All Formats

Loan Application Letter

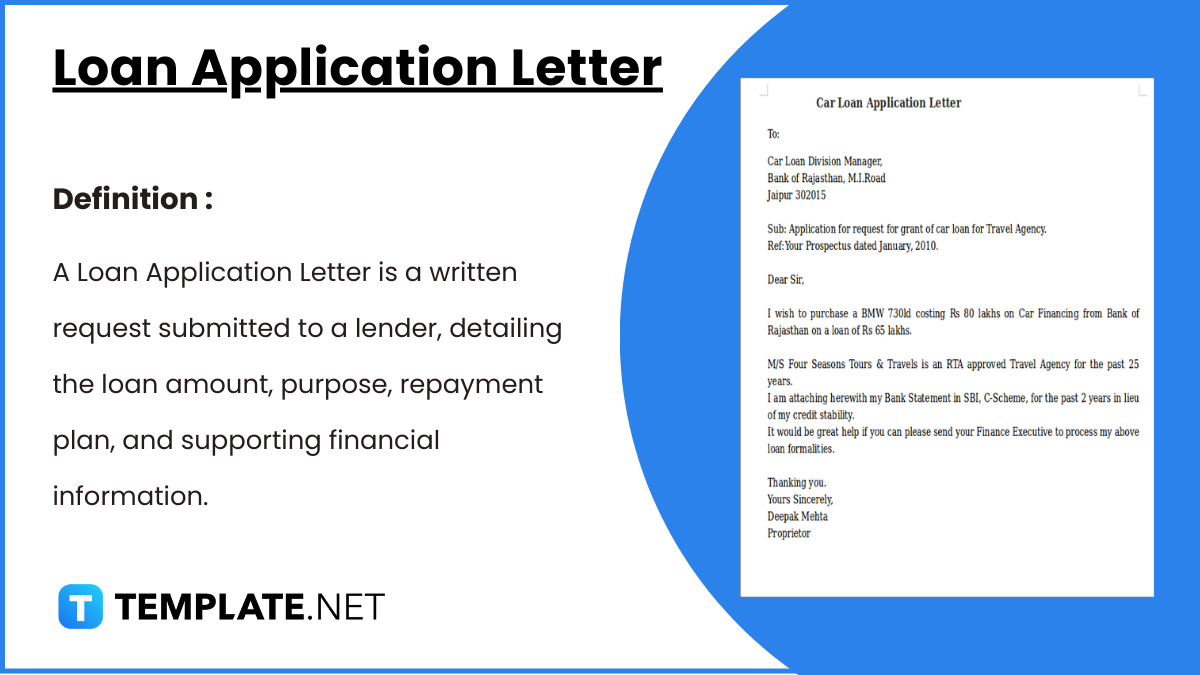

A Loan Application Letter , often referred to as a Loan Letter , is a formal document written to request a loan from a financial institution or individual. It highlights your loan purpose, repayment ability, financial credibility, and demonstrates your seriousness about the loan. This letter typically includes key details such as the loan amount, intended use, repayment timeline, and any supporting documentation. A clear, persuasive, and well-structured Loan Letter improves your chances of approval by building trust and ensuring effective communication.

Loan Application Letter Format

- Loan Amount: [Specify amount]

- Loan Type: [Specify type, e.g., personal, home, business]

- Repayment Period: [Specify period, e.g., 5 years]

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

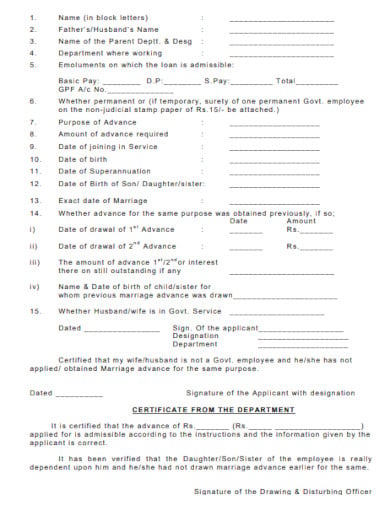

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

Formal Loan Purpose Application Letter to Senior Manager

Formal Event Management Small Business Letter

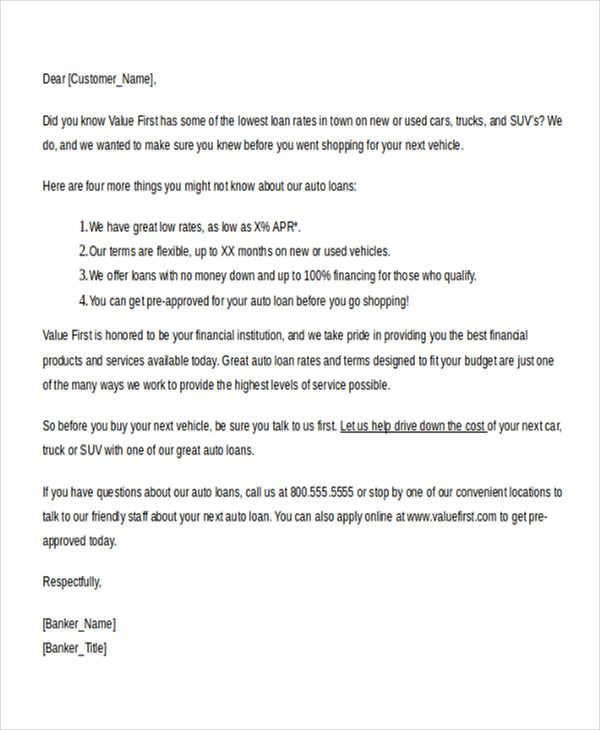

Sample Vehicle Application Letter Example

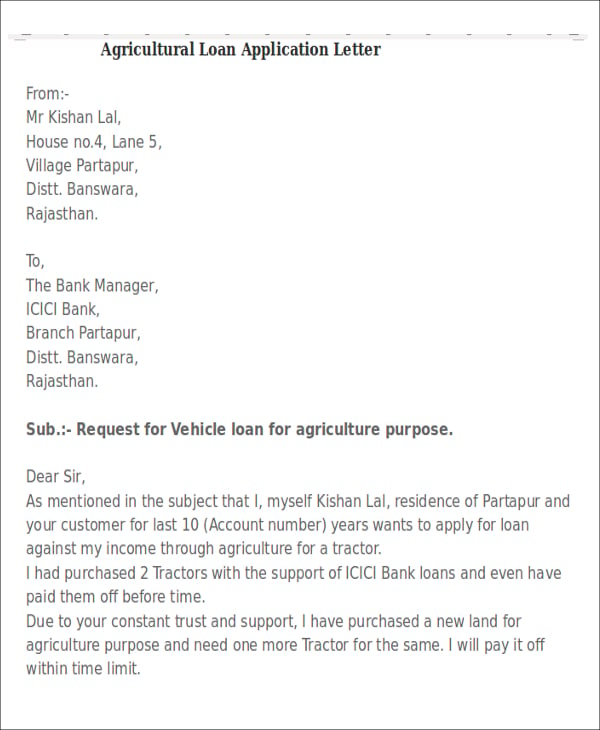

Agricultural Office Vehicle Application Letter Template

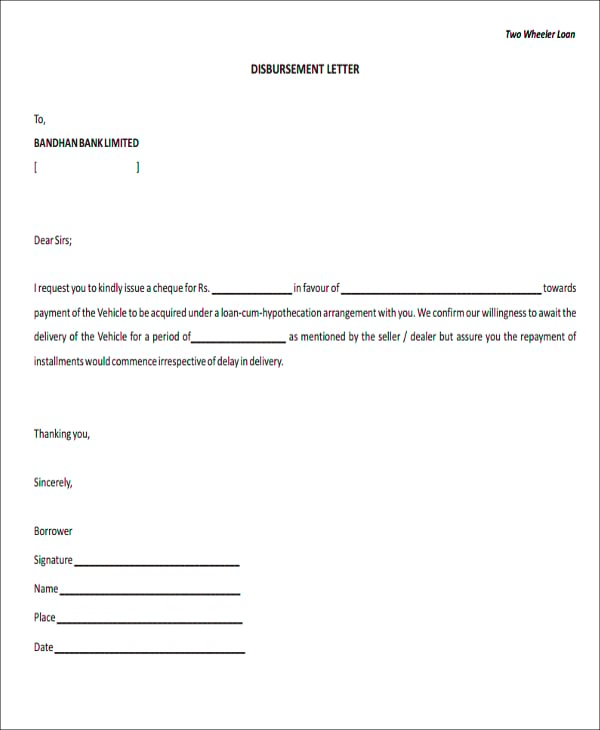

Sample Foreclosure Disbursement Application Form Letter

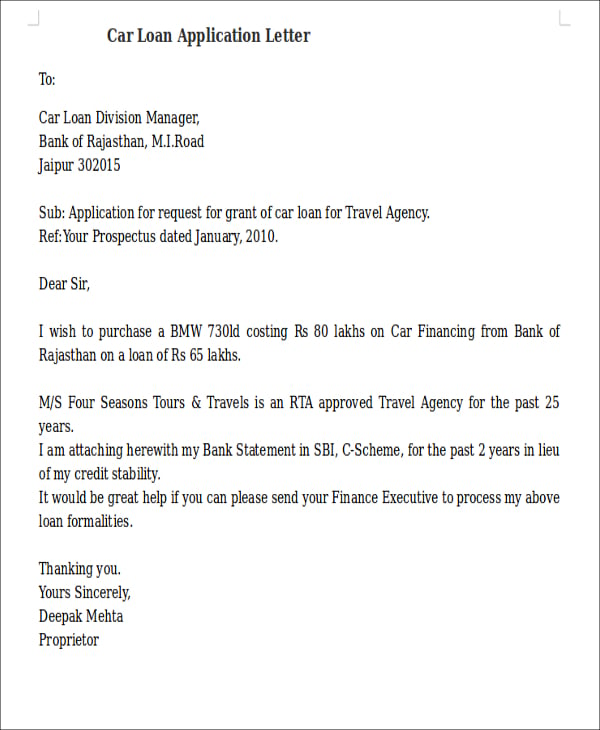

Example Work Travel Agency Letter

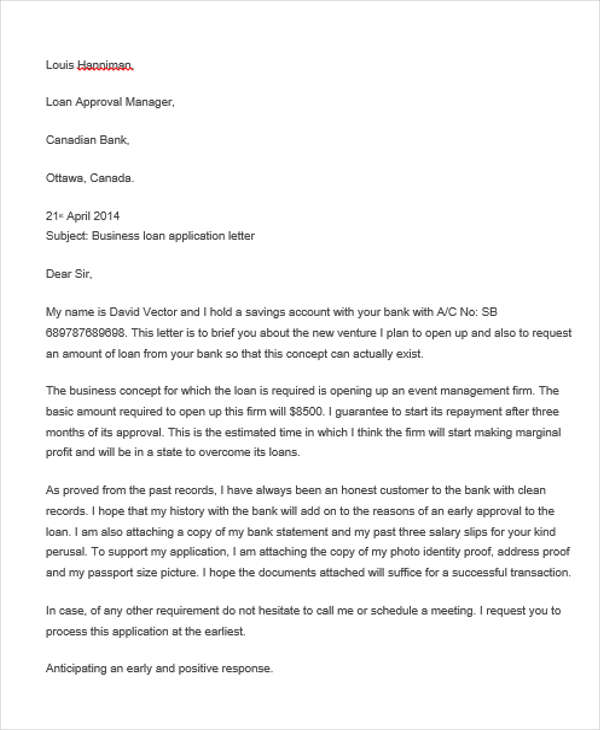

Application Letter to Canadian Bank for Loan

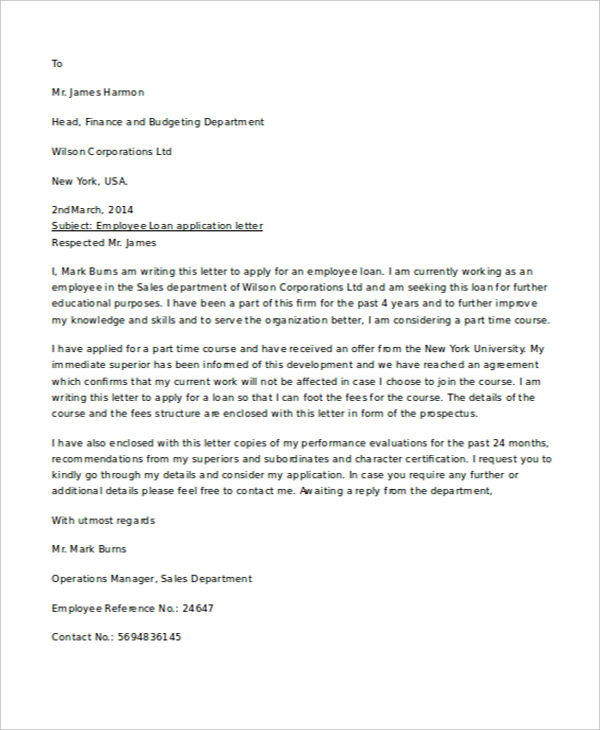

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract, the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

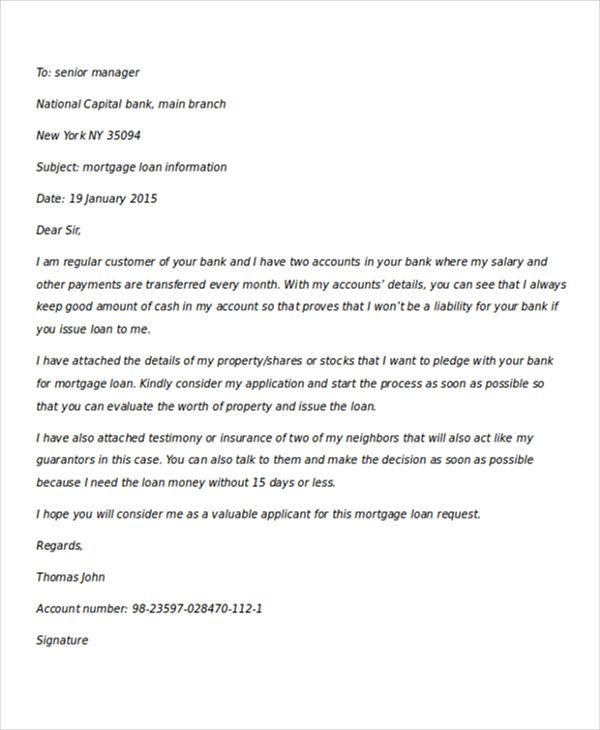

Mortgage Loan Application Letter with Boss Recommendation

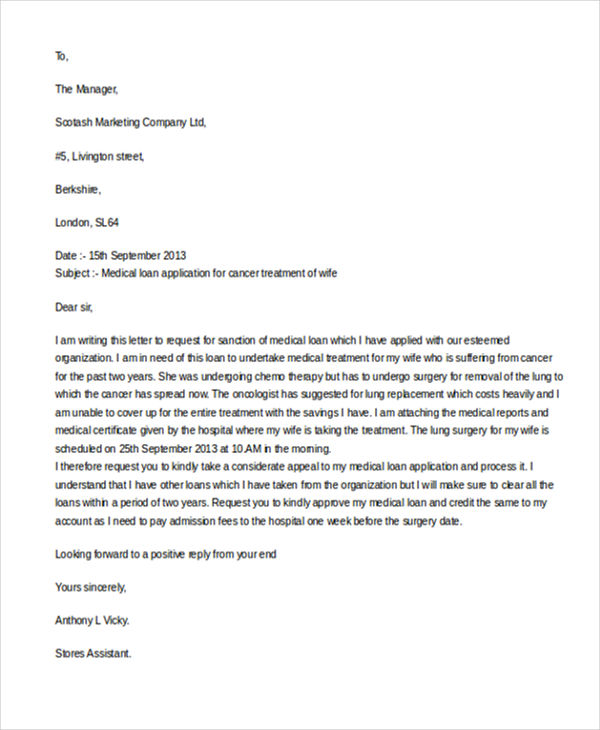

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

Loan Application Letter for Wedding/Marriage Template

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters.

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

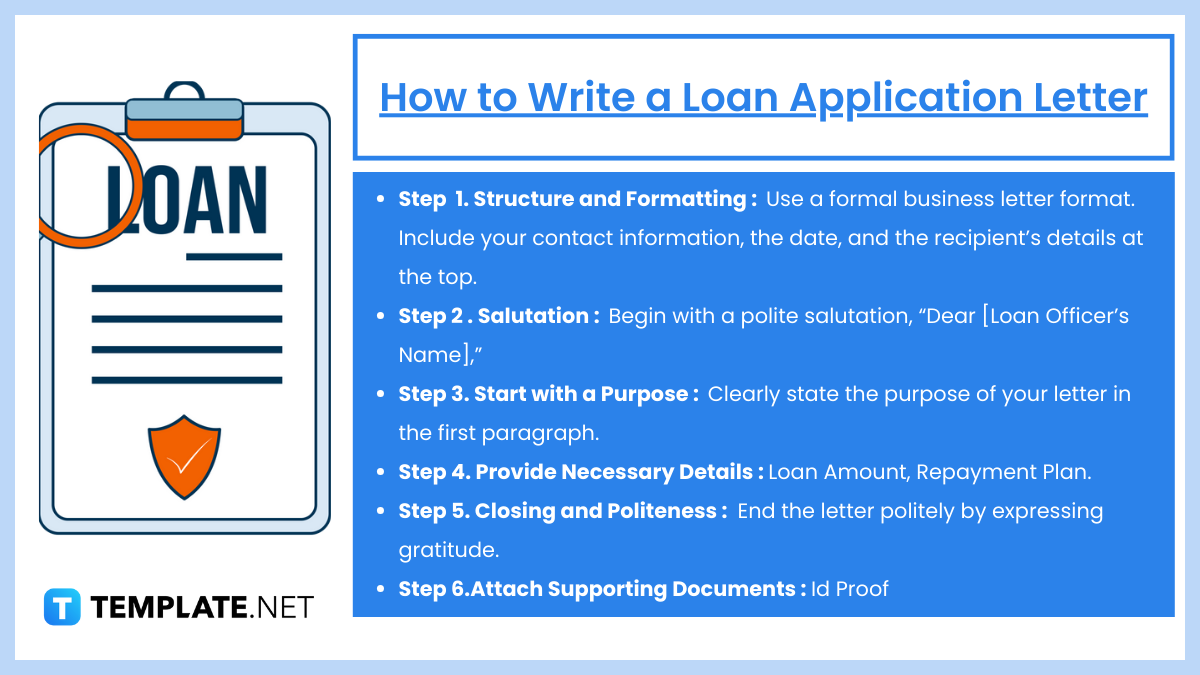

How to Write a Loan Application Letter

1. Structure and Formatting

- Use a formal business letter format.

- Include your contact information, the date, and the recipient’s details at the top.

- Use a clear, professional font and ensure proper alignment.

2. Salutation

- “Dear [Loan Officer’s Name],”

- If you don’t have a specific name, use “To Whom It May Concern.”

3. Start with a Purpose

- “I am writing to apply for a personal loan of $10,000 from [Bank Name] to support [specific purpose, e.g., home renovation, education, medical expenses].”

4. Provide Necessary Details

- Loan Amount: Clearly state the amount you wish to borrow.

- Purpose of the Loan: Explain why you need the loan.

- Repayment Plan: Highlight your plan to repay the loan, including income sources or collateral if required.

- Creditworthiness: Mention your credit score, steady income, or any assets.

5. Closing and Politeness

- “Thank you for considering my application. I am happy to provide additional documentation or discuss my application further at your earliest convenience.”

- “Sincerely,”

- “Yours faithfully,”

- Sign the letter if submitting a hard copy.

6. Attach Supporting Documents

- Income statements

- Employment proof

- Bank statements

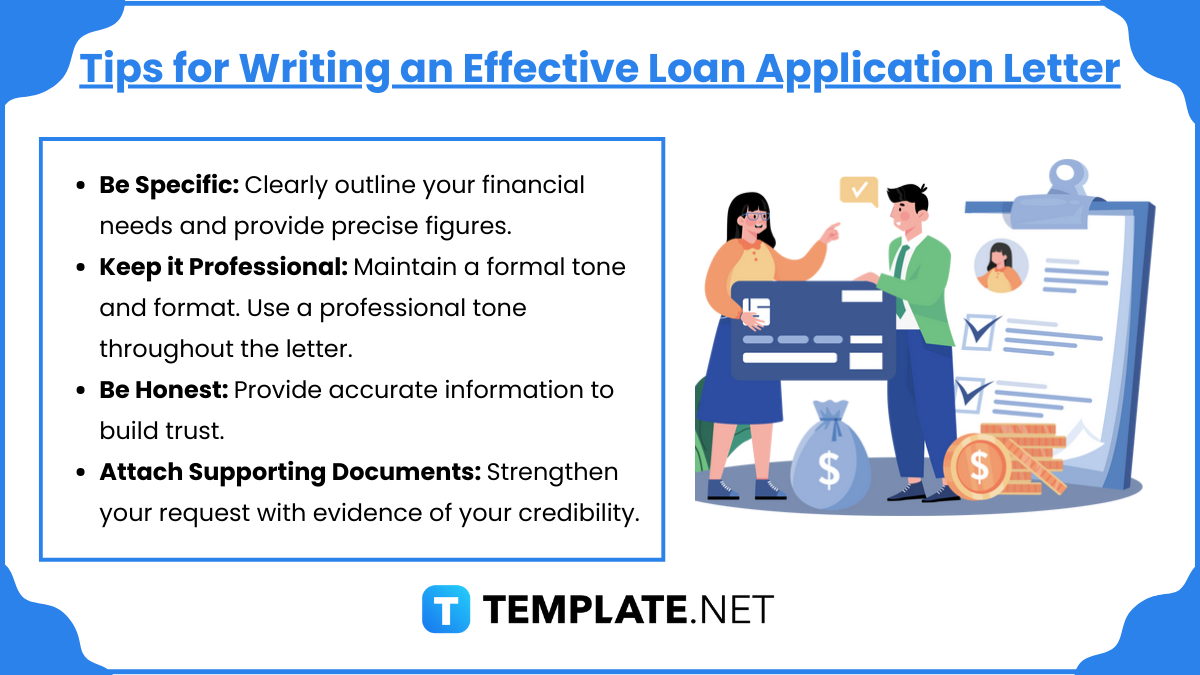

Tips for Writing an Effective Loan Application Letter

- Be Specific: Clearly outline your financial needs and provide precise figures. Avoid vague statements like “I need money for personal reasons.” Instead, explain exactly why you need the loan (e.g., “I require $10,000 to fund the purchase of new equipment for my business”).

- Keep it Professional: Maintain a formal tone and format. Use a professional tone throughout the letter. Avoid casual language or slang, as this can undermine your credibility.

- Be Honest: Provide accurate information to build trust. Never exaggerate or misrepresent your financial situation, purpose for the loan, or repayment capabilities.

- Attach Supporting Documents: Strengthen your request with evidence of your credibility. Mention these attachments in the letter to highlight your preparation. For example, “Please find attached my income statement and a copy of my business plan for your review.”

FAQ’s

What should i include in a loan application letter, how long should a loan application letter be, how does the loan purpose impact approval chances, should i mention my credit history in a loan application letter, how can i tailor a loan application letter for personal versus business loans, more in letters, mortgage lender snapchat geofilter template, mortgage lender linkedin post template, mortgage lender whatsapp post template, mortgage lender instagram story template, mortgage lender instagram post template, mortgage lender facebook post template, family loan agreement template, mortgage loan flyer template, home/house loan flyer template, home/house loan tri-fold brochure template.

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

- 22+ Internal Transfer Letters

- 16+ Sample Professional Reference Letter Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Word & Excel Templates

Printable word and excel templates.

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- One Day Absent Note to Boss

- Request Letter to Staff for Voluntary Deduction from Salary

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication