The Guide to Interview Analysis

- What is Interview Analysis?

- Advantages of Interviews in Research

- Disadvantages of Interviews in Research

- Ethical Considerations in Interviews

Introduction

How to prepare for an interview, how to create an interview guide, common errors when preparing for an interview.

- Recruitment & Sampling for Research Interviews

- Interview Design

- How to Formulate Interview Questions

- Rapport in Interviews

- Social Desirability Bias

- Interviewer Effect

- Types of Research Interviews

- Face-to-Face Interviews

- Focus Group Interviews

- Email Interviews

- Telephone Interviews

- Stimulated Recall Interviews

- Interviews vs. Surveys

- Interviews vs Questionnaires

- Interviews and Interrogations

- How to Transcribe Interviews?

- Verbatim Transcription

- Clean Interview Transcriptions

- Manual Interview Transcription

- Automated Interview Transcription

- How to Annotate Research Interviews?

- Formatting and Anonymizing Interviews

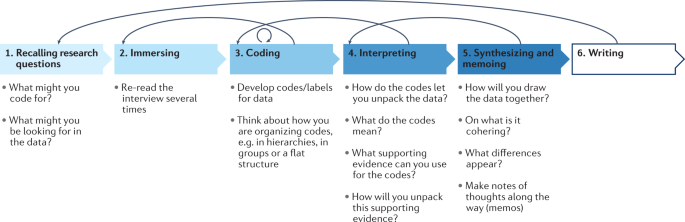

- Analyzing Interviews

- Coding Interviews

- Reporting & Presenting Interview Findings

In qualitative research, interviews are invaluable for gathering rich, detailed insights into participants' experiences, perceptions, and emotions. However, the success of these interviews relies heavily on thorough preparation, which ensures that the interview process is both effective and ethical. Without proper planning, researchers risk collecting shallow or irrelevant data, which can undermine the integrity of their study. This article explores the steps necessary to prepare qualitative research interviews, common errors to avoid, and why meticulous preparation is critical for obtaining valuable data.

The importance of preparing for an interview in qualitative research cannot be overstated. Effective interview preparation facilitates smooth interviews, yielding high-quality data while respecting the participants' rights and comfort. A well-prepared interviewer develops thoughtful, open-ended interview questions directly linked to the research objectives, allowing for richer, more detailed responses. Preparation also allows the interviewer to anticipate potential challenges, such as logistical issues or sensitive topics, and address them proactively. In essence, thorough interview preparation is essential to ensure the ethical conduct of the research and the collection of meaningful, insightful data.

Preparation involves developing questions and becoming familiar with the participant's background and context. This helps build rapport and encourages participants to share openly during the interview. When participants trust the interviewer, they are more likely to provide honest, detailed responses, which enhances the quality of the data. It also helps the researcher to follow up on points of interest more effectively, as familiarity with the participant’s context enables deeper and more informed probing.

Well-prepared interviews minimize the risk of unproductive tangents. You’re less likely to ask leading questions or get sidetracked when you go into an interview with a clear strategy. It also prepares you for potential challenges, such as participants providing incomplete answers or hesitating to engage. Anticipating these issues allows you to have strategies in place to manage them, ensuring the interview remains productive.

In qualitative research, preparing for an interview is not just about drafting questions—it's about creating a conducive environment for meaningful conversation, ensuring the collection of rich, relevant data, and ultimately contributing to the overall rigour of the research.

The success of an interview is based on the quality of the preparation and research conducted before the interview. Preparation will lead to the best questions which will lead to the best data collection possible. Here are some important reminders when preparing for an interview.

Understanding the research question

The foundation of any qualitative interview lies in a clear and well-defined research question. This question shapes the interview questions you explore with your participants and determines the data you will collect. For interview preparation, research is essential to develop a thorough understanding of the topic. Researchers must review existing literature and justify the need for their research to ensure the interview questions address unexplored areas and create meaningful discussions.

Questions should encourage participants to talk freely and in detail, so the interviewer can gather rich information. For example, an interviewer might ask participants to describe a specific experience rather than asking questions that can be answered with a simple "yes" or "no". By developing a clear interview guide, the interviewer can create questions that link directly to the research question while allowing for open-ended answers.

Developing an effective interview guide

An interview guide is a structured framework used in qualitative research to direct the conversation during interviews. It is an essential tool for maintaining focus while allowing for flexibility during the interview. The guide typically consists of a list of open-ended questions or key topics for exploring participants' experiences, opinions, and feelings related to the research topic.

The purpose of an interview guide is twofold. First, it ensures that all relevant topics are covered across different interviews, enhancing consistency. Second, it allows interviewers to probe further into participants’ responses, encouraging deeper insights that align with the research objectives. Although it provides structure, the guide is not rigid, allowing for deviations based on the natural flow of the conversation, ensuring richer data collection.

In qualitative research, interview guides are typically used in semi-structured or unstructured interviews. They are especially useful for creating a balance between guiding the discussion and giving the interviewee enough freedom to share detailed, meaningful information.

Pilot testing

Before conducting the actual interview, a pilot interview is an important step. It allows the interviewer to practice conducting the interview and test the flow of the interview guide. Through a review of the pilot interview, interviewers can identify unclear or irrelevant questions and make adjustments accordingly. This process also helps interviewers estimate the time required for each interview and ensures that the guide covers all relevant topics without overwhelming the participant.

Pilot testing also gives the researcher a chance to practice asking questions naturally, adjusting to the conversational flow that qualitative interviews often require. Pilot tests can be very helpful, significantly developing a researcher's knowledge and understanding of what to expect for the actual interview.

Preparing for ethical considerations

Ethical interview preparation is essential for ensuring that participants provide informed consent and are aware of their rights throughout the study. Ethical considerations are of paramount importance to protect participants’ privacy and emotional well-being. Participants must feel secure that their responses will be kept confidential, and the interviewer must anticipate any potentially sensitive topics that might arise.

Additionally, researchers should examine the emotional or psychological risks associated with certain topics and be prepared to offer support or referrals if needed. This ensures that the interview process remains respectful and professional while collecting useful research data.

Building rapport with participants

The interviewer's ability to build rapport with participants is a vital skill that greatly influences each interview. Establishing trust at the beginning of the interview helps participants feel at ease and encourages them to talk openly. By focusing on the person rather than just the data, interviewers can facilitate more natural conversations.

Strong communication skills are necessary to maintain the flow of conversation and keep the focus on the topic. During the interviewing process, the interviewer must practice active listening, demonstrate empathy, and avoid rushing participants through their responses.

Before the interview, researchers should familiarize themselves with the participants' backgrounds, where relevant, to understand their context. During the interview, the researcher should encourage open dialogue while maintaining a non-judgmental stance. This rapport enables participants to provide richer, more detailed responses, ultimately enhancing the quality of the data collected.

Anticipating logistical challenges

Careful attention to logistics is also part of effective interview preparation. Whether the interview is in-person or remote, the interviewer must ensure the setting is conducive to open and comfortable communication. For example, interviewers should choose a quiet location and test any necessary equipment beforehand.

Being well-prepared and anticipating potential issues, such as technical difficulties or external distractions, helps to foster an enjoyable interview and allows the interviewer to focus on obtaining valuable data.

Scheduling flexibility is also important, as participants' availability may vary. Researchers should be prepared to accommodate different time zones or personal schedules to facilitate participation. This attention to logistics helps create a smooth and uninterrupted interview experience.

Analyze your interviews with ATLAS.ti

Turn your transcriptions into key insights with our powerful tools. Download a free trial today.

Designing an interview guide in qualitative research is essential for structuring in-depth conversations that capture participants' nuanced experiences and reflections. Seidman (2006) emphasizes a flexible, participant-centered approach to guide development, which balances broad thematic direction with open-ended questions, facilitating a natural conversational flow. Below, we outline key considerations for constructing an interview guide that promotes meaningful engagement in qualitative studies:

Define the research question and objectives : Clarifying the research’s focus and the specific experiences under investigation provides the foundation for an effective interview guide (Seidman, 2006). By establishing a clear scope, researchers can ensure that the guide remains aligned with the core objectives of the study.

Create a framework that outlines the main concepts to study : structuring interview guides by organizing questions into overarching themes rather than prescribing fixed questions. The guide should accommodate a series of themes that broadly frame the participant’s narrative. In Seidman’s three-interview series model, these themes progress from a life history focus to current lived experience, and finally to reflection on meaning. Each theme allows the researcher to understand the participant’s experiences deeply and within the context of their personal narrative.

Design open-ended questions about each concept : The questions have to be in every-day language, not include jargon, and reflect on operational definitions of concepts to think about how questions could be crafted about that concept. The effectiveness of an interview guide lies in its capacity to elicit detailed and authentic responses. Seidman (2006) underscores the importance of open-ended questions, which invite participants to reconstruct their experiences rather than simply answer direct prompts. Questions should encourage narrative depth, for example: "Can you describe how you first became interested in your field?" "What does a typical day look like for you in your role?" These non-directive questions foster participant agency, enabling them to emphasize details personally significant to their experience.

Verify the order of questions : Questions need to go from broad to more specific, or more sensitive, challenging and direct. Make sure you have opening and closing questions.

Add prompts and probes to questions : While open-ended questions drive the interview, it is recommended to use specific prompts to deepen understanding when necessary. Prompts such as “Can you give an example?” or “What were your thoughts at that moment?” allow the interviewer to explore topics that emerge naturally from participants' responses, while still maintaining a non-intrusive approach.

Minimize directing the conversation : To capture the participant’s authentic experience, the guide should avoid leading or suggestive questions that may direct responses toward particular themes or values. Instead of prompting participants with, "Do you find your work rewarding?" researchers might ask, "How do you feel about your experience in this role?". This non-directive approach ensures that participants provide insights shaped by their unique perspectives rather than conforming to anticipated outcomes.

Allow for flexibility and adapt to participant responses : It is important to maintain flexibility in qualitative interviewing, allowing the guide to adapt according to the participant’s narrative. If a participant organically addresses certain themes, the researcher should adjust questions to avoid redundancy and follow the natural trajectory of the conversation. This flexibility is particularly beneficial in phenomenological approaches, where understanding participants’ lived experiences takes precedence over rigid adherence to a predefined question list.

Embrace silence as a tool for reflection : The guide should remind researchers to utilize silence and pauses strategically. According to Seidman (2006), allowing participants moments of reflection can often lead to deeper, more thoughtful insights. A well-designed guide includes prompts or notes encouraging the interviewer to embrace brief silences, providing space for participants to contemplate and expand upon their answers.

Pilot and revise the interview guide : It is important to check the wording of questions and revise for leading questions that may elicit social desirability bias and other errors.

By following these steps, you can create a well-structured interview guide that balances consistency with the flexibility to explore participant responses in depth. By focusing on open-ended questions and thematic progression, researchers can explore the depth and complexity of participants' lived experiences, fostering a qualitative study rich in insight and authenticity. This method not only respects participants' agency in the interview process but also aligns with qualitative research's broader goal of understanding the human experience from a contextually grounded perspective.

While thorough preparation is key, there are several common errors that researchers may encounter during the interview preparation process.

Overloading the interview guide

One of the most frequent mistakes is creating an interview guide that is too long or packed with too many questions. This can overwhelm participants and limit the depth of their responses. A well-prepared interview guide focuses on key themes and leaves room for follow-up questions, allowing participants to explore their thoughts more fully.

Failing to account for ethical concerns

Ethical considerations are often underestimated during preparation. Researchers may overlook the need for informed consent or underestimate the emotional impact of certain topics. Ensuring that participants understand their rights and the purpose of the study, along with obtaining approval from IRBs or ethics committees, is essential for conducting ethical interviews.

Neglecting rapport-building

Some researchers may jump straight into the interview questions without establishing rapport with the participant. This can create an overly formal or uncomfortable environment where participants may hesitate to share personal insights. Taking time to build trust at the start of the interview leads to more meaningful and open conversations.

Ignoring logistical issues

Poor logistical planning can disrupt the flow of an interview. For instance, technical difficulties during remote interviews, background noise, or interruptions can affect the participant’s comfort and willingness to share. Overlooking these details can undermine the effectiveness of the interview.

Effective interview preparation in qualitative research requires a balance between understanding the research topic, designing thoughtful questions, and planning the logistical and ethical aspects of the process. Researchers can conduct interviews that yield rich, insightful data by avoiding common errors such as overloading the interview guide, leading participants, or neglecting rapport. Properly prepared interviews enhance the quality of the research and ensure a respectful and ethical experience for participants.

- Bryman, A. (2016). Social research methods (5th ed.). Oxford University Press. https://global.oup.com/academic/product/social-research-methods-9780199689453

- Gerson, K., & Damaske, S. (2020). The science and art of interviewing. Oxford University Press. https://doi.org/10.1093/oso/9780199324286.001.0001

- Marecek, J., & Magnusson, E. (2015). Doing interview-based qualitative research: A learner’s guide. Cambridge University Press. https://doi.org/10.1017/CBO9781107449893.005

ATLAS.ti is there for you at every step of your interviews

From analyzing your transcript to the key insights, ATLAS.ti is there for you. See how with a free trial.

Chapter 11. Interviewing

Introduction.

Interviewing people is at the heart of qualitative research. It is not merely a way to collect data but an intrinsically rewarding activity—an interaction between two people that holds the potential for greater understanding and interpersonal development. Unlike many of our daily interactions with others that are fairly shallow and mundane, sitting down with a person for an hour or two and really listening to what they have to say is a profound and deep enterprise, one that can provide not only “data” for you, the interviewer, but also self-understanding and a feeling of being heard for the interviewee. I always approach interviewing with a deep appreciation for the opportunity it gives me to understand how other people experience the world. That said, there is not one kind of interview but many, and some of these are shallower than others. This chapter will provide you with an overview of interview techniques but with a special focus on the in-depth semistructured interview guide approach, which is the approach most widely used in social science research.

An interview can be variously defined as “a conversation with a purpose” ( Lune and Berg 2018 ) and an attempt to understand the world from the point of view of the person being interviewed: “to unfold the meaning of peoples’ experiences, to uncover their lived world prior to scientific explanations” ( Kvale 2007 ). It is a form of active listening in which the interviewer steers the conversation to subjects and topics of interest to their research but also manages to leave enough space for those interviewed to say surprising things. Achieving that balance is a tricky thing, which is why most practitioners believe interviewing is both an art and a science. In my experience as a teacher, there are some students who are “natural” interviewers (often they are introverts), but anyone can learn to conduct interviews, and everyone, even those of us who have been doing this for years, can improve their interviewing skills. This might be a good time to highlight the fact that the interview is a product between interviewer and interviewee and that this product is only as good as the rapport established between the two participants. Active listening is the key to establishing this necessary rapport.

Patton ( 2002 ) makes the argument that we use interviews because there are certain things that are not observable. In particular, “we cannot observe feelings, thoughts, and intentions. We cannot observe behaviors that took place at some previous point in time. We cannot observe situations that preclude the presence of an observer. We cannot observe how people have organized the world and the meanings they attach to what goes on in the world. We have to ask people questions about those things” ( 341 ).

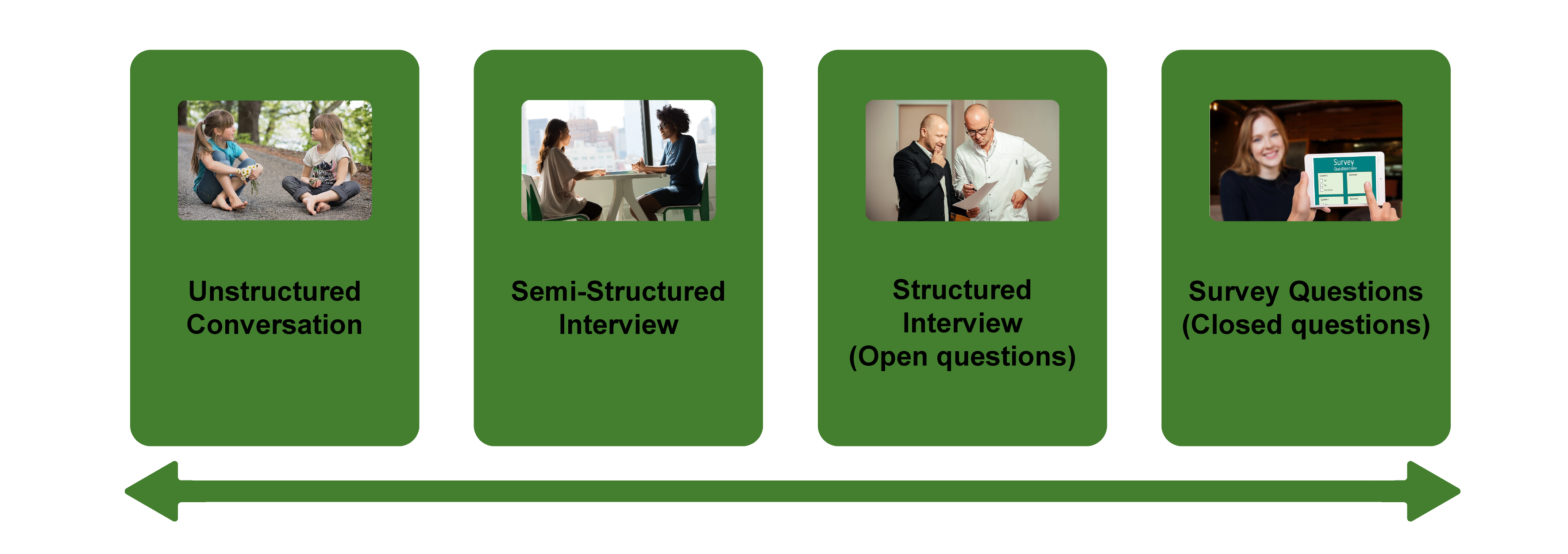

Types of Interviews

There are several distinct types of interviews. Imagine a continuum (figure 11.1). On one side are unstructured conversations—the kind you have with your friends. No one is in control of those conversations, and what you talk about is often random—whatever pops into your head. There is no secret, underlying purpose to your talking—if anything, the purpose is to talk to and engage with each other, and the words you use and the things you talk about are a little beside the point. An unstructured interview is a little like this informal conversation, except that one of the parties to the conversation (you, the researcher) does have an underlying purpose, and that is to understand the other person. You are not friends speaking for no purpose, but it might feel just as unstructured to the “interviewee” in this scenario. That is one side of the continuum. On the other side are fully structured and standardized survey-type questions asked face-to-face. Here it is very clear who is asking the questions and who is answering them. This doesn’t feel like a conversation at all! A lot of people new to interviewing have this ( erroneously !) in mind when they think about interviews as data collection. Somewhere in the middle of these two extreme cases is the “ semistructured” interview , in which the researcher uses an “interview guide” to gently move the conversation to certain topics and issues. This is the primary form of interviewing for qualitative social scientists and will be what I refer to as interviewing for the rest of this chapter, unless otherwise specified.

Informal (unstructured conversations). This is the most “open-ended” approach to interviewing. It is particularly useful in conjunction with observational methods (see chapters 13 and 14). There are no predetermined questions. Each interview will be different. Imagine you are researching the Oregon Country Fair, an annual event in Veneta, Oregon, that includes live music, artisan craft booths, face painting, and a lot of people walking through forest paths. It’s unlikely that you will be able to get a person to sit down with you and talk intensely about a set of questions for an hour and a half. But you might be able to sidle up to several people and engage with them about their experiences at the fair. You might have a general interest in what attracts people to these events, so you could start a conversation by asking strangers why they are here or why they come back every year. That’s it. Then you have a conversation that may lead you anywhere. Maybe one person tells a long story about how their parents brought them here when they were a kid. A second person talks about how this is better than Burning Man. A third person shares their favorite traveling band. And yet another enthuses about the public library in the woods. During your conversations, you also talk about a lot of other things—the weather, the utilikilts for sale, the fact that a favorite food booth has disappeared. It’s all good. You may not be able to record these conversations. Instead, you might jot down notes on the spot and then, when you have the time, write down as much as you can remember about the conversations in long fieldnotes. Later, you will have to sit down with these fieldnotes and try to make sense of all the information (see chapters 18 and 19).

Interview guide ( semistructured interview ). This is the primary type employed by social science qualitative researchers. The researcher creates an “interview guide” in advance, which she uses in every interview. In theory, every person interviewed is asked the same questions. In practice, every person interviewed is asked mostly the same topics but not always the same questions, as the whole point of a “guide” is that it guides the direction of the conversation but does not command it. The guide is typically between five and ten questions or question areas, sometimes with suggested follow-ups or prompts . For example, one question might be “What was it like growing up in Eastern Oregon?” with prompts such as “Did you live in a rural area? What kind of high school did you attend?” to help the conversation develop. These interviews generally take place in a quiet place (not a busy walkway during a festival) and are recorded. The recordings are transcribed, and those transcriptions then become the “data” that is analyzed (see chapters 18 and 19). The conventional length of one of these types of interviews is between one hour and two hours, optimally ninety minutes. Less than one hour doesn’t allow for much development of questions and thoughts, and two hours (or more) is a lot of time to ask someone to sit still and answer questions. If you have a lot of ground to cover, and the person is willing, I highly recommend two separate interview sessions, with the second session being slightly shorter than the first (e.g., ninety minutes the first day, sixty minutes the second). There are lots of good reasons for this, but the most compelling one is that this allows you to listen to the first day’s recording and catch anything interesting you might have missed in the moment and so develop follow-up questions that can probe further. This also allows the person being interviewed to have some time to think about the issues raised in the interview and go a little deeper with their answers.

Standardized questionnaire with open responses ( structured interview ). This is the type of interview a lot of people have in mind when they hear “interview”: a researcher comes to your door with a clipboard and proceeds to ask you a series of questions. These questions are all the same whoever answers the door; they are “standardized.” Both the wording and the exact order are important, as people’s responses may vary depending on how and when a question is asked. These are qualitative only in that the questions allow for “open-ended responses”: people can say whatever they want rather than select from a predetermined menu of responses. For example, a survey I collaborated on included this open-ended response question: “How does class affect one’s career success in sociology?” Some of the answers were simply one word long (e.g., “debt”), and others were long statements with stories and personal anecdotes. It is possible to be surprised by the responses. Although it’s a stretch to call this kind of questioning a conversation, it does allow the person answering the question some degree of freedom in how they answer.

Survey questionnaire with closed responses (not an interview!). Standardized survey questions with specific answer options (e.g., closed responses) are not really interviews at all, and they do not generate qualitative data. For example, if we included five options for the question “How does class affect one’s career success in sociology?”—(1) debt, (2) social networks, (3) alienation, (4) family doesn’t understand, (5) type of grad program—we leave no room for surprises at all. Instead, we would most likely look at patterns around these responses, thinking quantitatively rather than qualitatively (e.g., using regression analysis techniques, we might find that working-class sociologists were twice as likely to bring up alienation). It can sometimes be confusing for new students because the very same survey can include both closed-ended and open-ended questions. The key is to think about how these will be analyzed and to what level surprises are possible. If your plan is to turn all responses into a number and make predictions about correlations and relationships, you are no longer conducting qualitative research. This is true even if you are conducting this survey face-to-face with a real live human. Closed-response questions are not conversations of any kind, purposeful or not.

In summary, the semistructured interview guide approach is the predominant form of interviewing for social science qualitative researchers because it allows a high degree of freedom of responses from those interviewed (thus allowing for novel discoveries) while still maintaining some connection to a research question area or topic of interest. The rest of the chapter assumes the employment of this form.

Creating an Interview Guide

Your interview guide is the instrument used to bridge your research question(s) and what the people you are interviewing want to tell you. Unlike a standardized questionnaire, the questions actually asked do not need to be exactly what you have written down in your guide. The guide is meant to create space for those you are interviewing to talk about the phenomenon of interest, but sometimes you are not even sure what that phenomenon is until you start asking questions. A priority in creating an interview guide is to ensure it offers space. One of the worst mistakes is to create questions that are so specific that the person answering them will not stray. Relatedly, questions that sound “academic” will shut down a lot of respondents. A good interview guide invites respondents to talk about what is important to them, not feel like they are performing or being evaluated by you.

Good interview questions should not sound like your “research question” at all. For example, let’s say your research question is “How do patriarchal assumptions influence men’s understanding of climate change and responses to climate change?” It would be worse than unhelpful to ask a respondent, “How do your assumptions about the role of men affect your understanding of climate change?” You need to unpack this into manageable nuggets that pull your respondent into the area of interest without leading him anywhere. You could start by asking him what he thinks about climate change in general. Or, even better, whether he has any concerns about heatwaves or increased tornadoes or polar icecaps melting. Once he starts talking about that, you can ask follow-up questions that bring in issues around gendered roles, perhaps asking if he is married (to a woman) and whether his wife shares his thoughts and, if not, how they negotiate that difference. The fact is, you won’t really know the right questions to ask until he starts talking.

There are several distinct types of questions that can be used in your interview guide, either as main questions or as follow-up probes. If you remember that the point is to leave space for the respondent, you will craft a much more effective interview guide! You will also want to think about the place of time in both the questions themselves (past, present, future orientations) and the sequencing of the questions.

Researcher Note

Suggestion : As you read the next three sections (types of questions, temporality, question sequence), have in mind a particular research question, and try to draft questions and sequence them in a way that opens space for a discussion that helps you answer your research question.

Type of Questions

Experience and behavior questions ask about what a respondent does regularly (their behavior) or has done (their experience). These are relatively easy questions for people to answer because they appear more “factual” and less subjective. This makes them good opening questions. For the study on climate change above, you might ask, “Have you ever experienced an unusual weather event? What happened?” Or “You said you work outside? What is a typical summer workday like for you? How do you protect yourself from the heat?”

Opinion and values questions , in contrast, ask questions that get inside the minds of those you are interviewing. “Do you think climate change is real? Who or what is responsible for it?” are two such questions. Note that you don’t have to literally ask, “What is your opinion of X?” but you can find a way to ask the specific question relevant to the conversation you are having. These questions are a bit trickier to ask because the answers you get may depend in part on how your respondent perceives you and whether they want to please you or not. We’ve talked a fair amount about being reflective. Here is another place where this comes into play. You need to be aware of the effect your presence might have on the answers you are receiving and adjust accordingly. If you are a woman who is perceived as liberal asking a man who identifies as conservative about climate change, there is a lot of subtext that can be going on in the interview. There is no one right way to resolve this, but you must at least be aware of it.

Feeling questions are questions that ask respondents to draw on their emotional responses. It’s pretty common for academic researchers to forget that we have bodies and emotions, but people’s understandings of the world often operate at this affective level, sometimes unconsciously or barely consciously. It is a good idea to include questions that leave space for respondents to remember, imagine, or relive emotional responses to particular phenomena. “What was it like when you heard your cousin’s house burned down in that wildfire?” doesn’t explicitly use any emotion words, but it allows your respondent to remember what was probably a pretty emotional day. And if they respond emotionally neutral, that is pretty interesting data too. Note that asking someone “How do you feel about X” is not always going to evoke an emotional response, as they might simply turn around and respond with “I think that…” It is better to craft a question that actually pushes the respondent into the affective category. This might be a specific follow-up to an experience and behavior question —for example, “You just told me about your daily routine during the summer heat. Do you worry it is going to get worse?” or “Have you ever been afraid it will be too hot to get your work accomplished?”

Knowledge questions ask respondents what they actually know about something factual. We have to be careful when we ask these types of questions so that respondents do not feel like we are evaluating them (which would shut them down), but, for example, it is helpful to know when you are having a conversation about climate change that your respondent does in fact know that unusual weather events have increased and that these have been attributed to climate change! Asking these questions can set the stage for deeper questions and can ensure that the conversation makes the same kind of sense to both participants. For example, a conversation about political polarization can be put back on track once you realize that the respondent doesn’t really have a clear understanding that there are two parties in the US. Instead of asking a series of questions about Republicans and Democrats, you might shift your questions to talk more generally about political disagreements (e.g., “people against abortion”). And sometimes what you do want to know is the level of knowledge about a particular program or event (e.g., “Are you aware you can discharge your student loans through the Public Service Loan Forgiveness program?”).

Sensory questions call on all senses of the respondent to capture deeper responses. These are particularly helpful in sparking memory. “Think back to your childhood in Eastern Oregon. Describe the smells, the sounds…” Or you could use these questions to help a person access the full experience of a setting they customarily inhabit: “When you walk through the doors to your office building, what do you see? Hear? Smell?” As with feeling questions , these questions often supplement experience and behavior questions . They are another way of allowing your respondent to report fully and deeply rather than remain on the surface.

Creative questions employ illustrative examples, suggested scenarios, or simulations to get respondents to think more deeply about an issue, topic, or experience. There are many options here. In The Trouble with Passion , Erin Cech ( 2021 ) provides a scenario in which “Joe” is trying to decide whether to stay at his decent but boring computer job or follow his passion by opening a restaurant. She asks respondents, “What should Joe do?” Their answers illuminate the attraction of “passion” in job selection. In my own work, I have used a news story about an upwardly mobile young man who no longer has time to see his mother and sisters to probe respondents’ feelings about the costs of social mobility. Jessi Streib and Betsy Leondar-Wright have used single-page cartoon “scenes” to elicit evaluations of potential racial discrimination, sexual harassment, and classism. Barbara Sutton ( 2010 ) has employed lists of words (“strong,” “mother,” “victim”) on notecards she fans out and asks her female respondents to select and discuss.

Background/Demographic Questions

You most definitely will want to know more about the person you are interviewing in terms of conventional demographic information, such as age, race, gender identity, occupation, and educational attainment. These are not questions that normally open up inquiry. [1] For this reason, my practice has been to include a separate “demographic questionnaire” sheet that I ask each respondent to fill out at the conclusion of the interview. Only include those aspects that are relevant to your study. For example, if you are not exploring religion or religious affiliation, do not include questions about a person’s religion on the demographic sheet. See the example provided at the end of this chapter.

Temporality

Any type of question can have a past, present, or future orientation. For example, if you are asking a behavior question about workplace routine, you might ask the respondent to talk about past work, present work, and ideal (future) work. Similarly, if you want to understand how people cope with natural disasters, you might ask your respondent how they felt then during the wildfire and now in retrospect and whether and to what extent they have concerns for future wildfire disasters. It’s a relatively simple suggestion—don’t forget to ask about past, present, and future—but it can have a big impact on the quality of the responses you receive.

Question Sequence

Having a list of good questions or good question areas is not enough to make a good interview guide. You will want to pay attention to the order in which you ask your questions. Even though any one respondent can derail this order (perhaps by jumping to answer a question you haven’t yet asked), a good advance plan is always helpful. When thinking about sequence, remember that your goal is to get your respondent to open up to you and to say things that might surprise you. To establish rapport, it is best to start with nonthreatening questions. Asking about the present is often the safest place to begin, followed by the past (they have to know you a little bit to get there), and lastly, the future (talking about hopes and fears requires the most rapport). To allow for surprises, it is best to move from very general questions to more particular questions only later in the interview. This ensures that respondents have the freedom to bring up the topics that are relevant to them rather than feel like they are constrained to answer you narrowly. For example, refrain from asking about particular emotions until these have come up previously—don’t lead with them. Often, your more particular questions will emerge only during the course of the interview, tailored to what is emerging in conversation.

Once you have a set of questions, read through them aloud and imagine you are being asked the same questions. Does the set of questions have a natural flow? Would you be willing to answer the very first question to a total stranger? Does your sequence establish facts and experiences before moving on to opinions and values? Did you include prefatory statements, where necessary; transitions; and other announcements? These can be as simple as “Hey, we talked a lot about your experiences as a barista while in college.… Now I am turning to something completely different: how you managed friendships in college.” That is an abrupt transition, but it has been softened by your acknowledgment of that.

Probes and Flexibility

Once you have the interview guide, you will also want to leave room for probes and follow-up questions. As in the sample probe included here, you can write out the obvious probes and follow-up questions in advance. You might not need them, as your respondent might anticipate them and include full responses to the original question. Or you might need to tailor them to how your respondent answered the question. Some common probes and follow-up questions include asking for more details (When did that happen? Who else was there?), asking for elaboration (Could you say more about that?), asking for clarification (Does that mean what I think it means or something else? I understand what you mean, but someone else reading the transcript might not), and asking for contrast or comparison (How did this experience compare with last year’s event?). “Probing is a skill that comes from knowing what to look for in the interview, listening carefully to what is being said and what is not said, and being sensitive to the feedback needs of the person being interviewed” ( Patton 2002:374 ). It takes work! And energy. I and many other interviewers I know report feeling emotionally and even physically drained after conducting an interview. You are tasked with active listening and rearranging your interview guide as needed on the fly. If you only ask the questions written down in your interview guide with no deviations, you are doing it wrong. [2]

The Final Question

Every interview guide should include a very open-ended final question that allows for the respondent to say whatever it is they have been dying to tell you but you’ve forgotten to ask. About half the time they are tired too and will tell you they have nothing else to say. But incredibly, some of the most honest and complete responses take place here, at the end of a long interview. You have to realize that the person being interviewed is often discovering things about themselves as they talk to you and that this process of discovery can lead to new insights for them. Making space at the end is therefore crucial. Be sure you convey that you actually do want them to tell you more, that the offer of “anything else?” is not read as an empty convention where the polite response is no. Here is where you can pull from that active listening and tailor the final question to the particular person. For example, “I’ve asked you a lot of questions about what it was like to live through that wildfire. I’m wondering if there is anything I’ve forgotten to ask, especially because I haven’t had that experience myself” is a much more inviting final question than “Great. Anything you want to add?” It’s also helpful to convey to the person that you have the time to listen to their full answer, even if the allotted time is at the end. After all, there are no more questions to ask, so the respondent knows exactly how much time is left. Do them the courtesy of listening to them!

Conducting the Interview

Once you have your interview guide, you are on your way to conducting your first interview. I always practice my interview guide with a friend or family member. I do this even when the questions don’t make perfect sense for them, as it still helps me realize which questions make no sense, are poorly worded (too academic), or don’t follow sequentially. I also practice the routine I will use for interviewing, which goes something like this:

- Introduce myself and reintroduce the study

- Provide consent form and ask them to sign and retain/return copy

- Ask if they have any questions about the study before we begin

- Ask if I can begin recording

- Ask questions (from interview guide)

- Turn off the recording device

- Ask if they are willing to fill out my demographic questionnaire

- Collect questionnaire and, without looking at the answers, place in same folder as signed consent form

- Thank them and depart

A note on remote interviewing: Interviews have traditionally been conducted face-to-face in a private or quiet public setting. You don’t want a lot of background noise, as this will make transcriptions difficult. During the recent global pandemic, many interviewers, myself included, learned the benefits of interviewing remotely. Although face-to-face is still preferable for many reasons, Zoom interviewing is not a bad alternative, and it does allow more interviews across great distances. Zoom also includes automatic transcription, which significantly cuts down on the time it normally takes to convert our conversations into “data” to be analyzed. These automatic transcriptions are not perfect, however, and you will still need to listen to the recording and clarify and clean up the transcription. Nor do automatic transcriptions include notations of body language or change of tone, which you may want to include. When interviewing remotely, you will want to collect the consent form before you meet: ask them to read, sign, and return it as an email attachment. I think it is better to ask for the demographic questionnaire after the interview, but because some respondents may never return it then, it is probably best to ask for this at the same time as the consent form, in advance of the interview.

What should you bring to the interview? I would recommend bringing two copies of the consent form (one for you and one for the respondent), a demographic questionnaire, a manila folder in which to place the signed consent form and filled-out demographic questionnaire, a printed copy of your interview guide (I print with three-inch right margins so I can jot down notes on the page next to relevant questions), a pen, a recording device, and water.

After the interview, you will want to secure the signed consent form in a locked filing cabinet (if in print) or a password-protected folder on your computer. Using Excel or a similar program that allows tables/spreadsheets, create an identifying number for your interview that links to the consent form without using the name of your respondent. For example, let’s say that I conduct interviews with US politicians, and the first person I meet with is George W. Bush. I will assign the transcription the number “INT#001” and add it to the signed consent form. [3] The signed consent form goes into a locked filing cabinet, and I never use the name “George W. Bush” again. I take the information from the demographic sheet, open my Excel spreadsheet, and add the relevant information in separate columns for the row INT#001: White, male, Republican. When I interview Bill Clinton as my second interview, I include a second row: INT#002: White, male, Democrat. And so on. The only link to the actual name of the respondent and this information is the fact that the consent form (unavailable to anyone but me) has stamped on it the interview number.

Many students get very nervous before their first interview. Actually, many of us are always nervous before the interview! But do not worry—this is normal, and it does pass. Chances are, you will be pleasantly surprised at how comfortable it begins to feel. These “purposeful conversations” are often a delight for both participants. This is not to say that sometimes things go wrong. I often have my students practice several “bad scenarios” (e.g., a respondent that you cannot get to open up; a respondent who is too talkative and dominates the conversation, steering it away from the topics you are interested in; emotions that completely take over; or shocking disclosures you are ill-prepared to handle), but most of the time, things go quite well. Be prepared for the unexpected, but know that the reason interviews are so popular as a technique of data collection is that they are usually richly rewarding for both participants.

One thing that I stress to my methods students and remind myself about is that interviews are still conversations between people. If there’s something you might feel uncomfortable asking someone about in a “normal” conversation, you will likely also feel a bit of discomfort asking it in an interview. Maybe more importantly, your respondent may feel uncomfortable. Social research—especially about inequality—can be uncomfortable. And it’s easy to slip into an abstract, intellectualized, or removed perspective as an interviewer. This is one reason trying out interview questions is important. Another is that sometimes the question sounds good in your head but doesn’t work as well out loud in practice. I learned this the hard way when a respondent asked me how I would answer the question I had just posed, and I realized that not only did I not really know how I would answer it, but I also wasn’t quite as sure I knew what I was asking as I had thought.

—Elizabeth M. Lee, Associate Professor of Sociology at Saint Joseph’s University, author of Class and Campus Life , and co-author of Geographies of Campus Inequality

How Many Interviews?

Your research design has included a targeted number of interviews and a recruitment plan (see chapter 5). Follow your plan, but remember that “ saturation ” is your goal. You interview as many people as you can until you reach a point at which you are no longer surprised by what they tell you. This means not that no one after your first twenty interviews will have surprising, interesting stories to tell you but rather that the picture you are forming about the phenomenon of interest to you from a research perspective has come into focus, and none of the interviews are substantially refocusing that picture. That is when you should stop collecting interviews. Note that to know when you have reached this, you will need to read your transcripts as you go. More about this in chapters 18 and 19.

Your Final Product: The Ideal Interview Transcript

A good interview transcript will demonstrate a subtly controlled conversation by the skillful interviewer. In general, you want to see replies that are about one paragraph long, not short sentences and not running on for several pages. Although it is sometimes necessary to follow respondents down tangents, it is also often necessary to pull them back to the questions that form the basis of your research study. This is not really a free conversation, although it may feel like that to the person you are interviewing.

Final Tips from an Interview Master

Annette Lareau is arguably one of the masters of the trade. In Listening to People , she provides several guidelines for good interviews and then offers a detailed example of an interview gone wrong and how it could be addressed (please see the “Further Readings” at the end of this chapter). Here is an abbreviated version of her set of guidelines: (1) interview respondents who are experts on the subjects of most interest to you (as a corollary, don’t ask people about things they don’t know); (2) listen carefully and talk as little as possible; (3) keep in mind what you want to know and why you want to know it; (4) be a proactive interviewer (subtly guide the conversation); (5) assure respondents that there aren’t any right or wrong answers; (6) use the respondent’s own words to probe further (this both allows you to accurately identify what you heard and pushes the respondent to explain further); (7) reuse effective probes (don’t reinvent the wheel as you go—if repeating the words back works, do it again and again); (8) focus on learning the subjective meanings that events or experiences have for a respondent; (9) don’t be afraid to ask a question that draws on your own knowledge (unlike trial lawyers who are trained never to ask a question for which they don’t already know the answer, sometimes it’s worth it to ask risky questions based on your hypotheses or just plain hunches); (10) keep thinking while you are listening (so difficult…and important); (11) return to a theme raised by a respondent if you want further information; (12) be mindful of power inequalities (and never ever coerce a respondent to continue the interview if they want out); (13) take control with overly talkative respondents; (14) expect overly succinct responses, and develop strategies for probing further; (15) balance digging deep and moving on; (16) develop a plan to deflect questions (e.g., let them know you are happy to answer any questions at the end of the interview, but you don’t want to take time away from them now); and at the end, (17) check to see whether you have asked all your questions. You don’t always have to ask everyone the same set of questions, but if there is a big area you have forgotten to cover, now is the time to recover ( Lareau 2021:93–103 ).

Sample: Demographic Questionnaire

ASA Taskforce on First-Generation and Working-Class Persons in Sociology – Class Effects on Career Success

Supplementary Demographic Questionnaire

Thank you for your participation in this interview project. We would like to collect a few pieces of key demographic information from you to supplement our analyses. Your answers to these questions will be kept confidential and stored by ID number. All of your responses here are entirely voluntary!

What best captures your race/ethnicity? (please check any/all that apply)

- White (Non Hispanic/Latina/o/x)

- Black or African American

- Hispanic, Latino/a/x of Spanish

- Asian or Asian American

- American Indian or Alaska Native

- Middle Eastern or North African

- Native Hawaiian or Pacific Islander

- Other : (Please write in: ________________)

What is your current position?

- Grad Student

- Full Professor

Please check any and all of the following that apply to you:

- I identify as a working-class academic

- I was the first in my family to graduate from college

- I grew up poor

What best reflects your gender?

- Transgender female/Transgender woman

- Transgender male/Transgender man

- Gender queer/ Gender nonconforming

Anything else you would like us to know about you?

Example: Interview Guide

In this example, follow-up prompts are italicized. Note the sequence of questions. That second question often elicits an entire life history , answering several later questions in advance.

Introduction Script/Question

Thank you for participating in our survey of ASA members who identify as first-generation or working-class. As you may have heard, ASA has sponsored a taskforce on first-generation and working-class persons in sociology and we are interested in hearing from those who so identify. Your participation in this interview will help advance our knowledge in this area.

- The first thing we would like to as you is why you have volunteered to be part of this study? What does it mean to you be first-gen or working class? Why were you willing to be interviewed?

- How did you decide to become a sociologist?

- Can you tell me a little bit about where you grew up? ( prompts: what did your parent(s) do for a living? What kind of high school did you attend?)

- Has this identity been salient to your experience? (how? How much?)

- How welcoming was your grad program? Your first academic employer?

- Why did you decide to pursue sociology at the graduate level?

- Did you experience culture shock in college? In graduate school?

- Has your FGWC status shaped how you’ve thought about where you went to school? debt? etc?

- Were you mentored? How did this work (not work)? How might it?

- What did you consider when deciding where to go to grad school? Where to apply for your first position?

- What, to you, is a mark of career success? Have you achieved that success? What has helped or hindered your pursuit of success?

- Do you think sociology, as a field, cares about prestige?

- Let’s talk a little bit about intersectionality. How does being first-gen/working class work alongside other identities that are important to you?

- What do your friends and family think about your career? Have you had any difficulty relating to family members or past friends since becoming highly educated?

- Do you have any debt from college/grad school? Are you concerned about this? Could you explain more about how you paid for college/grad school? (here, include assistance from family, fellowships, scholarships, etc.)

- (You’ve mentioned issues or obstacles you had because of your background.) What could have helped? Or, who or what did? Can you think of fortuitous moments in your career?

- Do you have any regrets about the path you took?

- Is there anything else you would like to add? Anything that the Taskforce should take note of, that we did not ask you about here?

Further Readings

Britten, Nicky. 1995. “Qualitative Interviews in Medical Research.” BMJ: British Medical Journal 31(6999):251–253. A good basic overview of interviewing particularly useful for students of public health and medical research generally.

Corbin, Juliet, and Janice M. Morse. 2003. “The Unstructured Interactive Interview: Issues of Reciprocity and Risks When Dealing with Sensitive Topics.” Qualitative Inquiry 9(3):335–354. Weighs the potential benefits and harms of conducting interviews on topics that may cause emotional distress. Argues that the researcher’s skills and code of ethics should ensure that the interviewing process provides more of a benefit to both participant and researcher than a harm to the former.

Gerson, Kathleen, and Sarah Damaske. 2020. The Science and Art of Interviewing . New York: Oxford University Press. A useful guidebook/textbook for both undergraduates and graduate students, written by sociologists.

Kvale, Steiner. 2007. Doing Interviews . London: SAGE. An easy-to-follow guide to conducting and analyzing interviews by psychologists.

Lamont, Michèle, and Ann Swidler. 2014. “Methodological Pluralism and the Possibilities and Limits of Interviewing.” Qualitative Sociology 37(2):153–171. Written as a response to various debates surrounding the relative value of interview-based studies and ethnographic studies defending the particular strengths of interviewing. This is a must-read article for anyone seriously engaging in qualitative research!

Pugh, Allison J. 2013. “What Good Are Interviews for Thinking about Culture? Demystifying Interpretive Analysis.” American Journal of Cultural Sociology 1(1):42–68. Another defense of interviewing written against those who champion ethnographic methods as superior, particularly in the area of studying culture. A classic.

Rapley, Timothy John. 2001. “The ‘Artfulness’ of Open-Ended Interviewing: Some considerations in analyzing interviews.” Qualitative Research 1(3):303–323. Argues for the importance of “local context” of data production (the relationship built between interviewer and interviewee, for example) in properly analyzing interview data.

Weiss, Robert S. 1995. Learning from Strangers: The Art and Method of Qualitative Interview Studies . New York: Simon and Schuster. A classic and well-regarded textbook on interviewing. Because Weiss has extensive experience conducting surveys, he contrasts the qualitative interview with the survey questionnaire well; particularly useful for those trained in the latter.

- I say “normally” because how people understand their various identities can itself be an expansive topic of inquiry. Here, I am merely talking about collecting otherwise unexamined demographic data, similar to how we ask people to check boxes on surveys. ↵

- Again, this applies to “semistructured in-depth interviewing.” When conducting standardized questionnaires, you will want to ask each question exactly as written, without deviations! ↵

- I always include “INT” in the number because I sometimes have other kinds of data with their own numbering: FG#001 would mean the first focus group, for example. I also always include three-digit spaces, as this allows for up to 999 interviews (or, more realistically, allows for me to interview up to one hundred persons without having to reset my numbering system). ↵

A method of data collection in which the researcher asks the participant questions; the answers to these questions are often recorded and transcribed verbatim. There are many different kinds of interviews - see also semistructured interview , structured interview , and unstructured interview .

A document listing key questions and question areas for use during an interview. It is used most often for semi-structured interviews. A good interview guide may have no more than ten primary questions for two hours of interviewing, but these ten questions will be supplemented by probes and relevant follow-ups throughout the interview. Most IRBs require the inclusion of the interview guide in applications for review. See also interview and semi-structured interview .

A data-collection method that relies on casual, conversational, and informal interviewing. Despite its apparent conversational nature, the researcher usually has a set of particular questions or question areas in mind but allows the interview to unfold spontaneously. This is a common data-collection technique among ethnographers. Compare to the semi-structured or in-depth interview .

A form of interview that follows a standard guide of questions asked, although the order of the questions may change to match the particular needs of each individual interview subject, and probing “follow-up” questions are often added during the course of the interview. The semi-structured interview is the primary form of interviewing used by qualitative researchers in the social sciences. It is sometimes referred to as an “in-depth” interview. See also interview and interview guide .

The cluster of data-collection tools and techniques that involve observing interactions between people, the behaviors, and practices of individuals (sometimes in contrast to what they say about how they act and behave), and cultures in context. Observational methods are the key tools employed by ethnographers and Grounded Theory .

Follow-up questions used in a semi-structured interview to elicit further elaboration. Suggested prompts can be included in the interview guide to be used/deployed depending on how the initial question was answered or if the topic of the prompt does not emerge spontaneously.

A form of interview that follows a strict set of questions, asked in a particular order, for all interview subjects. The questions are also the kind that elicits short answers, and the data is more “informative” than probing. This is often used in mixed-methods studies, accompanying a survey instrument. Because there is no room for nuance or the exploration of meaning in structured interviews, qualitative researchers tend to employ semi-structured interviews instead. See also interview.

The point at which you can conclude data collection because every person you are interviewing, the interaction you are observing, or content you are analyzing merely confirms what you have already noted. Achieving saturation is often used as the justification for the final sample size.

An interview variant in which a person’s life story is elicited in a narrative form. Turning points and key themes are established by the researcher and used as data points for further analysis.

Introduction to Qualitative Research Methods Copyright © 2023 by Allison Hurst is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License , except where otherwise noted.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Published: 15 September 2022

Interviews in the social sciences

- Eleanor Knott ORCID: orcid.org/0000-0002-9131-3939 1 ,

- Aliya Hamid Rao ORCID: orcid.org/0000-0003-0674-4206 1 ,

- Kate Summers ORCID: orcid.org/0000-0001-9964-0259 1 &

- Chana Teeger ORCID: orcid.org/0000-0002-5046-8280 1

Nature Reviews Methods Primers volume 2 , Article number: 73 ( 2022 ) Cite this article

748k Accesses

104 Citations

190 Altmetric

Metrics details

- Interdisciplinary studies

In-depth interviews are a versatile form of qualitative data collection used by researchers across the social sciences. They allow individuals to explain, in their own words, how they understand and interpret the world around them. Interviews represent a deceptively familiar social encounter in which people interact by asking and answering questions. They are, however, a very particular type of conversation, guided by the researcher and used for specific ends. This dynamic introduces a range of methodological, analytical and ethical challenges, for novice researchers in particular. In this Primer, we focus on the stages and challenges of designing and conducting an interview project and analysing data from it, as well as strategies to overcome such challenges.

Similar content being viewed by others

The fundamental importance of method to theory

How ‘going online’ mediates the challenges of policy elite interviews

Participatory action research

Introduction.

In-depth interviews are a qualitative research method that follow a deceptively familiar logic of human interaction: they are conversations where people talk with each other, interact and pose and answer questions 1 . An interview is a specific type of interaction in which — usually and predominantly — a researcher asks questions about someone’s life experience, opinions, dreams, fears and hopes and the interview participant answers the questions 1 .

Interviews will often be used as a standalone method or combined with other qualitative methods, such as focus groups or ethnography, or quantitative methods, such as surveys or experiments. Although interviewing is a frequently used method, it should not be viewed as an easy default for qualitative researchers 2 . Interviews are also not suited to answering all qualitative research questions, but instead have specific strengths that should guide whether or not they are deployed in a research project. Whereas ethnography might be better suited to trying to observe what people do, interviews provide a space for extended conversations that allow the researcher insights into how people think and what they believe. Quantitative surveys also give these kinds of insights, but they use pre-determined questions and scales, privileging breadth over depth and often overlooking harder-to-reach participants.

In-depth interviews can take many different shapes and forms, often with more than one participant or researcher. For example, interviews might be highly structured (using an almost survey-like interview guide), entirely unstructured (taking a narrative and free-flowing approach) or semi-structured (using a topic guide ). Researchers might combine these approaches within a single project depending on the purpose of the interview and the characteristics of the participant. Whatever form the interview takes, researchers should be mindful of the dynamics between interviewer and participant and factor these in at all stages of the project.

In this Primer, we focus on the most common type of interview: one researcher taking a semi-structured approach to interviewing one participant using a topic guide. Focusing on how to plan research using interviews, we discuss the necessary stages of data collection. We also discuss the stages and thought-process behind analysing interview material to ensure that the richness and interpretability of interview material is maintained and communicated to readers. The Primer also tracks innovations in interview methods and discusses the developments we expect over the next 5–10 years.

We wrote this Primer as researchers from sociology, social policy and political science. We note our disciplinary background because we acknowledge that there are disciplinary differences in how interviews are approached and understood as a method.

Experimentation

Here we address research design considerations and data collection issues focusing on topic guide construction and other pragmatics of the interview. We also explore issues of ethics and reflexivity that are crucial throughout the research project.

Research design

Participant selection.

Participants can be selected and recruited in various ways for in-depth interview studies. The researcher must first decide what defines the people or social groups being studied. Often, this means moving from an abstract theoretical research question to a more precise empirical one. For example, the researcher might be interested in how people talk about race in contexts of diversity. Empirical settings in which this issue could be studied could include schools, workplaces or adoption agencies. The best research designs should clearly explain why the particular setting was chosen. Often there are both intrinsic and extrinsic reasons for choosing to study a particular group of people at a specific time and place 3 . Intrinsic motivations relate to the fact that the research is focused on an important specific social phenomenon that has been understudied. Extrinsic motivations speak to the broader theoretical research questions and explain why the case at hand is a good one through which to address them empirically.

Next, the researcher needs to decide which types of people they would like to interview. This decision amounts to delineating the inclusion and exclusion criteria for the study. The criteria might be based on demographic variables, like race or gender, but they may also be context-specific, for example, years of experience in an organization. These should be decided based on the research goals. Researchers should be clear about what characteristics would make an individual a candidate for inclusion in the study (and what would exclude them).

The next step is to identify and recruit the study’s sample . Usually, many more people fit the inclusion criteria than can be interviewed. In cases where lists of potential participants are available, the researcher might want to employ stratified sampling , dividing the list by characteristics of interest before sampling.

When there are no lists, researchers will often employ purposive sampling . Many researchers consider purposive sampling the most useful mode for interview-based research since the number of interviews to be conducted is too small to aim to be statistically representative 4 . Instead, the aim is not breadth, via representativeness, but depth via rich insights about a set of participants. In addition to purposive sampling, researchers often use snowball sampling . Both purposive and snowball sampling can be combined with quota sampling . All three types of sampling aim to ensure a variety of perspectives within the confines of a research project. A goal for in-depth interview studies can be to sample for range, being mindful of recruiting a diversity of participants fitting the inclusion criteria.

Study design

The total number of interviews depends on many factors, including the population studied, whether comparisons are to be made and the duration of interviews. Studies that rely on quota sampling where explicit comparisons are made between groups will require a larger number of interviews than studies focused on one group only. Studies where participants are interviewed over several hours, days or even repeatedly across years will tend to have fewer participants than those that entail a one-off engagement.

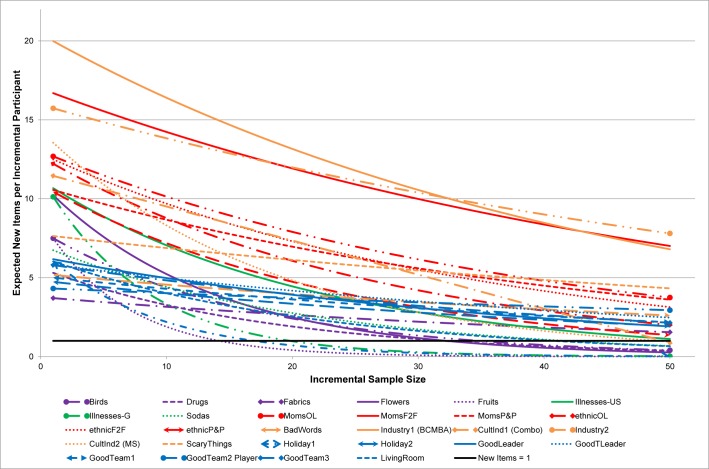

Researchers often stop interviewing when new interviews confirm findings from earlier interviews with no new or surprising insights (saturation) 4 , 5 , 6 . As a criterion for research design, saturation assumes that data collection and analysis are happening in tandem and that researchers will stop collecting new data once there is no new information emerging from the interviews. This is not always possible. Researchers rarely have time for systematic data analysis during data collection and they often need to specify their sample in funding proposals prior to data collection. As a result, researchers often draw on existing reports of saturation to estimate a sample size prior to data collection. These suggest between 12 and 20 interviews per category of participant (although researchers have reported saturation with samples that are both smaller and larger than this) 7 , 8 , 9 . The idea of saturation has been critiqued by many qualitative researchers because it assumes that meaning inheres in the data, waiting to be discovered — and confirmed — once saturation has been reached 7 . In-depth interview data are often multivalent and can give rise to different interpretations. The important consideration is, therefore, not merely how many participants are interviewed, but whether one’s research design allows for collecting rich and textured data that provide insight into participants’ understandings, accounts, perceptions and interpretations.

Sometimes, researchers will conduct interviews with more than one participant at a time. Researchers should consider the benefits and shortcomings of such an approach. Joint interviews may, for example, give researchers insight into how caregivers agree or debate childrearing decisions. At the same time, they may be less adaptive to exploring aspects of caregiving that participants may not wish to disclose to each other. In other cases, there may be more than one person interviewing each participant, such as when an interpreter is used, and so it is important to consider during the research design phase how this might shape the dynamics of the interview.

Data collection

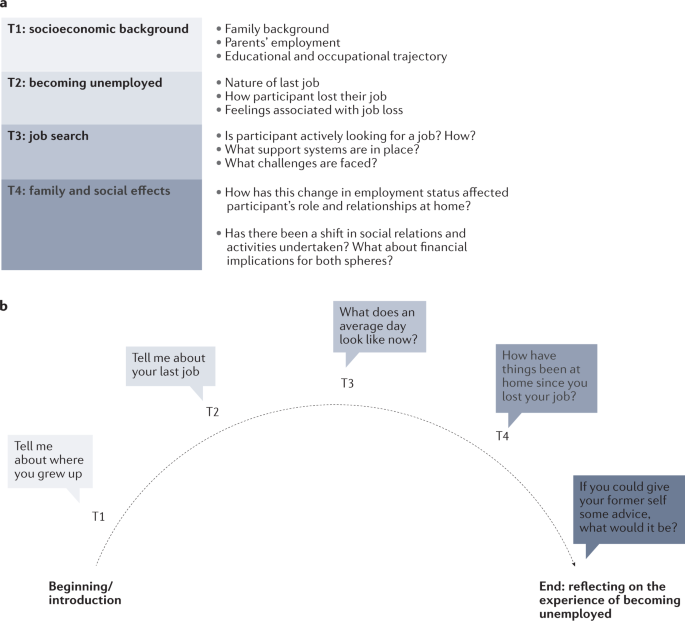

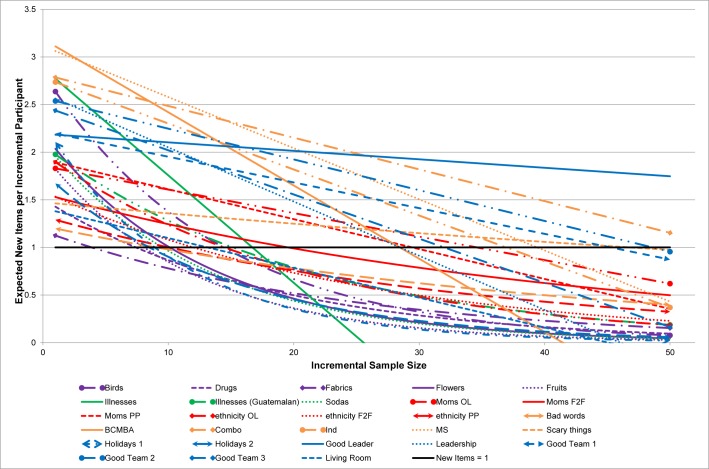

Semi-structured interviews are typically organized around a topic guide comprised of an ordered set of broad topics (usually 3–5). Each topic includes a set of questions that form the basis of the discussion between the researcher and participant (Fig. 1 ). These topics are organized around key concepts that the researcher has identified (for example, through a close study of prior research, or perhaps through piloting a small, exploratory study) 5 .

a | Elaborated topics the researcher wants to cover in the interview and example questions. b | An example topic arc. Using such an arc, one can think flexibly about the order of topics. Considering the main question for each topic will help to determine the best order for the topics. After conducting some interviews, the researcher can move topics around if a different order seems to make sense.

Topic guide

One common way to structure a topic guide is to start with relatively easy, open-ended questions (Table 1 ). Opening questions should be related to the research topic but broad and easy to answer, so that they help to ease the participant into conversation.

After these broad, opening questions, the topic guide may move into topics that speak more directly to the overarching research question. The interview questions will be accompanied by probes designed to elicit concrete details and examples from the participant (see Table 1 ).

Abstract questions are often easier for participants to answer once they have been asked more concrete questions. In our experience, for example, questions about feelings can be difficult for some participants to answer, but when following probes concerning factual experiences these questions can become less challenging. After the main themes of the topic guide have been covered, the topic guide can move onto closing questions. At this stage, participants often repeat something they have said before, although they may sometimes introduce a new topic.

Interviews are especially well suited to gaining a deeper insight into people’s experiences. Getting these insights largely depends on the participants’ willingness to talk to the researcher. We recommend designing open-ended questions that are more likely to elicit an elaborated response and extended reflection from participants rather than questions that can be answered with yes or no.

Questions should avoid foreclosing the possibility that the participant might disagree with the premise of the question. Take for example the question: “Do you support the new family-friendly policies?” This question minimizes the possibility of the participant disagreeing with the premise of this question, which assumes that the policies are ‘family-friendly’ and asks for a yes or no answer. Instead, asking more broadly how a participant feels about the specific policy being described as ‘family-friendly’ (for example, a work-from-home policy) allows them to express agreement, disagreement or impartiality and, crucially, to explain their reasoning 10 .

For an uninterrupted interview that will last between 90 and 120 minutes, the topic guide should be one to two single-spaced pages with questions and probes. Ideally, the researcher will memorize the topic guide before embarking on the first interview. It is fine to carry a printed-out copy of the topic guide but memorizing the topic guide ahead of the interviews can often make the interviewer feel well prepared in guiding the participant through the interview process.

Although the topic guide helps the researcher stay on track with the broad areas they want to cover, there is no need for the researcher to feel tied down by the topic guide. For instance, if a participant brings up a theme that the researcher intended to discuss later or a point the researcher had not anticipated, the researcher may well decide to follow the lead of the participant. The researcher’s role extends beyond simply stating the questions; it entails listening and responding, making split-second decisions about what line of inquiry to pursue and allowing the interview to proceed in unexpected directions.

Optimizing the interview