Happy Hour: Mastering pricing localization

Revenue models: 11 types and how to pick the right one

Finding the right revenue model for your company and products is an incredibly important part of starting and expanding your business. It's a key part of building a brand. Explore popular revenue models and how to choose the right one.

What is a revenue model?

- 11 different types of revenue models

Costs associated with revenue models

How to choose your revenue model.

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

In one of the most famous lines from the 1941 classic Citizen Kane , Mr. Bernstein proclaims: “ It's no trick to make an awful lot of money... if what you want is to do is make a lot of money .” If only that statement were as true as it seemed. It's probably more accurate to say, “There are a lot of ways to make a lot of money.”

That’s particularly true for software businesses, with the rise of the mobile internet stimulating an explosion in the number of viable revenue models. Choosing which revenue model works best for your SaaS business, though, is not easy (even if that's all you want to do is choose a revenue model for your SaaS business). Your choice will help determine your sales strategy , and from there the growth rates, the amount of money you’ll need to invest initially, and the kind of relationship you’re likely to build with your customers. More than that — the choice determines the future of your business. Let’s take a look at some of the most popular revenue models used today — why they’re popular, why they work, and why they will (or won’t) work for you.

A revenue model is the income generating framework that is part of a company’s business model. Common revenue models include subscription, licensing and markup. The revenue model helps businesses determine their revenue generation strategies such as: which revenue source to prioritize, understanding target customers, and how to price their products.

Revenue models often get conflated with revenue streams, probably because each is a single revenue generation source. They are also confused with business models, of which revenue models are a part. Revenue models help business owners determine how to manage their revenue streams and are required to complete a business model.

Without a considered revenue model, your business will incur costs it cannot sustain. With a revenue model, you can set, track, and forecast business growth based on specific customer segments.

11 different types of revenue models

There is no such thing as a perfect revenue model, but the popularity of some of the methods below suggests that many of them are well-tailored for the current state of the market. Here we’ll walk through each type of revenue model and when they may be most beneficial and applicable.

1. Subscription

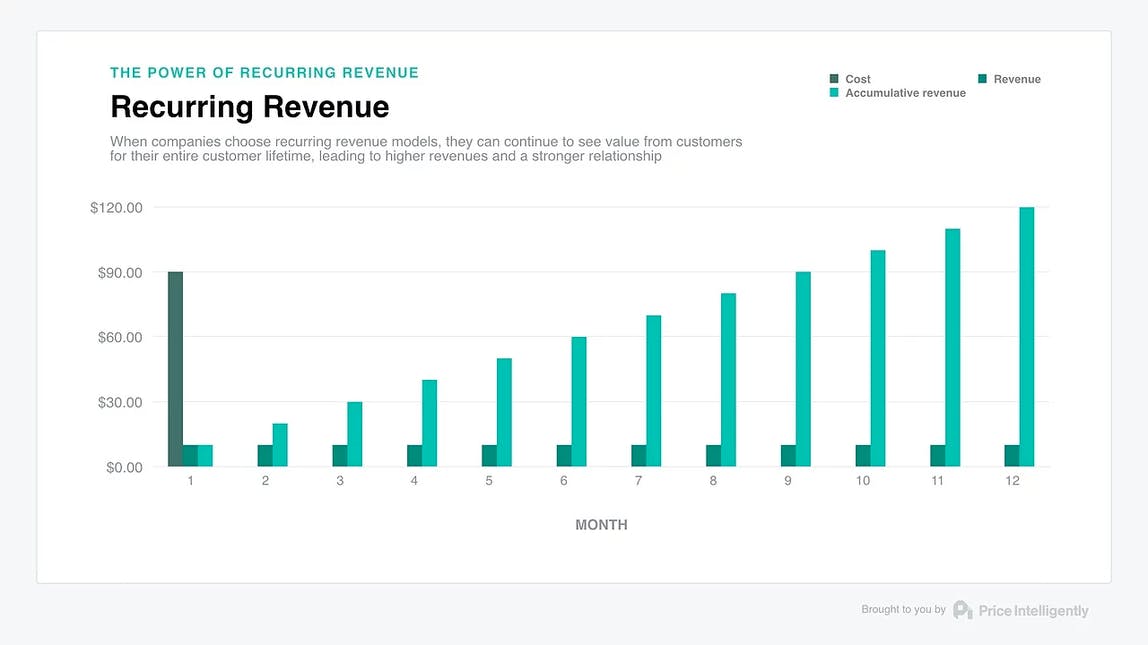

The subscription model is the “vanilla” SaaS revenue model, not that there’s anything boring about a well-worked subscription plan. Businesses charge a customer every month or year for use of a product or service. All revenue is deferred and then fulfilled in installments. The subscription model is perhaps the most popular among SaaS companies because of its versatility, promise of recurring revenue , and high value:customer lifetime balance. Done right it's a one-way-ticket to sustainable growth .

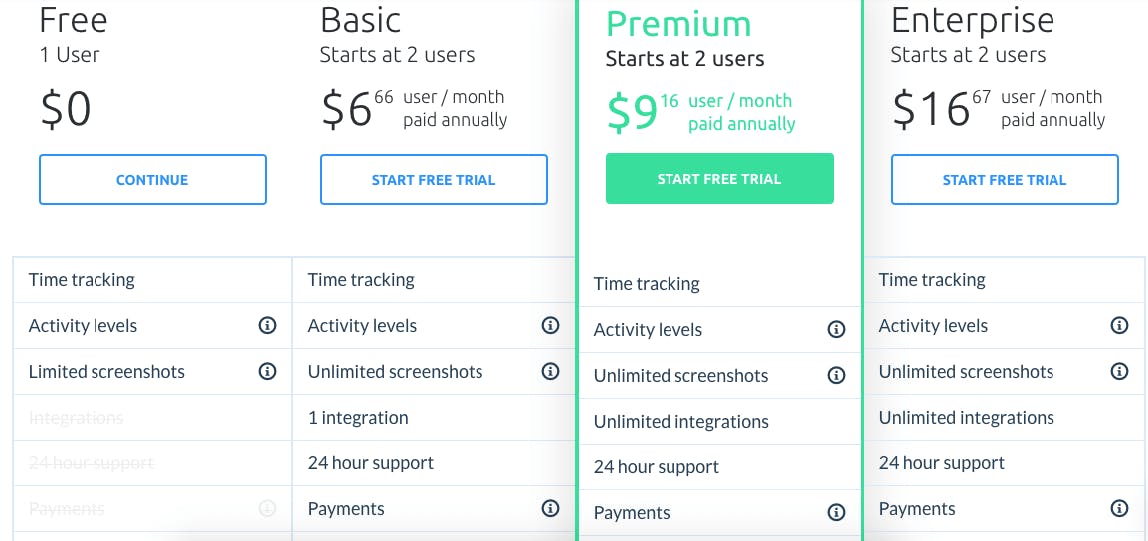

Companies working with recurring revenue models, such as subscription or licensing , see more value from a customer across a given customer lifetime. Being able to offer a variety of value options means your company can respond to more than one set of customer needs, expanding your appeal. Hubstaff’s subscription plan, seen below, is a classic of the genre:

Hubstaff’s various plans are distinct from one another in price and feature. This flexibility in the subscription model means that tentative or lower-budgeted customers can still get what they need, all the while maintaining visibility of what extra they could get for a few dollars more a month.

The freemium model is often described as a subscription revenue model, but in fact it’s an acquisition model, not a revenue model. Freemium involves giving users free access to an app and then selling subscriptions for a premium tier that includes more features.

Markup is a very common revenue model for buyer companies (i.e., companies that buy the products they sell). It’s as simple as can be: Take the cost of goods you just bought, mark it up X%, and make a profit margin on the original purchase. There are various subgenres of the markup model, including the following:

- Wholesale: Sale of goods or merchandise to retailers, business users, or other wholesalers

- Retail: Identification of demand, and satisfaction of it through a supply chain via a number of possible outlets, including physical and ecommercial ones

Markup is particularly used by mediators like ecommerce marketplaces — Amazon, for example. On average, Amazon charges a seller who uses their site 15% of the sale, plus FBA fees (including storage, pick & pack, shipping).

5. Pay-Per-User

One of the most enduring legacies of SaaS in the world of business is the introduction of pay-per-user (PPU). It involves giving a customer potentially unlimited to access to a range of features while charging them only for the services they use. At the dawn of SaaS, as the software required no physical delivery and deployed so quickly and cheaply, PPU appeared to be the most sensible revenue model. However, as natural as it seemed back in the day, pay-per-user is not popular anymore. Ascribing value to your product is one of the key considerations of your revenue model, and that includes demonstrating why it’s worth your target customers’ valuable dollars, not just making everything so cheap and easy that they can’t refuse. The issue with PPU, then, is that it’s rarely where value is ascribed to your product. Moreover, PPU kills your Monthly Active User metric. The per-user metric is not the most useful to customers in terms of deriving value — its take-it-or-leave-it approach actively works against your Daily Active Users number, and thus contributes to your churn rate.

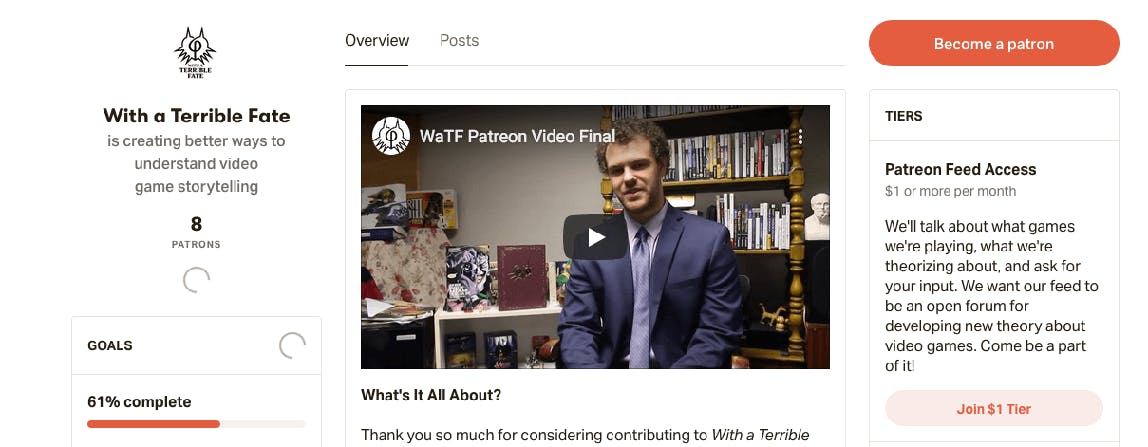

6. Donation

As evidenced by the rise and rise of Kickstarter - and Patreon -based ventures, altruism is, if unpredictable, a pretty effective revenue model by itself. Relying on the donations of regular users is a common revenue model for nonprofits, online media (i.e., YouTubers) and independent news outlets.

7. Affiliate

What is affiliate marketing ? This new, popular model works by promoting referral links to relevant products and collecting commission on any subsequent sales of those products. Leverage your product’s synergy with another product in an adjacent space and you both stand to gain. The affiliate model can be as simple as including in an article an outlink to a book or other product mentioned or offering your customers specialized recommendations relative to purchase history (again, Amazon is a master of this art). Some companies, such as Etsy, even have a specific program for their affiliates, where other companies can earn a commission on qualifying sales that result from featuring links to Etsy products and services. The affiliate revenue model is increasingly popular, owing to the way it dovetails effectively with other revenue models, particularly ad-based models.

8. Arbitrage

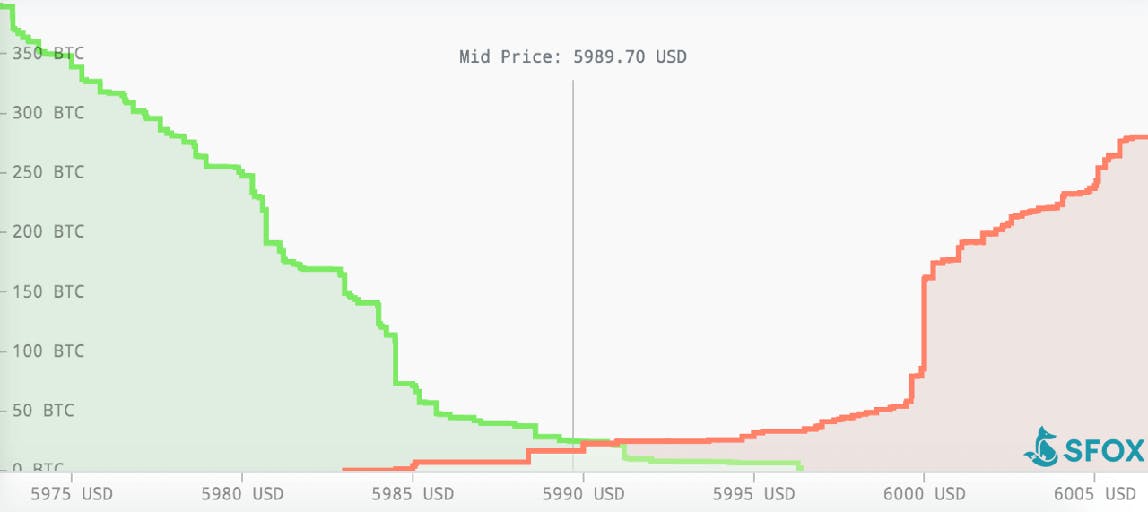

Applicable mainly to sellers or marketplace-oriented companies, the arbitrage revenue model uses the price difference in two different markets of the same good/service to make a profit. You buy in one market (a security/currency/commodity) and simultaneously sell in another market, at a higher price, what you just bought, pocketing the temporary price difference. Arbitrage is popular with affiliate marketers , as well as with many cryptocurrency firms, SFOX being a prime example.

9. Commission

This transactional revenue model involves a middleman charging commission for each transaction it handles between two parties or for any lead it provides to the other party. It’s particularly popular with online marketplaces and aggregators, as well as businesses like independent music distributors. It’s particularly easy to get up and running with a commission-based business model because you’re working off of existing products. However, unless your field is well-conditioned for a monopoly, and unless your company is (or can become) that monopoly, you’ll find the commission model very tough to scale .

10. Data Sales

Ever heard the phrase, “If you can’t see how the money’s made, you’re the product”? That’s data-selling in action. Many companies selling digital goods and services could not exist without core underlying data assets. In the data sale revenue model, this data is sold directly to a consumer or business customer. While certain companies will use data sale as their primary revenue model, the use of data sales to augment another revenue model is virtually ubiquitous. While some are using it as an entrepreneurial venture , it is also the subject of considerable justified public concern and should be handled with care in the event you decide to go with it as your revenue model.

11. Web/Direct Sales

The old-fashioned revenue model made new, web sales and direct sales involve payment for goods or services through a digital medium. Web sales involve a customer finding your product via outbound marketing (or a web search) and can used for software, hardware, and subscription-based offerings. Direct sales revolve around inbound marketing and is good for handling multiple buyers and influencers in big-ticket markets.

A good revenue model is not just about squeezing as much revenue possible out of a sales cycle; it’s also about balancing your ambitions in the market with your resourcing requirements. A startup revenue model may be significantly different than one for an established business because their resources are vastly different. When choosing your model, factoring in costs is paramount to ensure profitability.

Cost of revenue

The first cost you’ll be likely to factor in is your cost of goods — how much it costs to produce the goods or service that you then sell. For hardware, this can comprise testing and manufacture; for software, it’ll include the whole development cycle. Regardless of what you produce, administrative overheads will also apply. You will find cost of goods a considerably less comprehensive metric than cost of revenue, which is the total cost of manufacturing and delivering a product or service to consumers. That includes everything we’ve just covered, plus distribution and marketing costs. Cost of revenue is more often used in SaaS and other service-oriented industries because it makes the many costs incurred outside of production in SaaS easier to track.

Prototyping costs

Prototyping is a fundamental aspect of any production cycle and, unfortunately, is one of the most expensive. While testing prototypes or beta versions of your new product, even the smallest revisions can necessitate costly changes to your production/development process. This usually comprises a base-level cost, plus iteration costs on top of that. When forecasting prototyping costs, it’s wise to plan for several iterations; it’s highly unlikely you’ll get everything right the first time around, especially if your product is innovative or is composed of a number of features.

Equipment costs

One of the beautiful things about being a SaaS company is that there are no production lines to run. Nevertheless, equipment costs still factor into the bottom line. Firmware, app development tools , server rental, plus any other administrative services bought on subscription (e.g. Slack or Hubstaff) will play a part in your equipment costs, but, generally, equipment costs should be the easiest of all to forecast.

Labor costs

An underpaid workforce is an unhappy workforce (if it’s a workforce at all); wage costs come out of your bottom line. Based on the interaction of salary and commission in your compensation plan , as well as the type of commission you offer (entirely open-ended or capped? Will there be accelerators/decelerators involved?), you will have to plan for your expenditure on labor costs differently.

Advertising & marketing costs

Your advertising and marketing costs will be determined by the following:

- The size of your respective advertising and marketing teams

- The scale of exposure you’re shooting for

- Your method of approach to advertising and marketing: undefinedundefinedundefined

With all of those options, how could you possibly be expected to choose? The answer is in your product itself.

Know your market

Where are your customers? How are they accessible to you? If your buyer personas are mainly single customers, address subscription options to them that are expertly targeted to their needs and how your product can fulfill them . On the other hand, if you’re looking to sell to larger companies who need a customized version of your core product, consider a licensing-based option that will allow you to establish a solid, high-return relationship that has the legs to run for the long term. Knowing your market also means knowing your competitors. Before choosing a revenue model, make sure you have a firm grasp of industry benchmarks: Where is the baseline value for equivalent products to yours in the market? Where does your product sit? Interrogate your product honestly. Not only will a frank assessment of your product’s value save you the mistake of pricing your product too high (or too low), but it will also show you how to capitalize on its value and where your developmental compass should be pointed. Consider the strength of your connections with compatible peer companies. For instance, if you’re running time-management software and have connections to a neighboring company selling compatible HR software, reach out to them. A strong network connection can be leveraged with an effective affiliate revenue model–based strategy.

Know your product

Knowing your product is every bit as important as knowing your market, if not more so. Sometimes, the nature of a product dictates the best revenue model for it by itself. If you have a suite of products, is it most sensible to have them as a subscription service or as one-off purchased products? The smart money in this case, for the sake of your growth and daily-user figures, would be on the subscription option. Again, evaluate your product’s performance honestly. How does your product perform compared with its competitors? How wide is your feature array compared with the rest? An awareness of your product enables you to choose a revenue model that hits the value/willingness-to-pay sweet spot. Consider your options further if your product is not a straightforward software proposition. For example, if your product is platform-based, investigate your advertising prospects to capitalize on your traffic buzz, and think laterally to find possible partners for an affiliate strategy that will give your revenue an added kick.

Pitchfork’s affiliate program with makers of craft beer can be seen on the leftmost tab. Music blog platform Pitchfork sussed out that the only thing their readers like more than left-field music is craft beer, so they introduced an affiliate feature with brewer’s outlet October. It’s a smart exhibition of affiliate revenue scoring.

Expect the unexpected

As your product line changes and as your company grows, your initial revenue model may change. You may begin with a subscription revenue model that then assimilates aspects from the affiliate, advertising, and data sales models with time and opportunity. You might start off as a fledgling independent blog on donation with a little bit of advertising, then find yourself with an audience big enough that you can shun the advertisers, install a subscription model, and keep the integrity of your writing safeguarded. Alternatively, you may begin with subscription, see only a fraction of your potential success realized, and move to a licensing revenue model. The important thing is to be willing to shift your revenue model or bring in additional models to complement what you already use, if the situation calls for it.

Take the headache out of growing your software business

We manage your payments, tax, subscriptions and more, so you can focus on growing your software and subscription business.

Your revenue model is unique

So many revenue sources, so many revenue models, so little time. There are some fundamental differences between revenue models. For instance, if you’re a SaaS company producing your own software product, you’re unlikely to get all that far with an arbitrage model. Likewise, if your product is a medium or if you’re a seller, a subscription-based revenue model won’t do the trick. A product with a high ceiling for potential revenue is not best served by a donation model. Nevertheless, the choice of a main revenue model out of the batch that do work for your product, and how you then combine them with appropriate aspects of other models, is yours, and yours only. Your product and the market should be in mind at all times while you’re settling on, adding to, and refining your model. After that, bringing in the revenue itself should be as easy as Citizen Kane said.

Related reading

Trending Courses

Course Categories

Certification Programs

Free Courses

Management Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

ALL COURSES @ADDITIONAL 50% OFF

Revenue Model

Last Updated :

Blog Author :

Prakhar Gajendrakar

Edited by :

Collins Enosh

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

Revenue Models: 17 Types, Examples & Template [2023]

Revenue Models

How does (or will ) your business make money? It sounds almost too simple to ask, but having a clear understanding of your business' revenue model can be one of the most important ways to focus on key activities--and actually move the needles you care about most.

For indie businesses, settling on the right revenue model type rarely happens on first attempt. Instead, it's common to bounce around from subscriptions to digital products, membership communities and affiliate offerings until something finally *clicks* for you and your business.

This revenue models list component and template is intended to help you sort, consider and rank a list of common revenue models. In future, I'll be linking this table to related marketing channels, real data from other indie businesses and related templates--for now, let's take a quick look at the revenue models listed.

17 Common Revenue Model Examples

- Subscription

- Licensing (Digital Prod.)

- Advertising

- Affiliate Commission

- Project-Based Services

- Retainer-Based Services

- Tickets, Events, Workshops

- Manufacture (D2C)

- Library Access

- Community Access

- Marketplace

1. Subscription

The most common revenue model for SaaS and membership-based businesses. Customers pay a recurring fee, typically on a monthly or yearly basis, in exchange for access to your product or service.

Pros of subscription model

- Recurring revenue is more predictable and can be helpful in forecasting

- Can be a great way to build long-term relationships with customers

- Customers who are paying on a recurring basis are typically more engaged and have a higher lifetime value

Cons of subscription model:

- Can be difficult to acquire customers who are willing to pay a recurring fee

- Can be difficult to increase prices without losing customers

- There is always the risk of churn (customers cancelling their subscription)

The markup revenue model is most common in retail and ecommerce businesses, where goods are bought at wholesale prices and then sold to customers at a higher price.

Pros of markup model:

- Can be easier to get started since you don't need to develop a unique product or service

- There is less risk involved since you're not investing in developing or producing a good or service

- Can be easier to scale since you can simply buy more inventory as needed

Cons of markup model:

- Can be difficult to compete on price alone

- You may need to invest in marketing and branding to differentiate your business

- There can be slim margins if you're not careful with your pricing

3. Licensing (Digital Prod.)

The licensing revenue model is most common for digital products, where customers pay a one-time fee for access to your product.

Pros of licensing model:

- Can be a great way to generate one-time revenue from customers

- Customers who pays for a license typically have a higher perceived value of your product

- Can be easier to scale since you're not selling a physical good or service

Cons of licensing model:

- Can be difficult to acquire customers who are willing to pay a one-time fee

- There is always the risk of piracy (customers sharing your product without paying)

- Can be difficult to upsell customers or generate recurring revenue

4. Advertising

The advertising revenue model is most common for online businesses, where businesses sell advertising space on their website or in their email newsletter.

Pros of advertising model:

- Can be a great way to generate revenue from customers who are not ready to buy your product or service

- Advertising can be a complementary revenue stream to other revenue models

Cons of advertising model:

- Advertising can be disruptive to the user experience

- Advertising rates can fluctuate based on market conditions

- You may need to invest in marketing and branding to attract advertisers

5. Donation

The donation revenue model is most common for non-profit organizations, where customers donate money to support the cause or organization.

Pros of donation model:

- Can be a great way to generate revenue from customers who are passionate about your cause

- Donations are typically tax-deductible for the donor

- There is less pressure to generate revenue since donations are not expected to be recurring

Cons of donation model:

- Can be difficult to acquire customers who are willing to donate money

- May need to invest in marketing and branding to attract donors

- Donations can fluctuate based on economic conditions

6. Affiliate commission

The affiliate commission revenue model is another common for online businesses, where businesses pay a commission to affiliates for referring customers.

Pros of affiliate commission model:

- Can be a great way to generate revenue from customers who are already interested in your content

- Affiliates can provide valuable marketing and promotion for your business

- Can be easier to scale since you're not producing all the products you sell

Cons of affiliate commission model:

- Not always easy to find good affiliate programs

- You may need to invest in marketing and branding to attract affiliates, as well as readers

- Commissions can vary based on affiliate performance

7. Sponsors

The sponsorship revenue model is becoming increasingly common for online creators.

Pros of sponsorship model:

- Can be a great way to generate revenue from businesses or individuals who support your cause

- Sponsors typically have a high perceived value of your organization

Cons of sponsorship model:

- Can be difficult to acquire sponsors who are willing to pay

- May need to invest in marketing and branding to attract sponsors

- Sponsorship can fluctuate based on economic conditions

8. Data Sales

The data sales revenue model is most common for online businesses, where businesses sell data that they have collected.

Pros of data sales model:

- Scale advantages

- Data can be a valuable commodity for businesses

Cons of data sales model:

- Difficult to acquire unique data sets

- Longer sales cycle

- Data rates can fluctuate based on market conditions

9. Project-Based Services

The project-based services revenue model is most common for businesses that provide consulting or other services.

Pros of project-based services model:

- Can be a great way to generate revenue from customers who need your services

- Projects can be customized to the customer's needs

Cons of project-based services model:

- Very hands-on

- Need to keep your pipeline filled

- Projects can fluctuate based on economic conditions

10. Retainer-based services

The retainer-based services revenue model is most common recurring stream for businesses that provide consulting or other services.

Pros of retainer-based services model:

- Can be a good way to introduce recurring revenue to a services business

- Customers typically pay upfront for your services

Cons of retainer-based services model:

- Need to find a service that's profitable on retainer;

- Reducing churn;

- Pricing your retainer.

11. Tickets, Events, Workshops

The ticketing revenue model is most common for businesses that host events or workshops.

Pros of ticketing model:

- Can be a great way to generate revenue from customers who are interested in your event

- Tickets can be sold in advance of the event

- Virtual events and workshops can be easier to scale since you're not selling a physical good or service

Cons of ticketing model:

- Need to consistently market events

- Margins need to be high for it to be sustainable

- Often need to pay staff to help facilitate event

12. Royalties

The royalty revenue model is most common for businesses that sell digital content, such as books, music, or software.

Pros of royalty model:

- Royalties can be collected on a per-sale or per-use basis

- Highly asynchronous

Cons of royalty model:

- Can be difficult to track sales and commissions

- Typically low % commission

- Royalties can be volatile from year to year

13. Manufacture (D2C)

The manufacture model, going direct to customer, is probably the most familiar. You make a product and then sell it to the customer, whether that’s through your own store, a third-party retailer, or some other means.

Pros of Manufacture (D2C)

- You have complete control over your product

- You can build your own brand

- You can reach customers directly

Cons of Manufacture (D2C)

- It can be expensive to get started

- You have to invest in marketing and branding

- You have to manage inventory and shipping

14. Library Access

The library access model is common for businesses that offer digital content, such as books, music, or software. Customers can access your content through a subscription or pay-per-use basis.

Pros of Library Access

- Can reach a wide audience of potential customers

- Can generate revenue from customers who are interested in your content

Cons of Library Access

- Possibility of duplicating digital content without license

- Retaining users after they pay for first access

- Offering a unique library

15. Rent/Lease

The rent/lease revenue model is common for businesses that offer physical goods, such as equipment or vehicles. Customers can rent or lease your products on a short-term basis.

Pros of Rent/Lease

- Can generate revenue from customers who need your equipment

- Can be quite 'Passive' income

- Scalable if margins and demand are high enough

Cons of Rent/Lease

- High expenses upfront

- Potential damages costs

16. Community Access

The community access revenue model is common for businesses that offer physical goods or services. Customers can access your product or service through a subscription or pay-per-use basis.

Pros of Community Access

- Compounding as the community grows

- Plenty of online community software and tech popping up

Cons of Community Access

- Difficult to upgrade to a 'paid tier'

- Community moderation can be time-consuming

- Sustaining high community engagement

17. Marketplace

The marketplace revenue model is common for businesses that offer a platform for other businesses to sell their products or services. Customers can access the marketplace through a subscription or pay-per-use basis.

Pros of Marketplace

- Buyers will typically bring their own customers

- Can generate revenue from both sides of the market: buyers and sellers

- Don't need to produce your own products (beyond the marketplace itself)

Cons of Marketplace

- Quality control can be difficult

- Chicken-egg problem: getting your very first buyers and sellers

- Settling disputes and investing in customer support

Choosing A Revenue Model For Your Business

This Notion template database also includes some properties to help you understand more about the various revenue models listed, and how they compare with one another on a few important factors. These are:

- Volume needed;

- Typical Margins;

- Capital needed upfront;

- Relationship to customer (direct or indirect);

- Scalability;

- Revenue model examples; and

Volume Needed

The volume needed property gives an indication (on a scale from 'Very Low' to 'Very High') of how many customers are typically needed for this type of revenue model to work. For example, a subscription revenue model that charges $1.99/month will need a Very High volume of customers in order for the model to work; whereas a high-ticket services business may only need 1 or 2 big clients per year.

Typical Margins

The typical margins property is there to help you understand how profitable this revenue model can be, given the right circumstances, per sale or customer. For example, a business selling digital products will typically have very high margins (if they are priced correctly), whereas a business that relies on advertising as its primary revenue source may have lower margins.

Capital Needed Upfront

The capital needed upfront column describes (loosely) of how much money you will need to spend in order to get the business up-and-running. For example, a subscription business can be started with very little capital as there are no inventory or product development costs; whereas a manufacturing business may need a lot of money to get started as there are significant inventory and product development costs.

Relationship to Customer (Direct or Indirect)

The relationship to customer property gives an indication of whether the revenue model is direct, indirect or two-sided (e.g. marketplaces). A direct revenue model is one where you have a direct relationship with the customer; whereas an indirect revenue model is one where you do not have a direct relationship with the customer.

For example, a subscription business has a direct relationship with the customer as they are paying the business directly for a product/service; whereas an advertising-based revenue model has an indirect relationship with the customer as they are paying the advertiser, not the business.

Scalability

The scalability property gives an indication of how easy it is to scale this type of revenue model. A scalable revenue model is one that can grow without a significant increase in costs; whereas a non-scalable business is one that has fixed costs which limit its growth.

For example, a subscription business is usually more scalable than a manufacturing business as there are no inventory or product development costs; whereas a business that relies on a small number of high-value clients is usually less scalable as it is difficult for you to service more such clients with the same number of hours in a day.

Revenue Model Examples

This column provides an example of a real business that is deploying this revenue model. I've tried to select primarily indie businesses, however this isn't the case for all of the businesses listed (where I couldn't find an indie business, I chose something that may be relevant or a company that I just generally like).

It's also worth noting that many of the businesses listed under a certain revenue model type employ multiple revenue models, alongside the stream that they're listed under. This is quite common for indie businesses (to have multiple revenue streams) and can be a good hedge against any single revenue stream going dry.

As you look through the list of possible revenue models, you can give each a ranking and sort the list based on those that are best suited.

Getting Started

Duplicate this template into your own Notion workspace, and start ranking the various revenue models as they suit your own business, today.

Notion Components Library

110+ unique Notion business templates to extend your Notion workspaces. Try out our free collection of Notion templates with the button below. Or, for access to the full advanced library, check out our All Access Bundle.

💡 What is a Notion OS? Notion OS templates are ready-made workspaces that have been designed for specific business types. You can always customize your Notion OS further with individual components--but your OS should serve as your base hub, with the fundamental structure you need to run a business in Notion.

Maximizing Profitability: Explore Effective Revenue Models for Your Business

Choosing the right revenue model can help you earn more and create an effective pricing strategy. Explore the different types of revenue models here.

Imagine you're walking down the street on a hot summer day and see the neighborhood kids setting up a lemonade stand. Nothing sounds better on a day like this than an ice-cold lemonade. You approach their stand and find the price is $2 for a cup. While you know it wouldn't cost $2 to make just a glass of lemonade at home, you are willing to pay this price because you are thirsty and also want to support the kids.

From a business perspective, these kids are making a good amount of profit from their lemonade stand. They're actually using a markup revenue model where they increase the price of a cup of lemonade to account for their operating costs. It seems like the perfect model for making money. However, this might not be the case in every business situation. Depending on the scale and complexity of your business model , you need to consider different methods of developing revenue streams.

There are various revenue models implemented by businesses across the board. Many business models are far more complex than a simple lemonade stand and thus require a different revenue model strategy. There are subscription-based, advertising, and commission-based models, to name a few—but what is a revenue model, and how do you choose one?

If you're considering which revenue model to incorporate into your business strategy, keep reading to learn more.

What is a revenue model?

A revenue model is a blueprint for how a company produces income from its services or products. Simply put, it outlines the methods through which a business makes money. There are several components within a revenue model, including how you price your products and which sales channels you choose. A revenue model is established to answer how a company plans to financially optimize its business model.

Revenue models can be seen as roadmaps for understanding how your business will operate financially. They define how a company generates revenue, covers costs, and eventually turns a profit. A revenue model should outline the various sources of income to help guide decision-making related to the overall business strategy.

Benefits of implementing revenue models

Developing a revenue model is an essential step for growing your business. Here are some of the main benefits of implementing revenue models:

Financial sustainability

An effective revenue model establishes consistent income streams, providing financial security and sustainability. Your revenue model should help you understand how much revenue to expect so you can properly plan expenses, growth, and investments.

Pricing strategy

Factors such as market demand, competition, and product costs are considered within a revenue model. Each of these factors can inform your pricing strategy. Based on the revenue model, you can determine which prices maximize revenue while remaining appealing to customers.

Profitability analysis

Revenue models show how your business generates revenue. Understanding the costs incurred by creating your products or services, along with the generated revenue, allows you to analyze the profit margin of your business. Subsequently, you can make informed decisions to improve your resource allocation and pricing strategy.

Scalability

Growth is key to your business revenue model thriving. Implementing a revenue model provides insight into the scalability potential of your business. You can easily assess potential revenue growth by attracting more customers and introducing new products or services. Knowledge is power—the more information you have about how your business operates, the better you can plan for the future and make smarter investments.

Decision-making

A sound revenue model produces meaningful insights to influence strategic decision-making. Your revenue model indicates which products or services generate the highest income, enabling you to better allocate resources and focus on areas with the highest profitability potential.

Investor confidence

A smart revenue model will inspire investor and stakeholder confidence. Potential investors will be impressed by a well-defined revenue model that demonstrates a clear plan for generating multiple revenue streams.

Types of revenue models

There are various revenue models that can be implemented based on your specific business operations and needs. Understanding when and how to choose different types of revenue models will help you better calculate revenue growth rates.

Here are just a few revenue model examples:

Advertisement-based

An advertising revenue model is a popular type of revenue model. The main source of income is generated by displaying advertisements. In this model, your company sells advertising space to other businesses or brands who want to advertise with your customer base and users. How your business earns revenue is by charging advertisers for ad placements.

Pros of advertising-based revenue models

- Successful advertisement-based revenue models typically generate significant income.

- An advertising model can greatly boost revenue streams if you have a large user base or a popular platform.

- There's a low barrier to entry, meaning it's relatively easy to set up and requires minimal investment upfront.

- This revenue model also offers flexibility and opportunities for diversification since you can provide many ad types and have a full roster of advertisers.

Cons of advertising-based revenue models

- Advertisers aren't guaranteed.

- You need to attract advertisers who are willing to pay for placements on your platform.

- The advertising market constantly fluctuates, meaning your revenue may fluctuate whenever advertisers reduce their budgets and don't buy ad space.

- You must also consider user experience and how incorporating display ads will impact your engagement.

YouTube is well-known for using an advertising model. Content creators on the platform can monetize their content by displaying ads on their videos. YouTube earns revenue by selling advertising space to companies that want to reach a vast audience. In this case, content creators can also receive a share of the ad revenue based on several metrics, including clicks, view time, and impressions.

The affiliate model is a more common type of revenue model. It's where a company or person makes a profit by promoting and selling products on behalf of another business. In the affiliate revenue model, an affiliate acts as the middleman between potential customers and the products or services.

Pros of affiliate revenue models

- Affiliate models are generally low-risk and cost-effective.

- As an affiliate, you don't need to create your own products, nor do you handle inventory or customer segments.

- It offers the potential for passive income by earning commissions without active involvement.

- You can also generate income from various affiliate partners, making this model great for diversification and scalability.

Cons of affiliate revenue models

- As an affiliate, you have little to no control over the products or services you promote. This means that negative customer experiences may harm your reputation.

- This type of model also creates revenue dependence on partners.

- Generating a profit with affiliate marketing may be easy, but intense competition and market saturation can make it difficult to generate significant income.

Affiliate marketing is a common revenue model. Amazon Associates is an example of an affiliate revenue model that allows individuals or businesses to make money through commissions on Amazon products they promote. Amazon provides unique affiliate links that lead to participants earning a percentage of the sales on products they advertise.

Commission-based

Similar to the affiliate model, commission-based revenue models allow companies to generate revenue by receiving a commission from each transaction it facilitates. Again, the company acts as a mediator between sellers and buyers.

Pros of commission-based revenue models

- The commission-based revenue model can be extremely scalable.

- The more users you gain, the more transactions will occur, leading to an increase in revenue growth.

- Another benefit of this model type is risk-sharing between the company and the sellers.

Cons of commission-based revenue models

- One of the major downsides to this model is dependency on transaction volume. If there are few transactions happening, the opportunities for generating revenue significantly decrease.

- You'll also experience limited control over pricing, which can lead to price competition among sellers and lower commission rates.

Airbnb uses a commission-based model. The platform makes money by connecting individuals with accommodation. Airbnb earns a commission on every booking made on the platform, making the company reliant on users securing lodging through their platform in order to generate revenue.

Another popular revenue model is donation-based. This strategy is implemented by soliciting and accepting voluntary donations instead of selling services or products.

Pros of donation revenue models

- One of the main benefits of a donation revenue model is the flexibility of revenue generation.

- Organizations can receive revenue streams from diverse donors.

- It's one of the most common revenue models implemented by charitable organizations and comes with tax benefits.

Cons of donation revenue models

- The downside of relying on donations is having an unsteady and uncertain revenue stream.

- Organizations are dependent on donors and are also required to spend money and time on fundraising.

- There are certain stipulations associated with receiving donations and how that money can be used

The Red Cross uses a donation revenue model. As a global humanitarian organization, the Red Cross relies on voluntary contributions to fund its services and programs. The Red Cross doesn't sell products, but they provide services for the community. The donation model is used to support the execution of these services.

The markup model entails a pricing strategy of marking up the cost or adding a margin on top to ensure financial viability. This strategy is used to cover expenses and generate profit despite external factors.

Pros of markup revenue models

- A markup revenue model is simple in practice.

- It doesn't require complex calculations and ensures the profit calculation is straightforward and transparent.

- The markup model also offers flexibility in pricing, meaning businesses can adjust the markup percentage depending on market conditions, supply, competition, and more.

Cons of markup revenue models

- The markup model can be difficult to implement in competitive markets.

- Competing while maintaining profit margins can be challenging when competitors implement aggressive pricing.

The retail industry generally relies on the markup model. There are specific production costs associated with making a pair of shoes. Retailers typically purchase the shoes from wholesalers at a fixed price. Then, they add a markup percentage to determine the selling price so it covers operating expenses and allows the retailer to earn money.

An interest revenue model refers to businesses generating income by earning interest. In this case, companies are making money by leveraging interest rates rather than making direct sales.

Pros of interest revenue models

- Interest models allow companies to earn passive income and diversify their revenue streams.

- This revenue model is also highly scalable and can benefit from changes in interest rates, leading to enhanced earning potential.

Cons of interest revenue models

- There's a level of risk associated with the interest revenue model. Risks include borrowers defaulting on loans, interest rate fluctuations, regulatory and compliance laws, and intense market competition.

Credit card companies use the interest operating model. They lend money to borrowers and earn interest back based on interest rates. These companies manage credit and loan portfolios while taking advantage of interest rates to increase profitability.

Subscription

A subscription revenue model relies on customers who subscribe and pay for your products or services. Customers pay fees to access the company's collection of products or services, allowing for steady revenue sources. The subscription-based revenue model allows a company to generate revenue by offering long-term subscriptions, resulting in consistent income such as monthly recurring revenue .

Pros of subscription revenue models

- The subscription model provides a reliable and predictable revenue stream.

- Customers pay in regular installments, allowing businesses to easily forecast finances.

- This revenue model also promotes customer retention and loyalty while lending itself to upselling and cross-selling opportunities.

Cons of subscription revenue models

- Acquiring customers with the subscription model can be challenging, meaning you may need to spend more time and money on marketing and sales.

- Customers can also cancel their subscriptions, leading to an increase in customer turnover.

Netflix is one of the most popular subscription revenue model examples. Users pay a monthly fee to access the streaming platform. Revenue generation results from monthly subscriptions. Not all subscription models are successful, but Netflix is the best example of how a subscription model can succeed in making money.

Which revenue model is right for you?

Choosing which revenue model is right for your business will depend on a variety of factors, such as your target audience, operating costs, and overall business model.

The first step for choosing a revenue model is to understand your market and the needs of your target audience. For example, media organizations will have different audiences than healthcare companies. Conduct market research to understand your customers and their needs, preferences, and pain points. These findings will inform your business strategy and how you decide to conduct business operations.

The next step is to specify your value proposition by clearly defining the unique value of your product or service. Identify key benefits and determine what sets your business apart from the competition. Consider how your business performs in terms of innovation, convenience, and quality. Communicating these benefits clearly and concisely enables your target customers to connect with your company.

Know your product or service inside-out. Understanding how your product functions, what it offers to target customers, and what your mission is will help you determine your company's business model. The ultimate goal is to generate revenue, so the more you understand your product or service, the better you can make sound business decisions.

There are several common revenue models to choose from. Online businesses, such as an e-commerce platform, might consider an advertising revenue model to diversify income streams. A local bakery may opt for other revenue models more suitable for their needs and production model. Select a revenue model after thorough research and consideration to ensure a steady and effective revenue stream.

Grow your profits with the right revenue model

Business models rely on generating income. The best way to grow your profits is to choose a revenue model that fits your company's unique needs. A company's revenue streams are dependent on more than just direct sales. Make sure to consider all different revenue model types when developing your strategy. A smart strategy is essential for a scalable business .

Whether you're just getting started or considering a switch in your revenue model, you can land more sales by leveraging market insights . Unlock your full earning potential by exploring the different tools and resources available for choosing a revenue model and growing your business. Rely on actionable data to make informed business decisions and hit your targets.

What Is a Revenue Model?

Updated: October 06, 2021

Published: September 24, 2021

Deciding how you’ll generate revenue is one of the most challenging decisions for a business to make, aside from coming up with what you’ll actually sell.

You want to ensure that you’re accounting for production costs, salaries for workers, what your consumers are willing to pay, and that you generate enough to continue business operations. You also want to make sure that your strategy fits with what you’re trying to sell.

Various revenue models will help you set your business on the right path. In this post, we’ll outline what they are and how to choose the right one for your company.

![revenue model of business plan Download Now: Annual State of RevOps [Free Report]](https://no-cache.hubspot.com/cta/default/53/78dd9e0f-e514-4c88-835a-a8bbff930a4c.png)

What is a revenue model?

A revenue model dictates how a business will charge customers for a product or service to generate revenue. Revenue models prioritize the most effective ways to make money based on what is offered and who pays for it.

Revenue models are not to be confused with pricing models , which is when a business considers the products’ value and target audience to establish the best possible price for what they are selling to maximize profits. Once the pricing strategy is set, the revenue model will dictate how customers pay that price when they purchase.

RevOps teams also use pricing models to predict and forecast revenue for future business planning. Knowing where your money is coming from and how you’ll get it makes it easier to predict how often it will come in.

There are various revenue models that businesses use, and we’ll cover some below.

Types of Revenue Models

Recurring revenue model.

Recurring revenue model , sometimes called the subscription revenue model, generates revenue by charging customers at specific intervals (monthly, quarterly, annually, etc.) for access to a product or service. Businesses using this model are guaranteed to receive payment at each interval so long as customers don’t cancel their plans.

Recurring Revenue Model Example

Businesses that benefit from recurring revenue models are service-based (like providing software), product-based (like subscription boxes), or content-based (like newspapers or streaming services). Businesses you may be familiar with that use this strategy are Spotify, Amazon, and Hello Fresh.

Affiliate Revenue Model

Businesses using affiliate revenue models generate revenue through commission, as they sell items from other retailers on their site or vice versa.

Sellers work with different businesses to advertise and sell their products, tracking transactions with an affiliate link . When someone makes a purchase, the unique link notes the responsible affiliate, and commission is paid.

Affiliate Revenue Model Example

Businesses you may be familiar with that use the affiliate revenue model include Amazon affiliate links and ticket promoting services. Influencers also use this model to advertise products from businesses and entice users to purchase them through custom links.

Advertising Revenue Model

The advertising revenue model involves selling advertising space to other businesses. This space is sought after because the advertiser (who is selling the space) has high traffic and large audiences that the buyer (who is purchasing the space) wants to benefit from to give their business, product, or service visibility.

Advertising Revenue Model Example

Various types of online businesses use this model, like YouTube and Google, and so do traditional outlets like newspapers and magazines.

Sales Revenue Model

The sales revenue model states that you make money by selling goods and services to consumers, online and in person. Therefore, any business that directly sells products and services uses this model.

Sales Revenue Model Example

Clothing stores that only sell their products in a storefront or business-specific retail website use the sales revenue model as they sell directly to consumers with no third-party involvement.

SaaS Revenue Model

The Software as a Service (SaaS) revenue model is similar to the recurring revenue model as users are charged on an interval basis to use software. Businesses using this model focus on customer retention, as revenue is only guaranteed if you keep your customers. The image below is the HubSpot Marketing Hub pricing page that uses the SaaS recurring subscription model pricing.

SaaS Revenue Model Example

Businesses using this revenue model include video conferencing tool Zoom, communication platform Slack, and Adobe Suite.

How to Choose a Revenue Model

Choosing a revenue model is entirely dependent on your specific business needs and your pricing strategy.

There is no one-size-fits-all solution, and some businesses have multiple revenue streams within their revenue model. For example, if you use a recurring revenue model, you still may sell advertising space on your website to other businesses because you have a high-traffic page.

There are some key factors to keep in mind, though:

1. Understand your audience.

When picking a revenue model, the most important thing to remember is the target market and audience your pricing strategy has identified. You want to understand their pain points and what model makes the most sense for charging them.

For example, if you’re a service that sells meal kits, your target audience is likely busy and wants the convenience of food that is set up and easy to make after a long day. Using the recurring revenue model makes sense, as you’ll automatically charge them on an interval basis, and they won’t have to remember to submit payment — speaking directly to their desire for convenience .

2. Understand your product or service.

It’s also essential to have an in-depth understanding of your product or service and how your audience will use it. For example, if you sell shoes, your audience likely won’t need a new pair every month, so it may make sense to go with the Sales Revenue Model. Instead, your customers can come to you directly every time they need a new pair.

Choose the Model That Best Fits Your Needs

Ultimately, choosing a revenue model is centered around understanding what makes the most sense for what you’re selling and what makes the most sense (and will be most convenient) for the audiences you’re targeting.

Take time to develop your pricing strategy, choose a revenue model aligned with it, and begin generating revenue.

Don't forget to share this post!

Related articles.

A Simple Guide to Lean Process Improvement

The Marketer's Guide to Process Mapping

Data Tracking: What Is It and What Are the Best Tools

What is a Data Warehouse? Everything You Need to Know

![revenue model of business plan Why Every Company Needs an Operating Model [+ Steps to Build One]](https://www.hubspot.com/hubfs/Operating%20Model.webp)

Why Every Company Needs an Operating Model [+ Steps to Build One]

What is Data as a Service (DaaS)?

Data Ingestion: What It Is Plus How And Why Your Business Should Leverage It

Data Mapping: What Is It Plus The Best Techniques and Tools

Marketing vs. Operations: The Battle for a Small Business' Attention

![revenue model of business plan What Is an Enterprise Data Model? [+ Examples]](https://www.hubspot.com/hubfs/woman%20working%20on%20enterprise%20data%20.jpg)

What Is an Enterprise Data Model? [+ Examples]

Free data that will get your RevOps strategy on the right track.

The weekly email to help take your career to the next level. No fluff, only first-hand expert advice & useful marketing trends.

Must enter a valid email

We're committed to your privacy. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our privacy policy .

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

You've been subscribed

Revenue Model Types in Software Business: Examples and Model Choice

- 14 min read

- Last updated: 6 Sep, 2024

- No comments Share

A business starts with an idea of how to generate value for a customer. So, if a customer is looking for a table, you can produce a table, market it, ship it, and receive payment for it — and that's your business model. The total amount of money earned — in other words, revenue — is the coal that keeps your train running. Depending on the business model’s complexity, revenue will cover manufacturing, distribution, marketing, and other costs. Besides simple transactions, there are many ways to generate revenue. That’s even truer for software companies: Web distribution and the nature of software create various possibilities to monetize code. Think of licensed/freemium apps, service subscriptions, and others. All of these represent a certain mechanism that specifies how a business generates revenue. The structure of this mechanism is called a revenue model.

Here's our video breakdown of revenue models

For those exploring the world of business strategy planning, we’ll elaborate on the definition of the revenue model, and the correlation between business models and revenue streams. We’ll also analyze different types of revenue models and look at some examples to scrutinize the pros and cons of each approach. Finally, we’ll reflect on how to choose or develop a model for your business.

What is a revenue model?

A revenue model is a plan for earning revenue from a business or project. It explains different mechanisms of revenue generation and its sources. Since selling software products is an online business, a plan for making money from it is also called an eCommerce revenue model. The simplest example of a revenue model is a high-traffic blog that places ads to make money. Web resources that present content, e.g., news (value), to the public will make use of its traffic (audience) to place ads. The ads in turn will generate revenue that a website will use to cover its maintenance costs and staff salaries, leaving the profit. Revenue models are often confused with business models and revenue streams. To avoid any misinterpretations, let’s quickly define these three terms that form a business strategy.

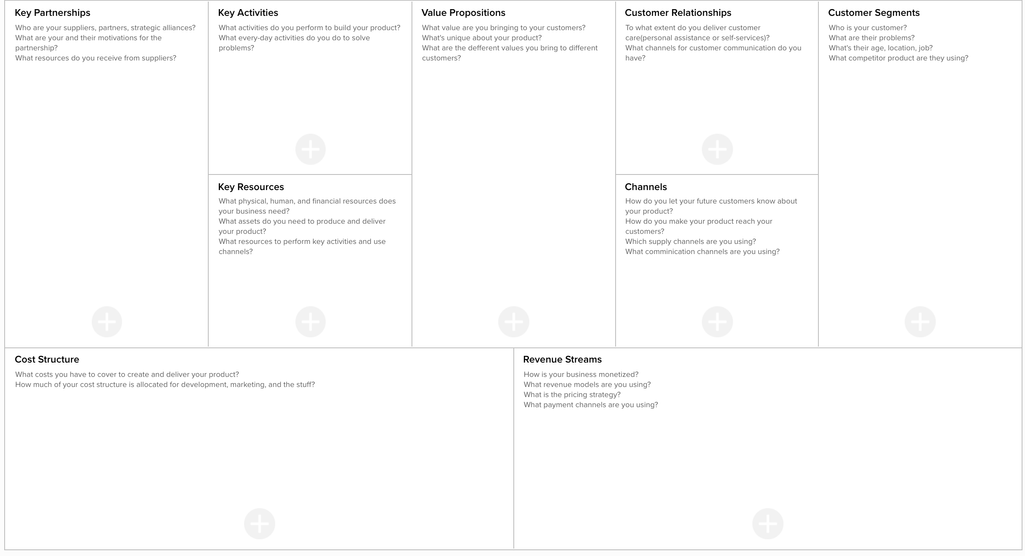

Revenue model vs business model

A business model (BM) is a broad term outlining everything concerning the main aspects of the business, all of which are contained in the answers to the following questions.

- What value will we create?

- How will we deliver it?

- How will we bring in revenue?

- How will we earn profit?

Numerous forms of business models can’t be classified in a single list because each part is highly individual to the industry, type of product/service, audience, or profitability. Business models are often depicted strategically on a business model canvas . This is a compound representation of all the key elements of a BM.

A business model canvas template by AltexSoft

So the BM describes how a business will work from the standpoint of value generation. Revenue models, on the other hand, are a part of the business model used to describe how the company gets gross sales.

Revenue model vs revenue stream

A revenue model is used to manage a company’s revenue streams, predict income, and modify revenue strategy. The revenue itself is one of the main KPIs for a business. Measuring it annually or quarterly allows you to understand how your business operates in general and whether you should change the way you sell the products or charge for them. But what are revenue streams ? A revenue stream is a single source of revenue that a business has. There can be many of them. Streams are often divided by customer segments that bring revenue via a given method. The two terms – revenue stream and revenue model – are often used interchangeably, since, from a business perspective, the subscription revenue model will have a revenue stream coming from subscriptions. However, models can name multiple streams divided into customer segments, while the principle of revenue generation (subscription) will remain the same.

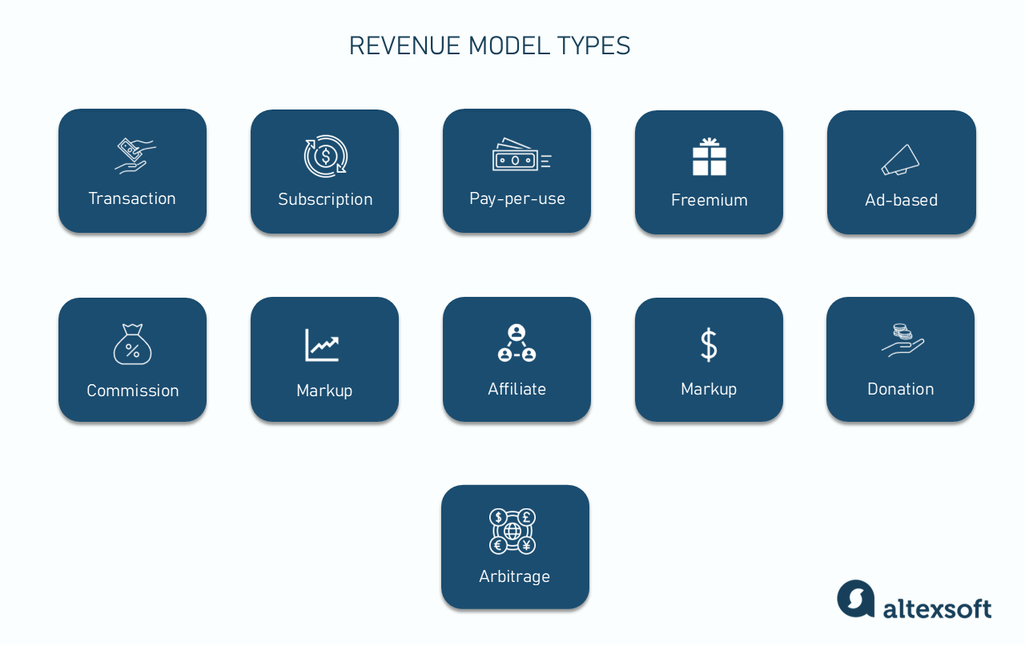

Revenue model types

Any start-up, tech company, or digital business may combine different revenue models. The revenue model will look different depending on the industry and the product/service type. Here we will pay more attention to the most common revenue models used in the software industry and online business.

Transaction-based revenue model

A transaction-based revenue model is a classic and one of the most straightforward methods of generating income, where businesses earn revenue each time a customer completes a transaction. The customer can be another company (B2B) or a consumer (B2C).

This model is commonly used by companies that sell software licenses, one-time services, or digital products. Revenue is directly tied to the volume of transactions, meaning that businesses that use this model must continuously attract and retain customers to sustain their income.

Nearly any company that produces and sells its products uses this type of revenue model. Examples include Samsung, Rolls Royce, Nike, Microsoft, Apple, Boeing, and McDonald’s.

The pros . You have full control over the pricing strategy.

The cons . The cons will depend on the industry/product type and pricing tactics, as the model itself imposes a constant generation of sales with the help of advertising and marketing strategies. The only con we might mention here is the financial burden connected with sales you will carry on your own.

Subscription revenue model

A subscription revenue model involves charging customers a recurring fee — usually monthly or annually — for ongoing access to a product or service. This model is popular among SaaS companies, streaming services, and digital content providers. The steady revenue stream allows companies to plan for long-term growth and continuously invest in product development.

Subscription models provide predictable, recurring revenue streams. Businesses that adopt this model usually offer different tiers of service to cater to various customer needs and budgets.

Software companies, ranging from streaming services like YouTube and Netflix and cloud storage platforms to healthcare solutions and digital newspapers, use this model.

The pros . This model provides businesses with a predictable and stable revenue stream. It also encourages long-term customer relationships and makes it easy to forecast future revenue.

The cons . This model is plagued by high customer acquisition and retention costs.

Pay-per-use revenue model

A pay-per-use model charges customers based on their usage of a product or service. This model is particularly effective for cloud computing services, where users are billed for the resources they consume, such as data storage or processing power. It aligns costs with usage, making it attractive to customers who prefer to pay only for what they use.

Cloud computing providers like Amazon Web Services and Google Cloud Platform deploy this model. Twilio also adopts usage-based pricing for its services.

The pros . This model appeals to cost-conscious customers by aligning costs directly with usage. There’s also the potential for higher revenues from power users.

The cons . Revenue can be inconsistent and difficult to predict and it requires robust tracking and billing systems. Also, high usage can lead to unexpectedly high costs for customers.

Freemium/hybrid revenue model

Have you ever downloaded a mobile app riddled with ads and seen popups asking you to buy the premium version to eliminate them? Or maybe your favorite mobile game wants you to pay for more hearts. These are classic examples of the freemium revenue model in action.

A freemium revenue model is a type of app monetization in which users can access the main product for free but are charged for additional functions, services, bonuses, plugins, or extensions.

Freemium models are hybrid in nature, as they are always combined with other revenue models. For example, Dropbox starts as a free product. However, once users exceed the free 2GB storage, they are promoted to subscribe to one of Dropbox’s plans. LinkedIn, Duolingo, video games, and other widely known businesses have also adopted the freemium/hybrid revenue model.

The pros . This model provides a low barrier to entry since the free version attracts users and allows them to experience the product in hopes of upselling or converting them into paying customers.

The cons . A major downside of this revenue model is the cost of supporting free users. Take Duolingo, for example. It has around 34 million active users, but only a tiny percentage — 8.6 percent — are paying customers. Overall, the freemium/hybrid model requires tenacity and patience, as conversion rates are low, and users who do convert take time to do so.

Advertisement-based revenue model

The advertisement-based revenue model is a plan with which businesses make money by selling ad spaces. It is one of the most standard methods of producing top-line growth, and it’s valid both for online and offline businesses. It’s often used by websites/applications/marketplaces or any other web resource that attracts huge amounts of traffic.

YouTube, Instagram, Facebook, and Google are just a few prominent examples. All these platforms generate revenue by displaying advertisements to users and charging businesses for exposure. In addition to promotion, these platforms may also generate revenue through other sources, such as premium subscriptions or licensing agreements. The pros. Having a high-traffic resource allows you to monetize the ad space nearly instantly. Often, there is a strong demand for advertising space, especially with organic traffic and platforms with the target audience. The cons. Running advertising campaigns to gain web visibility on various platforms like social networks is a standard marketing activity with targeting instruments more precise than ever. However, advertisements are everywhere, so you might think twice about whether you want to distract a user by placing an ad in your app – even if it is a secondary revenue stream.

Commission-based revenue models

A commission-based revenue model is one of the most common ways businesses make money today. A commission is a sum of money a retailer adds to the total cost of a product or service. A commission may be charged per marketplace or transaction and can be assigned as a

- flat rate, a fixed sum of money for any type of transaction, e.g., a $450/300/1500 transaction is charged with a $20 commission;

- percent of transaction size, e.g., a $100 transaction is charged with a 10 percent commission – $10; or

- tiered commission, a percent or flat rate that grows based on the transaction volume, e.g., 50,000 transactions are charged a 4 percent commission, 150,000 transactions a 7 percent commission.

Marketplaces and eCommerce platforms, in particular, utilize commissions the most. Another large category includes businesses that connect service providers/renters with consumers. Think of any ride-hailing company, food delivery, online travel agency (OTA) , or alternative accommodation services.

Airbnb is a platform that allows individuals to list and rent their homes or apartments as short-term rentals . It generates revenue by charging a commission on each booking made through its platform. The commission is typically a percentage of the total booking cost and is paid by the host (property owner). Other examples are Booking.com, Uber, Lyft, Ticketmaster, Priceline, and Upwork. The pros. Revenue is easily predictable because of the sheer fee. The cons. There are many problems bound to the concept of a commission, but the major one goes to the scalability of a business that’s attached to a transaction size or volume. In general, dependency on the product supplier’s sales makes generating revenue require upfront investments and competitive superiority.

Markup revenue model

Markup is the type of revenue model with which you buy a product at a certain cost and then sell it for a higher price: The difference between the two is your profit margin. This model is often used by wholesale, retail, and service-based businesses. For example, a wholesaler may be a bed bank — a B2B company that purchases rooms from accommodation providers in bulk at a discounted, static price for specific dates, and sells them to OTAs , travel agents, destination management companies, airlines, or tour operators.

In addition to bed banks, airline consolidators leverage a markup model to earn revenue: They are brokers that book flight seats in bulk at discount rates and then resell them to travel agencies. Examples are Mondee, Picasso Travel, and Centrav. Pros. Markup revenue models are straightforward, allowing businesses to easily calculate their profit margins on each sale. With this approach, businesses can be flexible with their pricing by adjusting the markup to reflect changes in the cost of goods or changes in market conditions. Cons. While markups provide a great deal of flexibility, some organizations may not have enough resources to manage revenue and apply changes to their markup strategy based on the market state. So, they set a uniform markup for all of their products or services. This may lead to prices being too low or too high and businesses may not be able to fully capitalize on the value of certain products.

Affiliate revenue model

The affiliate model is similar to the commission-based model. The main difference is that, with the affiliate model, you do not sell the product or service on your own platform, but rather redirect the customer to the original provider's platform to make the purchase and earn a commission on any resulting sales. An affiliate model is a contract between a supplier of a product/service and a promoter. A promoter can be another business/media resource/blogger who recommends a supplier’s product. The earnings will come as a percentage of sales or fees for the number of registrations done via referral links. Businesses utilizing the affiliate model include metasearch engines as a unique example. Metasearch tools can be found almost everywhere. Their main difference with retailers is that they don’t sell products directly but offer comparison and search as a value. Advertising and affiliate programs are the main revenue models used to get earnings in this case.

Blogging and event-promoting platforms like Broadway.com or TheaterMania generate revenue using this model. Among other examples are Amazon affiliate websites, e.g., Cloud Living and ThisIsWhyImBroke. The pros. Just like the advertisement-based revenue model, once you have a huge traffic resource, you might apply for an affiliate program to earn money. This will bring you income without any investments because you will basically generate traffic and leads for the affiliate program provider. The cons. Unfortunately, the percentage of affiliate programs promised to the promoter is quite low. Sometimes, it fluctuates between 1-2 percent and requires a high volume of sales generated through your links.

Interest revenue model

An interest or investment revenue model relates to any type of business that generates revenue in the form of interest on their loans or deposit payments. These are most often banking or electronic wallet companies that work with financial operations. The revenue is generated by making a loan to a customer or by a customer depositing or investing money (or other resources) into the business. At the end of a return period, a percentage of the loan sum will return as revenue. Debit/credit money provided with the bank accounts also relates to this model. That’s just one of the ways financial companies can make money, combining it with transaction fees for using their e-wallet/bank account.

Many banks, credit card companies, and other financial institutions use the interest revenue model. For example, peer-to-peer lending platforms, such as LendingClub and Prosper, generate revenue by charging interest on loans funded by investors. The pros. The interest rate provides a clear view of what revenue a business will generate, as the percentage stays unchanged until the return period is over. The cons. The regulations of an interest rate impact both the customer and the business. Sometimes, it depends on the economic environment. Think of currency rate changes that influence potential and existing borrowers.

Donation-based or pay-what-you-want revenue models

This is a revenue model based on investments made by businesses or customers on a voluntary basis. The product or service itself is free to use by default, so that’s the primary value a company brings to the customer. The revenue is generated in the form of donations, or sometimes in the form of “pay-what-you-want.” It’s important to mention that there is a difference between a donation-based business and a charity organization. A donation-based company is still required to pay taxes.

For example, AdBlock generates revenue through donations from users who support the development and maintenance of the software. At the same time, AdBlock offers a premium version of the software for a fee, which includes additional features and support. Among other examples is Wikipedia which relies on donations as a significant source of revenue. Additionally, the platform makes money through grants and partnerships. The pros. Because of the free access to the product, some companies manage to get increasingly popular, resulting in donations becoming a major part of their revenue. The cons. The model is never used on its own and the revenue generated by it remains a secondary source because of its random/unstable nature.

Arbitrage model

An arbitrage revenue model involves buying products or assets at a low price in one market and selling them in another market at a higher price, capitalizing on price differences. This model is common in finance, trading, and some eCommerce businesses. Its success relies on the ability to identify and exploit price discrepancies quickly.

An example is Airbnb arbitrage, where individuals rent properties long-term and then sublet them as short-term rentals on platforms like Airbnb. Someone might rent an apartment for $1,500 monthly and list it on Airbnb for $100 per night. If they can keep it occupied for 20 nights a month, they'd earn $2,000 and make a $500 profit. This practice is not how Airbnb itself makes money but a method users deploy to generate income through the platform.

The pros . If done correctly, you can generate high profits with minimal risk using this model. Also, significant capital investment is not required to deploy this model.

The cons . Arbitrage requires expertise and constant market monitoring. It may involve using sophisticated algorithms and fast processing capabilities to identify opportunities. There are many other revenue models, and a business or project may use more than one revenue model. It is important for businesses and projects to carefully consider their revenue model as it can have a significant impact on the overall success of the venture.

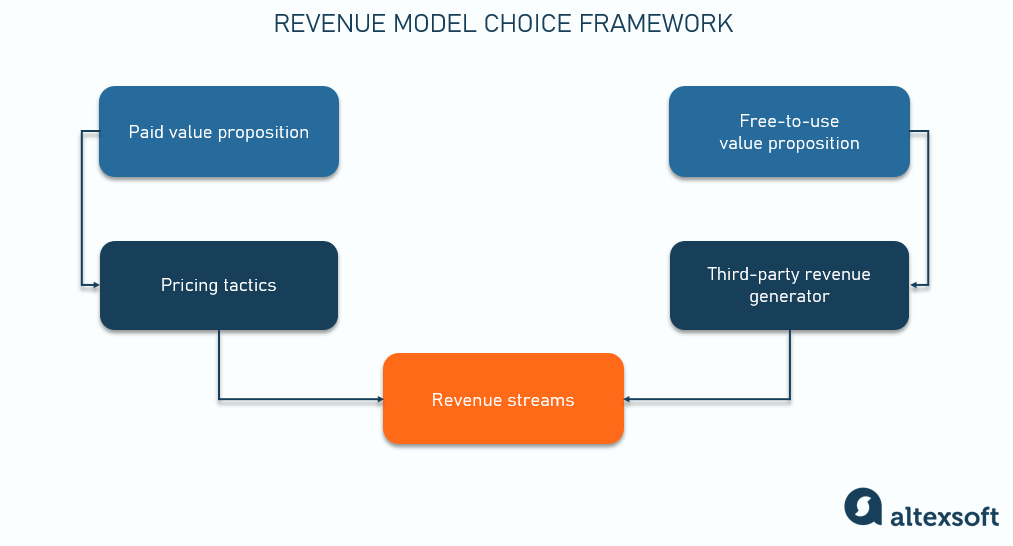

How to choose a revenue model framewor k