Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Investment Banking Resume Guide & Examples

Banker Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Commercial Banker

- Personal Banker

Get advice on each section of your resume:

Jump to a resource:

- Banker Resume Tips

Banker Resume Template

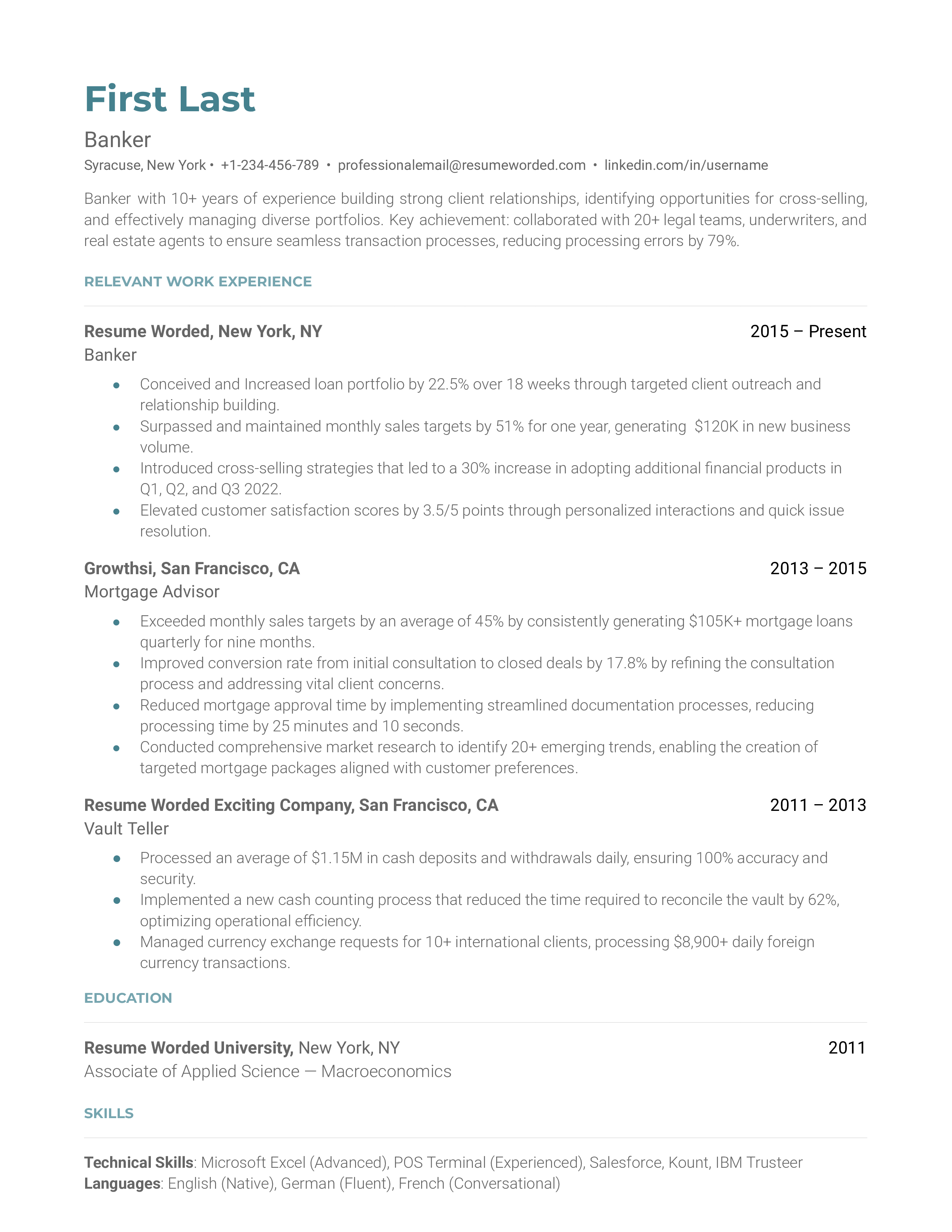

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., banker resume sample.

The banking industry is all about trust, relationship management, and understanding complex financial systems. A strong resume for a Banker role should reflect your ability to handle these tasks. Recently, the industry has been leaning heavily on technological innovation with online banking and digital transactions becoming standard. Also, sustainability and ethical banking practices are gaining traction. So, while it's essential to demonstrate your fundamental banking knowledge and financial acumen, showcasing your proficiency in the latest banking technologies and awareness of ethical banking practices could give you an added advantage. When crafting your resume, bear in mind that bankers are detail-oriented and value effective communication. Therefore, your resume needs to be impeccably neat, clear, and concise. It needs to quickly communicate your qualifications, experience, and skills relevant to the banking world.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your banker resume in 2024, showcase technical skills and digital proficiency.

Banking is no longer just about traditional financial services; it's rapidly going digital. Mention any experience or familiarity with banking software, online transaction systems, or fintech innovations. This shows you’re not just adaptable, but also forward-thinking.

Highlight understanding of ethical banking norms

As the industry shifts towards ethical banking practices and sustainable investing, it’s crucial to demonstrate your knowledge in this area. If you’ve been involved in any projects or initiatives related to ethical banking, sustainable finance, or corporate social responsibility (CSR), make sure it's there on your resume.

As a banker, your role is about more than just crunching numbers; you're expected to provide financial guidance, build relationships with clients, and work effectively in a highly regulated environment. Digital banking continues to grow so it's critical to understand latest technological trends and how they fit within the banking industry. By being mindful of these factors, you can tailor your resume to reflect the skills and experience that make you stand out in the evolving banking landscape. In crafting an effective banker resume, remember to emphasize your financial acumen and your customer service expertise. Don't just list out your duties; instead, quantify your achievements. It's a competitive field, so giving concrete evidence of your successes will definitely make your application more compelling.

Demonstrate knowledge of banking regulations

In your resume, you should clearly state your understanding and application of banking regulations. Mention specific regulatory projects you've managed or contributed to. This shows that you can navigate the complexities of banking law, a crucial skill for any banker.

Showcase your digital literacy

In light of the digital banking trend, demonstrating that you’re tech-savvy is a plus. List any software, tools or technologies you’ve used or learned that are relevant to banking. If you’ve been part of a project involving digital banking or fintech, make sure to include this in your list of accomplishments.

Commercial Banker Resume Sample

Personal banker resume sample.

We spoke with hiring managers at top banks like JPMorgan Chase, Bank of America, and Wells Fargo to understand what they look for in a banker's resume. The following tips will help you create a strong resume that stands out from other applicants and gets you interviews.

Highlight your banking experience and skills

Recruiters want to see that you have relevant experience and skills for the banking role you are applying for. Emphasize your banking experience and skills in your resume, such as:

- 5+ years of experience in retail banking, managing customer accounts and transactions

- Expertise in financial analysis, risk assessment, and lending products

- Strong knowledge of banking regulations and compliance requirements

Quantify your achievements wherever possible to show the impact you made. Instead of generic statements, use specific examples like:

- Managed customer accounts

- Skilled in financial analysis

- Managed 200+ customer accounts with $10M+ in assets, consistently meeting sales targets

- Conducted financial analysis for 50+ commercial lending deals, averaging $5M per deal

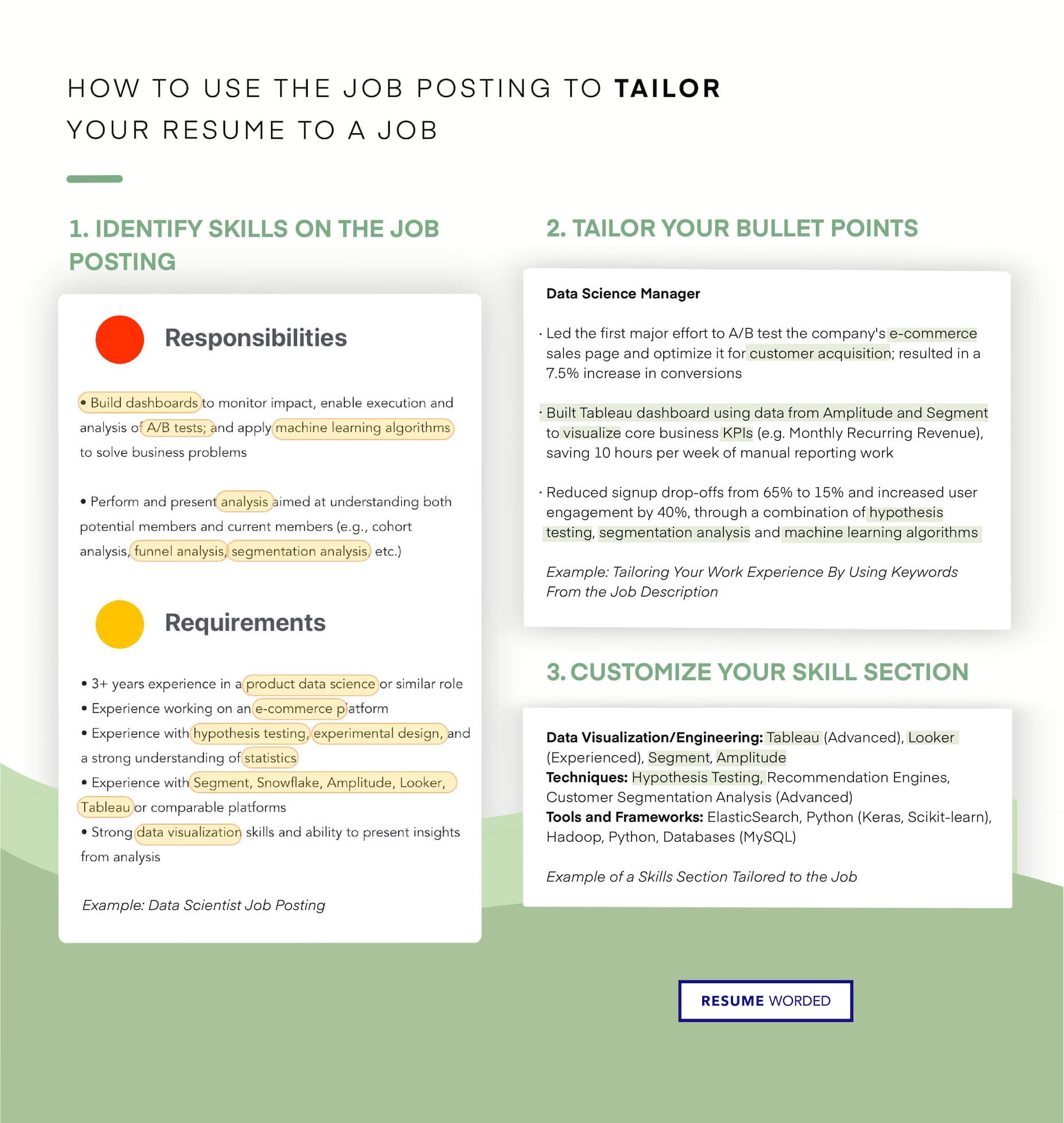

Tailor your resume to the specific banking role

Banking is a broad field with many different roles, such as retail banking, commercial banking, investment banking, and risk management. Tailor your resume to the specific role you are applying for. Here are some examples:

- For a retail banking role, focus on your experience with customer service, sales, and account management.

- For a commercial banking role, highlight your experience with business lending, financial analysis, and relationship management.

- For an investment banking role, emphasize your experience with financial modeling, deal execution, and client presentations.

Customizing your resume shows the recruiter that you understand the role and have the relevant skills and experience.

Use industry-specific keywords

Many banks use applicant tracking systems (ATS) to screen resumes for relevant keywords before a recruiter even looks at them. Include banking-specific keywords in your resume to increase your chances of passing the ATS screening. Some examples:

- Risk assessment

- Financial analysis

- Lending products

- Regulatory compliance

- Customer relationship management

Sprinkle these keywords throughout your resume in the relevant sections, such as your professional summary, skills, and work experience. However, avoid keyword stuffing or using keywords that do not apply to your actual experience.

Show your career progression

Recruiters want to see that you have progressed in your banking career and taken on increasing responsibilities. Show your career progression by listing your work experience in reverse-chronological order, with your most recent and relevant experience first.

For each job, include your title, the company name, dates of employment, and a few bullet points highlighting your key responsibilities and achievements. Use action verbs to describe what you did and the results you achieved. Here's an example:

Commercial Banking Relationship Manager, ABC Bank, 2018-2022 Managed a portfolio of 50+ mid-sized business clients with $100M+ in total loans Conducted financial analysis and risk assessment for new loan applications, resulting in a 20% increase in loan volume Developed and implemented a new client onboarding process, reducing onboarding time by 30%

Include relevant education and certifications

In addition to work experience, recruiters also look for relevant education and certifications on a banker's resume. Include your degree(s), major(s), and any relevant coursework or projects. Here are some examples:

- Bachelor of Science in Finance, XYZ University, 2015

- Coursework: Financial Accounting, Corporate Finance, Investment Analysis

- Capstone project: Developed a financial model for a $50M real estate investment

Also include any relevant banking certifications you have earned, such as:

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

These certifications show your expertise and commitment to the banking profession.

Demonstrate your soft skills

In addition to technical skills, banks also look for candidates with strong soft skills, such as communication, teamwork, and leadership. Demonstrate your soft skills by including examples in your work experience bullet points. Here are some examples:

- Collaborated with a cross-functional team of 10+ bankers, credit analysts, and underwriters to structure and close a $25M syndicated loan deal

- Presented quarterly portfolio performance reports to senior management, highlighting key risks and opportunities

- Mentored and trained 5 junior bankers on financial analysis and credit underwriting, resulting in a 50% reduction in errors

You can also include a separate skills section on your resume to highlight your key soft skills, such as:

- Relationship building

- Problem-solving

- Attention to detail

Writing Your Banker Resume: Section By Section

summary.

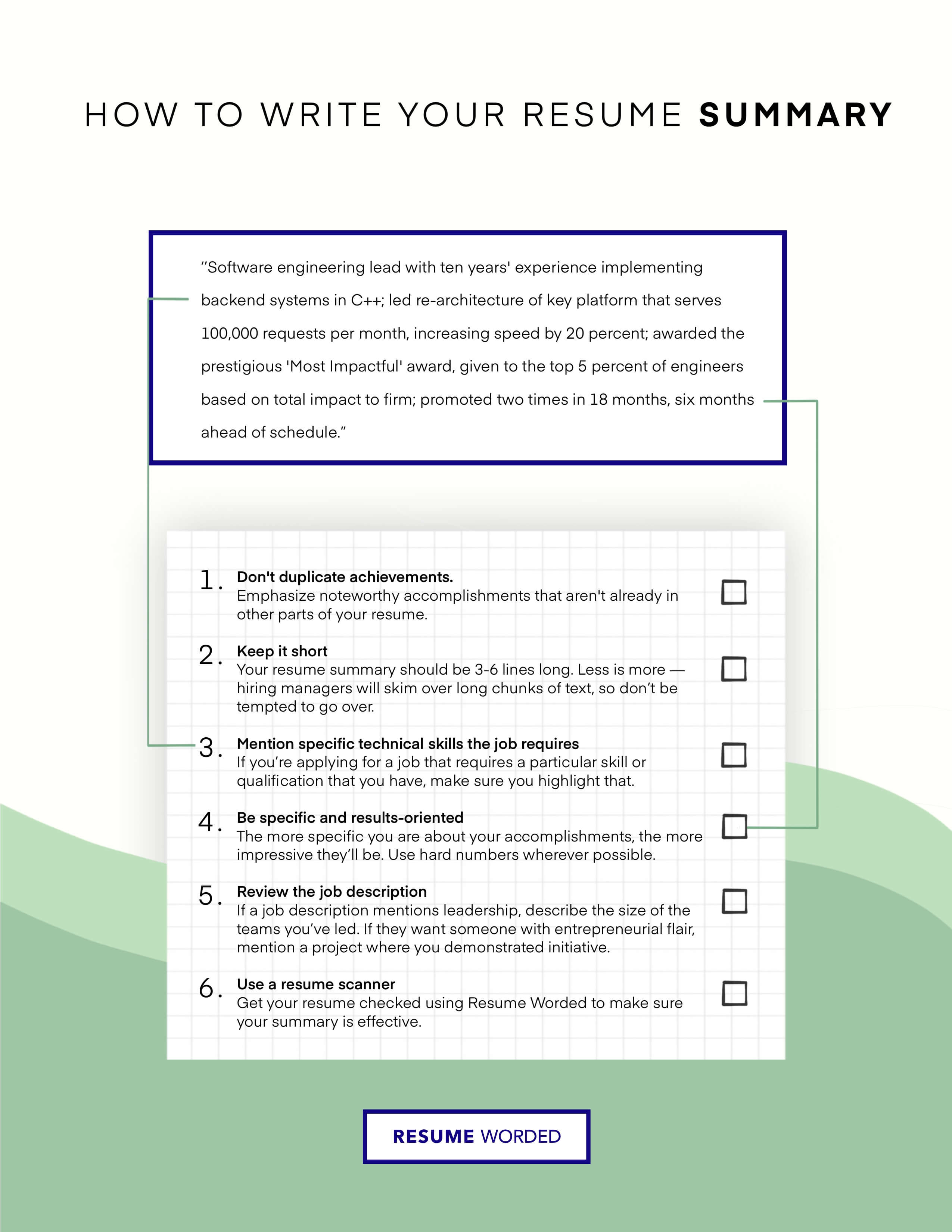

A resume summary for a banker is an optional section that provides a brief overview of your professional experience, skills, and career goals. While a summary is not required, it can be a useful tool to provide context for your resume and highlight your most relevant qualifications. However, it's important to avoid using an objective statement, as these are outdated and focus on what you want rather than what you can offer the employer.

When writing your banker resume summary, focus on your key strengths, accomplishments, and the value you can bring to the role. Tailor your summary to the specific position you're applying for and the financial institution's needs. Keep it concise, no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Banker resume, or figure out if you need one, please read Banker Resume Summary Examples , or Banker Resume Objective Examples .

1. Highlight your banking expertise and specializations

In your resume summary, showcase your specific areas of expertise within the banking industry. This helps employers quickly understand your focus and how you can contribute to their organization. Consider the following examples:

- Experienced banker with a proven track record of success.

- Skilled professional with experience in various banking roles.

Instead, be more specific and highlight your key areas of specialization:

- Commercial banker with 5+ years of experience in loan origination and portfolio management.

- Investment banker specializing in mergers and acquisitions for technology startups.

By focusing on your specific expertise, you demonstrate your value to potential employers and help them envision how you can contribute to their team.

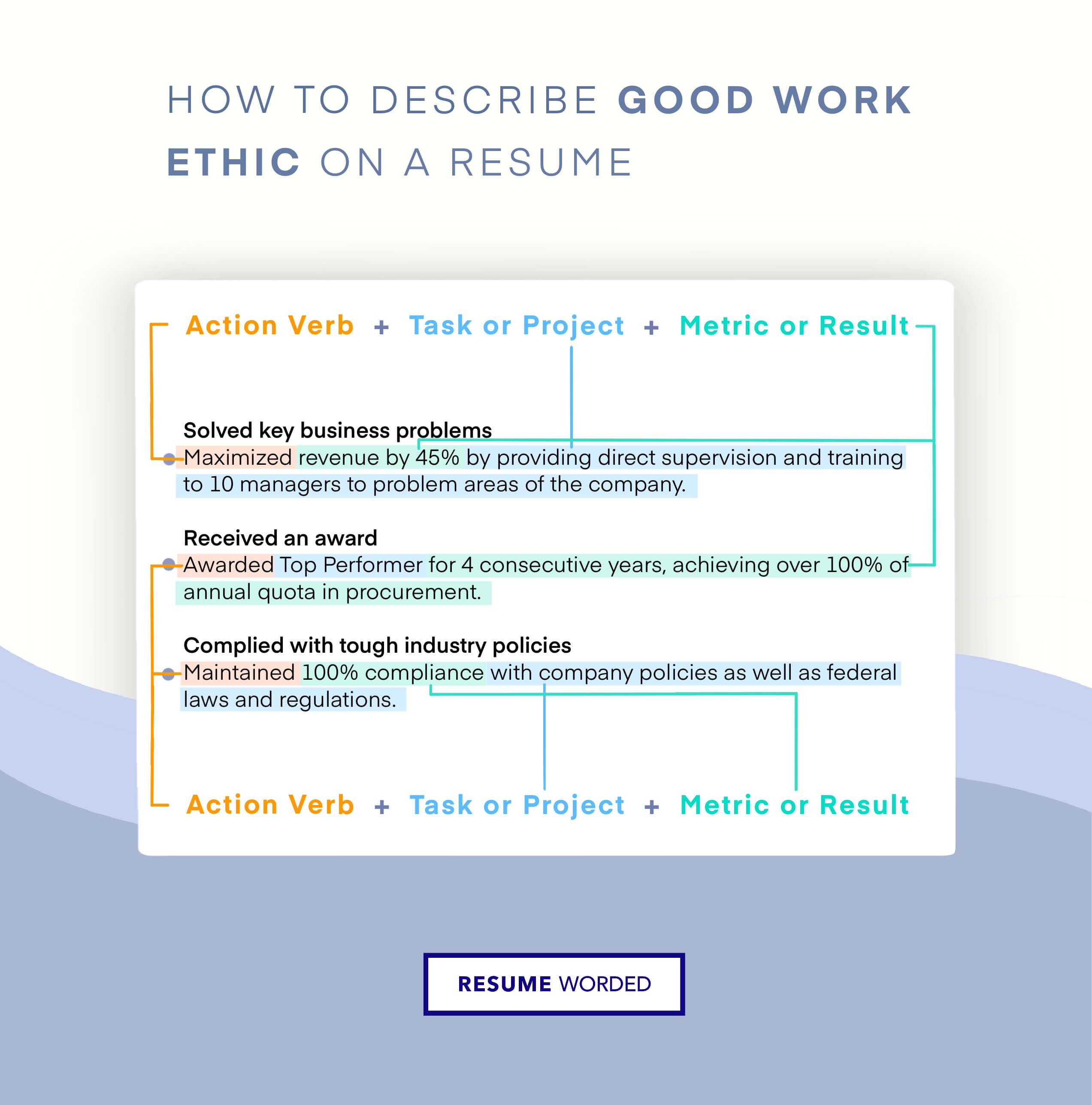

2. Emphasize your achievements and impact

When crafting your banker resume summary, focus on your achievements and the impact you've made in your previous roles. Quantify your results whenever possible to provide concrete evidence of your success.

Experienced relationship manager with strong communication and interpersonal skills. Proven ability to build and maintain client relationships.

While this summary mentions relevant skills, it lacks specific achievements and impact. Instead, consider a summary that highlights quantifiable results:

Accomplished relationship manager with a track record of growing client portfolio by 30% and increasing revenue by $5M+ annually. Skilled in developing strategic partnerships and providing exceptional client service to high-net-worth individuals.

By emphasizing your achievements and impact, you demonstrate your value to potential employers and set yourself apart from other candidates.

Experience

The work experience section is the heart of your resume. It's where you demonstrate your qualifications and show the hiring manager how you've applied your skills to produce results. When writing your work experience section, aim to create a compelling narrative that paints a clear picture of your career trajectory and accomplishments.

1. Highlight banking experience and skills

When describing your work experience, focus on the aspects of your roles that are most relevant to banking. This could include:

- Managing client accounts and portfolios

- Conducting financial analysis and risk assessments

- Developing investment strategies and providing financial advice

- Collaborating with cross-functional teams to deliver banking solutions

By emphasizing your banking-specific experience and skills, you demonstrate your qualifications for the role and make it easier for the hiring manager to visualize you in the position.

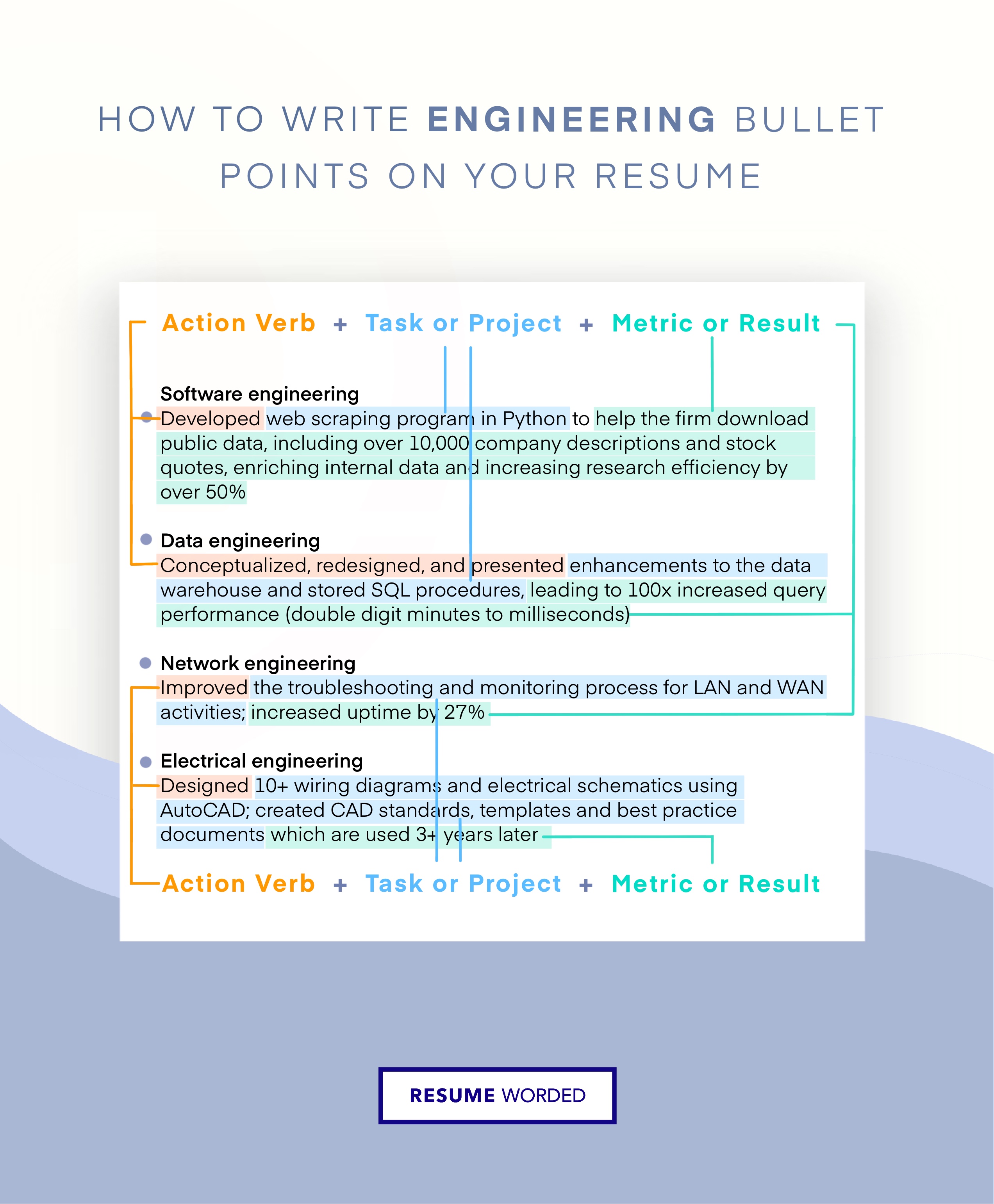

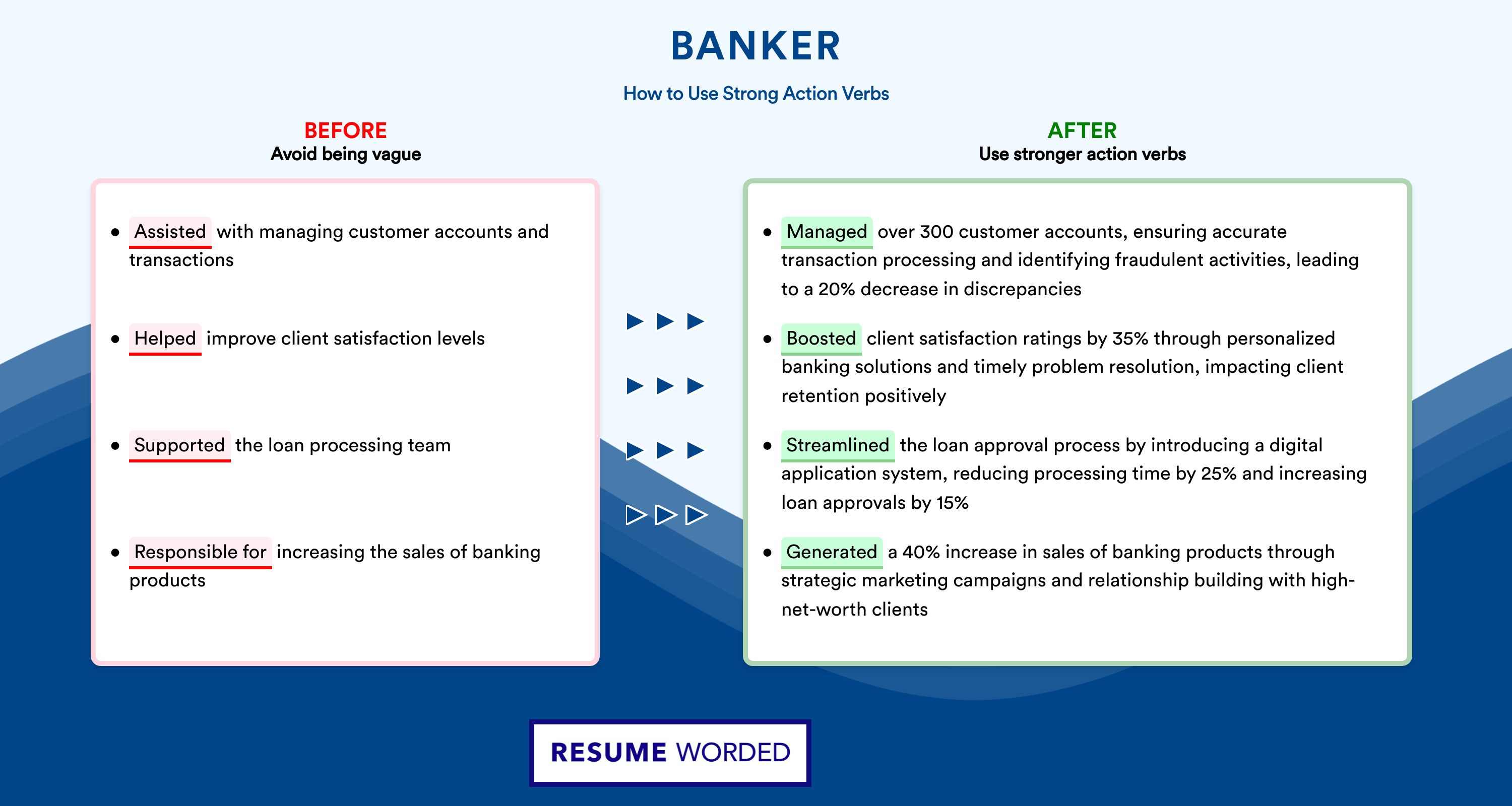

2. Use strong banking action verbs

When describing your achievements, use strong action verbs that resonate with the banking industry. Compare the following examples:

- Responsible for managing client portfolios

- Worked on financial analysis and risk assessment

Instead, use powerful verbs that convey your impact:

- Spearheaded the management of a $50M client portfolio, implementing strategies that generated a 15% return on investment

- Conducted in-depth financial analysis and risk assessments, identifying potential threats and opportunities for clients

Action verbs like "spearheaded," "implemented," "generated," "conducted," and "identified" create a stronger impression of your contributions and leadership.

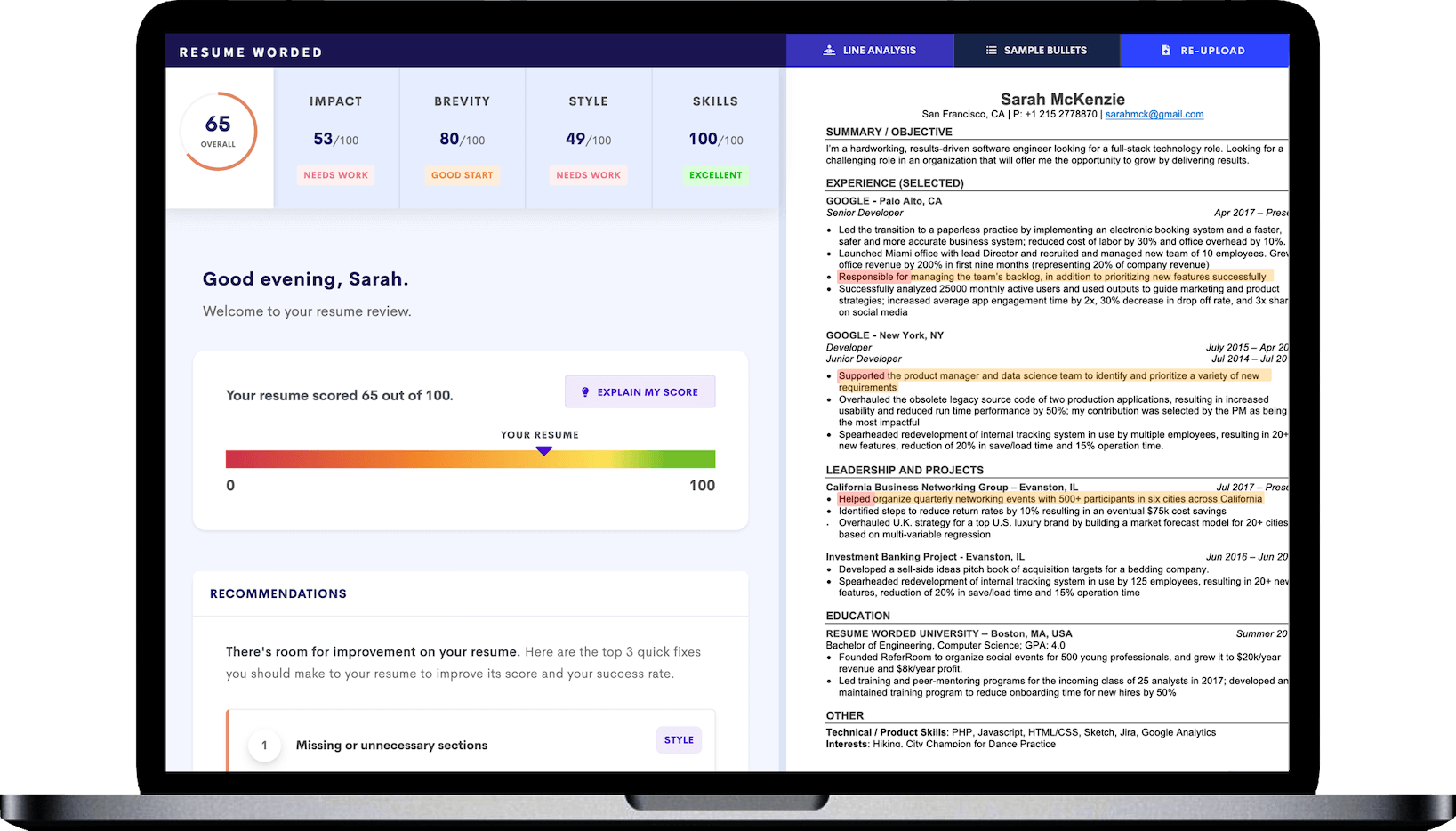

After writing your work experience section, use our Score My Resume tool to get instant feedback on the strength of your resume based on criteria hiring managers care about, including your use of action verbs.

3. Quantify your banking accomplishments

Whenever possible, use metrics to quantify your achievements and provide context for your contributions. Numbers help hiring managers understand the scope and impact of your work. For example:

Managed a portfolio of 50+ high-net-worth clients, overseeing $250M in assets and achieving an average annual return of 12%

If you don't have access to specific metrics, you can still provide context by using numbers or percentages, such as:

- Collaborated with a team of 15 bankers to develop and implement a new risk assessment framework

- Streamlined the account opening process, reducing average processing time by 30%

4. Demonstrate career growth in banking

Showcase your career progression within the banking industry by highlighting promotions, increased responsibilities, and key projects. This demonstrates your ability to learn, grow, and take on new challenges. For example:

Promoted to Senior Financial Analyst after consistently exceeding performance targets and demonstrating strong leadership skills. In this role, led a team of five analysts in developing and implementing a new investment strategy that increased client portfolio returns by an average of 10%.

By showcasing your career growth, you signal to hiring managers that you have the potential to continue advancing and making valuable contributions to their organization.

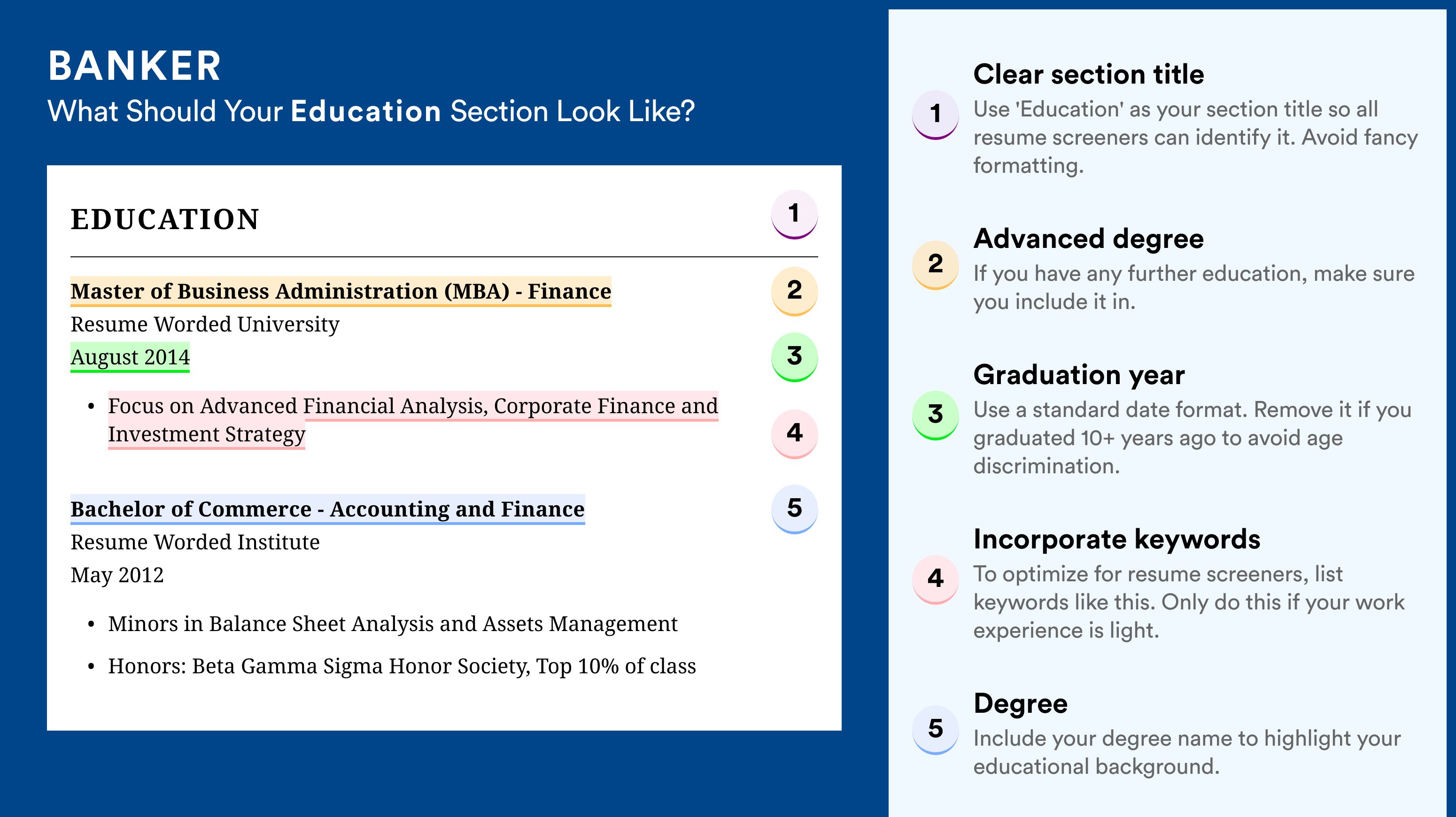

Education

Your education section is a key part of your resume as a banker. It shows hiring managers that you have the necessary knowledge and qualifications for the role. In this section, we'll cover what to include and how to format your education section to make it stand out.

1. List your degrees in reverse chronological order

Start with your most recent degree first, and work backwards. This is the standard format for resumes in the banking industry.

For each degree, include:

- Name of the degree (e.g. Bachelor of Science in Finance)

- Name of the university

- Graduation year

- GPA (if above 3.5)

Here's an example of how to format your degrees:

- Master of Business Administration (MBA), XYZ University, 2020

- Bachelor of Science in Finance, ABC University, 2016

2. Highlight relevant coursework for entry-level bankers

If you are a recent graduate or have limited work experience, you can strengthen your education section by listing relevant coursework. This shows hiring managers that you have specific knowledge that applies to the banking role.

However, avoid listing every course you've taken. Instead, choose 3-5 courses that are most relevant to the job description.

Here's an example:

Bachelor of Science in Finance, DEF University, 2022 Relevant Coursework: Financial Modeling, Investment Banking, Corporate Finance, Financial Accounting

3. Keep it concise for experienced bankers

If you are a senior-level banker with many years of experience, your education section should be brief. Hiring managers will be more interested in your professional accomplishments than your degrees from many years ago.

Here's an example of what not to do:

- Master of Business Administration, XYZ University, 1995-1997

- Bachelor of Arts in Economics, ABC College, 1991-1995

- Online Course in Advanced Excel for Finance, 2005

Instead, keep it short and sweet:

- MBA, XYZ University

- B.A. Economics, ABC College

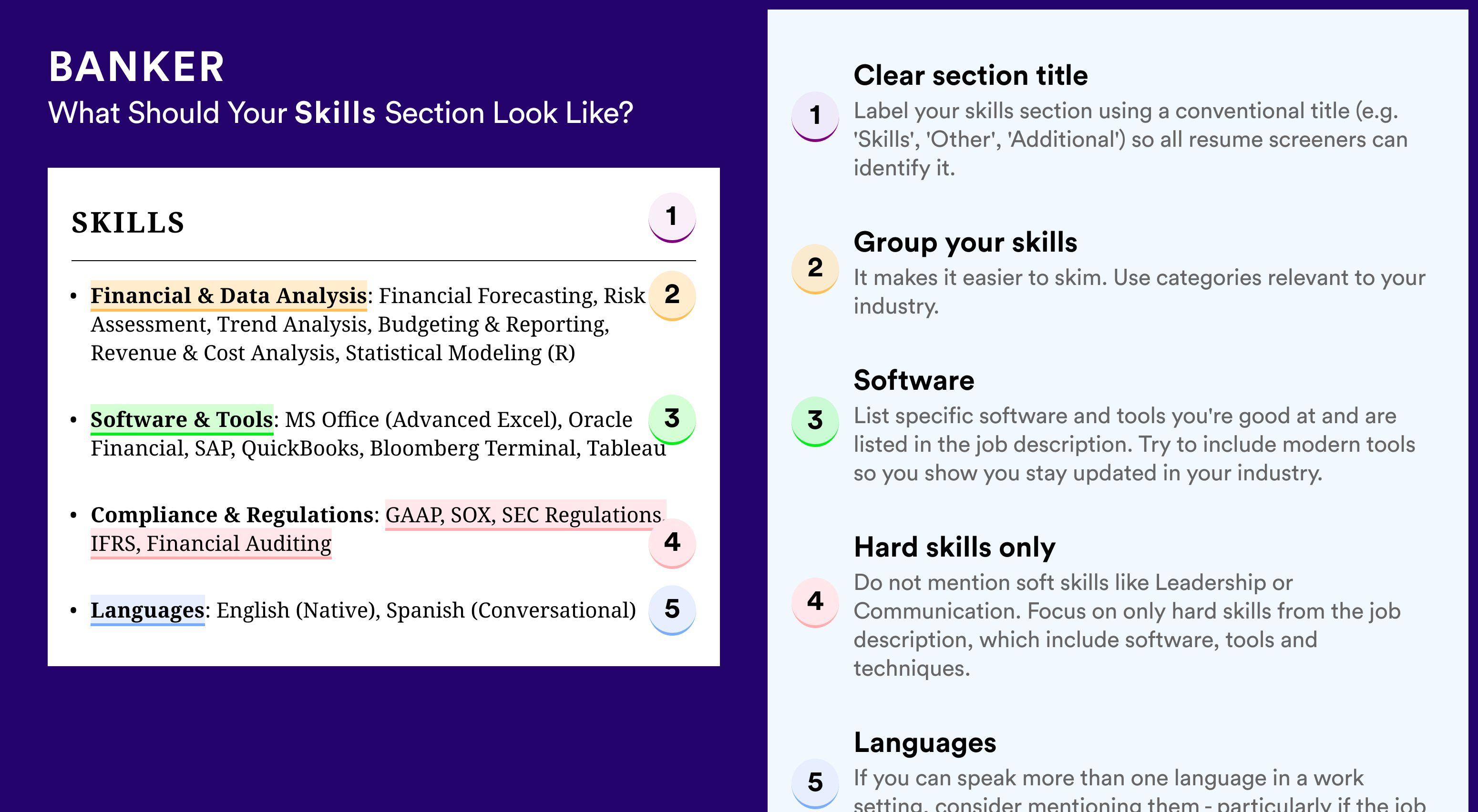

Skills

The skills section of your banker resume is a critical component that showcases your abilities and qualifications to potential employers. It's important to highlight the most relevant and valuable skills that align with the job requirements and demonstrate your expertise in the banking industry. In this section, we'll provide you with tips and examples to help you craft a compelling skills section that will catch the attention of hiring managers and increase your chances of landing an interview.

1. Prioritize banking-specific skills

When listing your skills, focus on those that are directly related to the banking industry and the specific job you're applying for. Highlight your expertise in areas such as financial analysis, risk management, loan processing, and customer service.

Here's an example of a well-structured skills section for a banker resume:

Financial Analysis : Financial modeling, financial statement analysis, credit analysis, budgeting and forecasting Risk Management : Risk assessment, fraud detection, compliance, anti-money laundering (AML) Loan Processing : Loan origination, underwriting, documentation, closing Customer Service : Relationship building, problem-solving, communication, sales

To ensure your skills section is tailored to the job, review the job description carefully and incorporate the key skills and qualifications mentioned. Using our Targeted Resume tool can help you identify the most important skills to include based on the specific job posting.

2. Avoid generic or outdated skills

When crafting your skills section, steer clear of listing generic or outdated skills that don't add value to your resume. For example, instead of simply stating "computer skills," be specific and mention the relevant software or tools you're proficient in, such as financial analysis software or customer relationship management (CRM) systems.

Computer skills Microsoft Office Communication Teamwork

Instead, showcase your skills in a more targeted and impactful way:

Financial Software : Bloomberg Terminal, Thomson Reuters Eikon, Morningstar CRM Systems : Salesforce, Oracle CRM, Microsoft Dynamics Data Analysis : Excel (Advanced), SQL, Tableau

Keep in mind that hiring managers often use Applicant Tracking Systems (ATS) to filter resumes based on the presence of specific skills and keywords. By including relevant and up-to-date skills, you increase your chances of passing the ATS screening and reaching the next stage of the hiring process.

3. Quantify your skills with proficiency levels

To provide hiring managers with a clear understanding of your skill levels, consider including proficiency indicators next to each skill. This can be done using terms like "Expert," "Advanced," "Intermediate," or "Beginner," or by using a visual scale, such as stars or bars.

Here's an example of how you can incorporate proficiency levels into your skills section:

Financial Analysis (Expert) Risk Management (Advanced) Loan Processing (Intermediate) Customer Service (Expert)

By quantifying your skills, you provide hiring managers with a quick and easy way to assess your capabilities and determine if you're a good fit for the role.

To ensure your skills section is effective and impactful, consider using our Score My Resume tool, which provides instant expert feedback on your resume, including an assessment of your skills section. The tool checks your resume against 30+ key criteria that hiring managers look for and offers suggestions for improvement.

Skills For Banker Resumes

Here are examples of popular skills from Banker job descriptions that you can include on your resume.

- DCF Valuation

- Financial Analysis

- Capital Markets

- Python (Programming Language)

- Due Diligence

- S&P Capital IQ

- Financial Modeling

Skills Word Cloud For Banker Resumes

This word cloud highlights the important keywords that appear on Banker job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, investment banking.

- C-Level and Executive Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

- Bookkeeper Resume Guide

- Financial Advisor Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Investment Banking Resume Guide & Examples for 2022

Improve your Banker resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Banker resumes in your industry.

• Fix all your resume's mistakes.

• Find the Banker skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Banker Resumes

- Template #1: Banker

- Template #2: Banker

- Template #3: Banker

- Template #4: Commercial Banker

- Template #5: Personal Banker

- Skills for Banker Resumes

- Free Banker Resume Review

- Other Finance Resumes

- Banker Interview Guide

- Banker Sample Cover Letters

- Alternative Careers to a Investment Banking Specialist

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

15 Banking Resume Examples That Made the Cut in 2024

Best for professionals eager to make a mark

Looking for one of the best resume templates? Your accomplishments are sure to stand out with these bold lines and distinct resume sections.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Banking Resume

- Banking Resume by Experience

- Banking Resumes by Role

- Write Your Banking Resume

Banking FAQs

Whether you’re an entry-level bank teller or you’ve climbed the ladder to being a manager, working in banking requires that you know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, your bank’s customers walk away happy after each visit.

With various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our AI cover letter generator , banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

or download as PDF

Why this resume works

- Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Experienced Banker Resume

- On top of your achievements, including a certification such as a Certified Bank Teller further lends credibility to your application and gets you closer to the door.

Associate Banker Resume

- Your Certified Wealth Strategist (CWS) or Commercial Banking & Credit Analyst (CBCA) certification, for instance, can give your associate banker resume a much-needed facelift. It signals to recruiters that you meet industry benchmarks and are willing to go the extra mile to strengthen your skill set and propel your career forward.

Senior Banker Resume

- Integrate your measurable achievements such as meeting sales quotas, solving customer problems, driving up profits, and so on in your personal banker resume .

Bank Branch Manager Resume

- To do this, display how you’ve streamlined processes, led teams, and boosted customer satisfaction. Now is great time to introduce metrics such as cutting administrative overhead, spearheading staff training, and more.

Personal Banker Resume

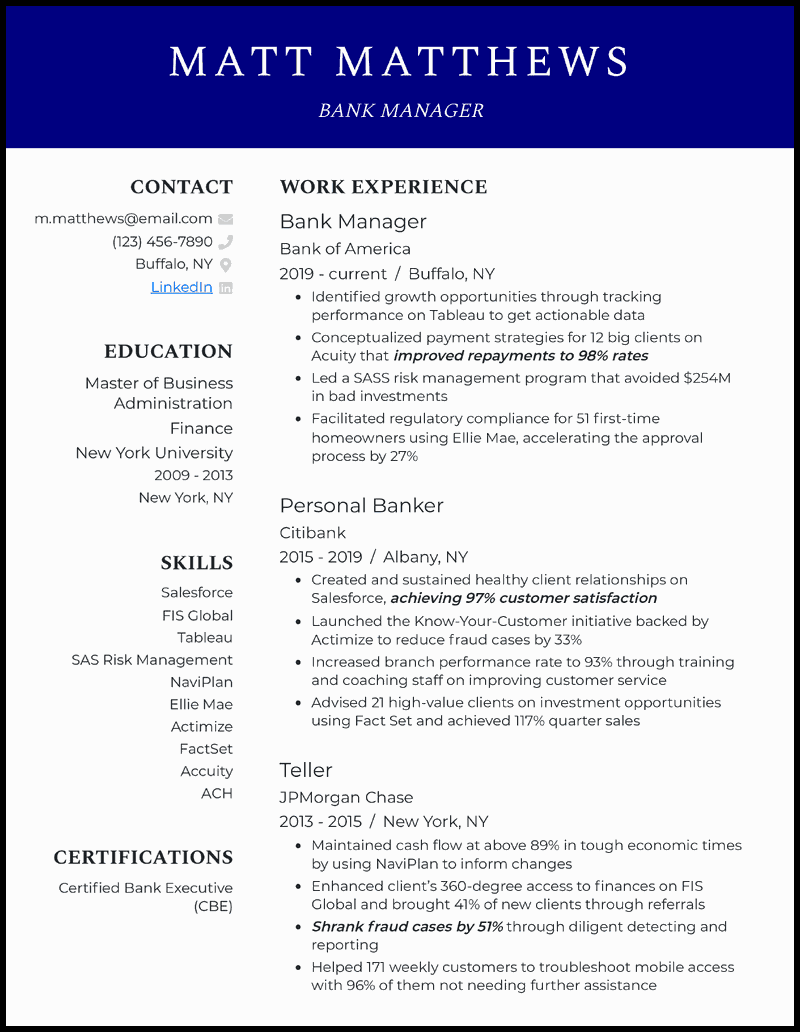

Bank Manager Resume

- Impress potential employers by showing your sales performance, customer service, and business growth metrics in your bank manager resume .

Relationship Banker Resume

- We suggest injecting some life into your work history with quantified accomplishments. Take “…ensuring 100% compliance with JPMorgan’s regulatory standards while processing $2.7 million in assets over six months” and “…preventing over $$99K in load default losses,” for instance. Now, that’s how you turn a good narration into a wow moment for hiring managers.

Universal Banker Resume

- Get down to specifics like how you turned detective with Experian Fraud Detection tools, screening transaction data, and customer behavior, thus preventing six fraud attempts in a month. Or how you advocated the integration of DocuSign for account opening procedures, which not only trimmed document turnaround time (by maybe two days) but also boosted client satisfaction. That’s gold!

Business Banker Resume

- Calling attention to at least one experience in a work setting similar to that you’re vying to join can do the trick for your business banker resume. And don’t rattle off your duties to give recruiters a taste of your potential; do them one better by serving up your proudest accomplishments complemented by genuine metrics.

Private Banker Resume

- Your updated contact deets (think phone number and professional email address) should sit at the top, regardless of the resume template you go with. And right after that, it’s smart to hyperlink to your LinkedIn profile, inviting hiring managers to dig deeper into your professional world.

Mortgage Banker Resume

- So, why not let software like Calyx Point, Salesforce, Dropbox Business, ComplianceEase, and LoanSifter steal the show in the skills part of your mortgage banker resume? Spice things up a bit, though—your work history section should illustrate how you’ve milked the tools dry to squeeze out impressive results at various companies.

Retail Banker Resume

- You see statements such as “Processed $2.3M in in-person and online card payments through Worldpay” and “…spearheading a new membership growth initiative that attracted 854 new customers over six months?” That will catch the recruiter’s eye and showcase your value straight away. Keep the accentuation to the right amount, though—a single phrase per job listing will do.

Commercial Banker Resume

- Nailing the look of your commercial banker resume comes down to a few key elements: white space, a legible, consistent font, and well-defined sections. A splash of color doesn’t hurt either. So, feel free to give your header, names of former places of work, and sidebar sections a pop with something vibrant like burnt orange.

Corporate Banker Resume

- Let’s say you have a bachelor’s degree in finance. Mentioning it boosts professionalism and credibility, plus signals you have the chops for this job. Now, if you’ve pursued a Master’s in something related, that’s even cooler. Let it take the lead in your education credentials, with your bachelor’s degree sitting proudly after that—reverse chronological order, remember.

Related resume examples

- Investment Banking

- Bank Teller

- Financial Analyst

Create a Banking Resume that Matches the Job Description Perfectly

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

15 popular banking skills

- Fiserv Signature

- Loan Processing

- Banking Regulations

- Credit Analysis

- Oracle Flexcube

- Microsoft Dynamics

- Fraud Detection

- Basic Accounting

- Customer Service

- Sales Strategies

- FIS Horizon

- Crisis Management

- Temenos T24 Transact

Your banking work experience bullet points

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

- Discuss your success in driving profits for the bank and its clients with financial metrics, such as revenue growth, ROI, and cost-to-income ratio.

- Mention any increases in efficiency, such as the branch performance rate, directing customers to other channels to free up more tellers, or optimizing client documentation.

- Take a customer-centric approach and talk about customer satisfaction ratings, retention, and engagement.

- Sales play a big part in banking, so show off metrics related to cross-selling, up-selling, handling loans, credit cards, and investments.

See what we mean?

- Fixed minor jam errors on NCR Selfserv that decreased customer wait time by 67%

- Detected 91% of fraud cases on Verafin and thwarted them without escalation to the supervisor

- Built 101 long-term client relationships, exceeding annual sales quota by 117%

- Conceptualized payment strategies for 12 big clients on Acuity that improved repayments to 98% rates

9 active verbs to start your banking work experience bullet points

- Facilitated

3 Tips for Writing a Banking Resume if You’re Starting Your Career

- You may be new to banking, but as long as you have any experience in working with customers, you’ve got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and internships.

- Banking requires a great deal of attention to detail, so don’t make the mistake of sending out a resume that’s tailored to a different job. Take the time to read the job description and update your work experience and skills accordingly.

- Pick a resume template that lets you add courses or certifications and include them to increase your credibility. The Certified Bank Teller (CBT) certification is great, but so is the Anti-Money Laundering (AML).

3 Tips for Writing a Banking Resume for a Seasoned Financial Expert

- As you advance in your career, leadership becomes a key skill, whether it is training new colleagues or managing an entire branch. Provide examples of times when you were in charge, such as assigning tasks or handling performance appraisals.

- Don’t be afraid to flaunt your financial acumen by talking about your ability to manage budgets, control costs, or drive growth. For instance, discuss the kinds of budgets you managed for your branch or for particular business accounts, making sure to mention ROI to showcase your impact.

- A successful banker is one who leaves a trail of happy customers behind. Underscore this in your resume by including metrics like customer retention, cross-selling, or satisfaction ratings, as well as mentioning how you helped your staff stick to bank policies.

Unless your career spans over 10 years, we recommend sticking to a one-page resume . Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.

IMAGES

VIDEO

COMMENTS

Secure your next role in the banking industry by taking ideas from our 13 banking resume examples as well as our resume-writing walkthrough.

Whether You Are a Fresher or an Experienced Banker, We Have CV Templates That You Can Use to Apply for a Finance Executive or Bank Job. Each Sample Is Available in Word, PDF, and Google Docs. Format a CV Easily with Just One …

View, Copy & Download (Free) ZipRecruiter Banking resume template & example for Microsoft Word, Google Docs, PDF.

A recruiter-approved Banker resume example in Google Docs and Word format, with insights from hiring managers in the industry. Updated for 2024.

Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Read along, and learn how to craft a resume that demonstrates your readiness to compete in the globalized banking business. What we’ll cover: The state of the banking industry today, with potential salaries and job …

Spell out the results of your past work as a banking professional, and describe how your efforts helped customers or the wider organization. Show your skills relevant to a …