to profitably ignore this market

- While Duraflex does have greater market share in the casual boot market, we know from information given in the case that the casual boot market is smaller in size than the work boot market, which may indicate less opportunity for share growth; also, we derive lower margins (15% vs. 22%) from casual boots (from Diagram 7)

- Given that Badger is introducing a new work line , they may see new growth potential in the market which Duraflex may also want to capitalise on

- Building a stronger image among blue collar workers may entice them to try other Duraflex footwear products

Implications

- Enter safety / work channel – we may be faced with pressure from Badger exerting influence on retailers in this channel

- Build “ Comfort ” and “ Quality / Durability ” perception among blue collar workers

- Increase proportion of costs allocated to materials and labour – potentially reducing company margin

- There may be unique / niche positionings for Duraflex (suggestions should be well thought through)

- Introduce sub-brand or increase promotion of brand with a focus on blue collar workers : may include on-site promotions, advertising in industry publications, or advertising in magazines / on television with a higher blue collar readership / viewership

Emphasis Casual Boots

- Stronghold for Duraflex right now (40% market share)

- Fastest growing market

- Represents approximately 40% of Duraflex’s business , making it very difficult to profitably ignore this market

- Focusing additional resources on the work boot market would risk alienating casual boot buyers (white-collar workers and students)

- “ Style ” is the top BPC for Duraflex (from Diagram 5). From the statistics on Badger and Steeler, we know this is likely not an important criterion for the work boot market. By focusing on the casual boot market Duraflex can devote additional resources to keeping up with styles to better appeal to this target

- Unlikely to be a strong competitor reaction, since Duraflex is already the dominant player

- Duraflex will not need to enter new distribution channels

- Candidate should discuss a strategy for work boot market – either winding down, maintenance, etc. and implications of this

How do we know from the information in the case that Casual boots are the fastest growing segment?

Case study ppt, marketing strategy, competitive response.

You have to analyze how your customer should react to the strategy of a major competitor? Learn everything about competitive response cases now.

- Select category

- General Feedback

- Case Interview Preparation

- Technical Problems

IMAGES

VIDEO