How to present your business plan to investors

- Fundrising Ready

- MAC & PC Compatible

- Immediate Download

Related Blogs

- Master Your Money: Categorize, Cut & Track Expenses

- Key Considerations for Starting a Business

- What is Business Valuation and Why It Matters

- What to consider when creating a business plan

- Understanding Problem Solving and Its Relevance to Business

Presenting your business plan to investors is a critical step in securing funding and driving your vision forward. To captivate your audience, focus on clearly defined objectives , a comprehensive market analysis , and detailed financial projections . Engaging storytelling and tailored presentations can significantly enhance your appeal, making it essential to master these elements for a successful pitch.

What are the key components of a successful business plan?

Clearly defined business objectives.

When presenting your business plan to investors, it is crucial to start with clearly defined business objectives . These objectives should articulate what you aim to achieve and serve as a roadmap for your business. Investors are particularly interested in understanding how your objectives align with market opportunities and potential returns on investment. Ensure that your objectives are specific, measurable, achievable, relevant, and time-bound (SMART).

Comprehensive Market Analysis

A thorough market analysis is a cornerstone of an effective business plan presentation. This analysis should cover key aspects such as target demographics, market size, growth potential, and competitive landscape. Highlighting relevant industry trends and opportunities will demonstrate to investors that you have a deep understanding of the market and can navigate its complexities. Utilize data and statistics to back your claims, making your presentation more compelling.

Detailed Financial Projections

Investors are particularly keen on understanding the financial projections of your business. This section should include detailed forecasts of revenue, expenses, and profitability over the next few years. Make sure to address how you will achieve these projections and the assumptions behind them. Providing a clear financial roadmap not only instills confidence in your business model but also showcases your preparedness for potential investor questions about finances.

Outline of Marketing and Sales Strategies

Your marketing and sales strategies must be clear and actionable. This section should explain how you plan to attract and retain customers, as well as how you will generate sales. Investors want to see a well-thought-out plan that outlines specific tactics, channels, and budgets. Including timelines for implementing these strategies can also help investors visualize your path to success.

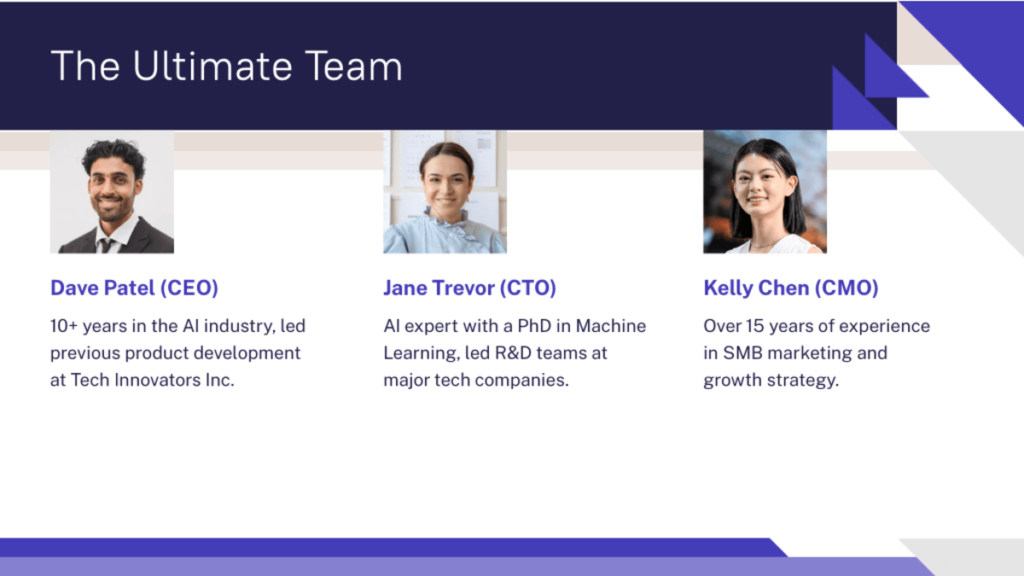

Organizational Structure and Management Team

Lastly, your business plan should detail your organizational structure and highlight your management team. Investors often look for experienced leadership that can drive the business forward. Include brief biographies of key team members, focusing on their relevant experience and achievements. This information can significantly impact investor confidence in your ability to execute the business plan.

- Ensure your business objectives are aligned with investor interests and market opportunities.

- Use visuals to present market analysis data effectively.

- Be transparent about financial projections and the underlying assumptions.

- Incorporate clear timelines into your marketing and sales strategies.

- Highlight the strengths of your management team to build trust with investors.

How can you effectively tailor your presentation to your audience?

Research the investors' interests and backgrounds.

Understanding your audience is a critical component of an effective business plan presentation. Before you step into the room, take the time to research the investor interests and backgrounds . This knowledge enables you to align your pitch with their specific goals and preferences. Look into their previous investments, industry focus, and any public statements they’ve made about what they value in potential business opportunities. Tailoring your presentation in this way ensures that you can speak directly to their motivations, increasing the likelihood of a positive reception.

Highlight relevant industry trends and opportunities

Investors are often keen on understanding the landscape within which your business operates. By highlighting relevant industry trends and opportunities , you can place your business in a context that resonates with their interests. Discuss current market dynamics, emerging technologies, and consumer behavior shifts that align with your business objectives. This approach not only demonstrates your knowledge but also positions your business as a timely and attractive investment opportunity.

Adjust the level of detail based on investor expertise

Not all investors have the same level of expertise when it comes to your industry. Therefore, it’s essential to adjust the level of detail in your presentation accordingly. For seasoned investors familiar with your sector, a high-level overview with in-depth financial projections and market analysis may suffice. Conversely, for those less familiar, it’s beneficial to provide more foundational information about the business plan components , emphasizing how your business fits into the larger market landscape.

Focus on what matters most to the specific investor group

Every investor has unique priorities. Some may be more interested in financial returns, while others might prioritize social impact or innovation. By focusing on what matters most to the specific investor group, you can craft a presentation that speaks directly to their values. This could mean emphasizing your financial projections, detailing your marketing strategies, or showcasing your team’s qualifications. Tailoring your pitch in this way creates a stronger connection and demonstrates that you understand their investment criteria.

Use relatable examples and analogies

Complex ideas can sometimes alienate your audience. To engage investors effectively, use relatable examples and analogies that simplify your concepts. For instance, if you’re discussing a complex technology, compare it to a well-known product that they’re familiar with. This technique not only clarifies your points but also makes your presentation more memorable. By using familiar references, you can bridge the gap between your innovative ideas and the investors' understanding.

- Prepare a tailored executive summary that highlights key points relevant to the investors.

- Incorporate data and statistics that align with investors' interests in your industry.

- Practice delivering your pitch to ensure you can adjust on the fly based on audience feedback.

What visual aids can enhance your presentation?

Utilize slides to summarize key points.

Using slides is one of the most effective techniques for presenting your business plan to investors . A well-structured slide deck can help you maintain focus and ensure that you cover all essential business plan components . Aim for a clean and professional design, avoiding clutter and excessive text. Each slide should highlight the core message, making it easier for investors to grasp your vision quickly.

Include charts and graphs for data representation

Data-driven decisions are crucial in the investment world. Utilizing charts and graphs can make your financial projections and market analysis more digestible. Investors appreciate when complex data is presented visually, as it helps them see trends, comparisons, and forecasts at a glance. Consider using:

- Bar graphs for comparing sales forecasts

- Line charts to show growth over time

- Pie charts for market share distribution

Use infographics for complex information

Infographics are a fantastic way to distill complex information into easily understandable visuals. They can effectively convey the essence of your marketing and sales strategies or illustrate the organizational structure and management team . By incorporating infographics, you not only make your effective business plan presentation more engaging but also help investors visualize your business model.

Consider prototypes or product demos if applicable

If your business involves a physical product or a software solution, incorporating a prototype or product demo into your presentation can be a game changer. This hands-on approach allows investors to experience your offering firsthand, making your pitch more memorable. It demonstrates your commitment to the business and can significantly enhance your credibility as a founder.

Ensure visuals are professional and clear

Professionalism in your visual aids cannot be overstated. Ensure that all visuals are clear, high-quality, and free from errors. Remember that your investor presentation tips should always align with the professional image you want to portray. Use consistent fonts, colors, and styles across slides to create a cohesive look. A polished presentation reflects well on your diligence and attention to detail.

- Limit text on slides; aim for no more than six bullet points per slide.

- Use a consistent color palette that reflects your brand identity.

- Practice transitioning between slides to maintain a smooth flow.

- Test your visuals on different devices to ensure compatibility.

How can you prepare for potential questions from investors?

Anticipate common questions and concerns.

When presenting your business plan to investors, it’s crucial to anticipate the types of questions they may ask. Investors are often concerned about aspects such as your financial projections , market competition, and the overall viability of your business model. By preparing for these common inquiries, you can demonstrate your knowledge and confidence in your business plan.

- What is your revenue model?

- How do you plan to acquire customers?

- What are the key risks associated with your business?

- How do you plan to use the funds you are seeking?

Practice responses with a focus on clarity

Once you've identified potential questions, it’s essential to practice your responses. Clarity is key when addressing investor inquiries, as investors value straightforward answers that reflect your understanding of the business. Aim to articulate your thoughts succinctly while providing enough detail to satisfy investors' curiosity.

- Rehearse with a mentor or colleague to refine your answers.

- Record yourself to evaluate your tone and clarity.

Gather data and examples to support answers

Backing up your responses with relevant data and real-world examples can significantly enhance your credibility during the presentation. Investors appreciate evidence that supports your claims, making it essential to compile market analysis and financial projections that align with the questions you anticipate.

- Use industry benchmarks to validate your financial forecasts.

- Reference case studies that demonstrate successful strategies.

Be honest about challenges and risks

Investors prefer transparency over sugarcoated responses. Being candid about potential challenges and risks associated with your business not only shows integrity but also prepares you for follow-up questions. Discussing your strategies for mitigating these risks can further reassure investors about your preparedness.

Encourage a conversational approach during Q&A

During the Q&A session, strive to create a relaxed atmosphere that encourages dialogue. This approach can help build rapport with investors, making them feel more comfortable engaging with you. Listen actively to their questions, and respond thoughtfully, fostering a two-way conversation instead of a one-sided Q&A.

- Maintain eye contact to foster connection.

- Use open body language to show you are approachable.

What role does storytelling play in your presentation?

Storytelling is a powerful tool when presenting your business plan to investors . It transforms a simple presentation into a compelling narrative that not only captures attention but also fosters emotional connections. A well-crafted story can make your business idea resonate deeply with potential investors, leading to a more memorable and impactful pitch.

Create a compelling narrative around your business idea

At the heart of an effective business plan presentation is a strong narrative that weaves together the essential components of your business. This narrative should clearly outline your vision, mission, and the problem your business aims to solve. By framing your business objectives within a story, you provide context that makes your plan more relatable.

Use personal anecdotes to connect with investors

Integrating personal anecdotes into your pitch can significantly enhance your connection with investors. Sharing your journey, the challenges you faced, and your motivations can humanize your business and make it more engaging. This approach not only builds trust but also illustrates your passion for the project, which is crucial for how to pitch to investors .

Highlight customer success stories or testimonials

Including customer success stories or testimonials in your presentation can serve as powerful endorsements for your business. These stories demonstrate the real-world impact of your product or service and validate your business plan components. They help investors visualize the practical applications of your offering and the value it brings to customers.

Illustrate the problem and your innovative solution

Effective storytelling requires you to clearly define the problem your business addresses. Use relatable examples to illustrate this issue, making it tangible for your audience. Following this, present your innovative solution in a way that highlights its uniqueness and effectiveness. This structure not only engages investors but also emphasizes the need for your product or service in the market.

Keep the story concise and relevant to the main points

While storytelling is crucial, it’s important to maintain focus and brevity. Keep your narrative concise, ensuring that it aligns with the main points of your presentation. Avoid unnecessary tangents that could dilute your message. A well-structured story should complement your financial projections for startups and market analysis without overshadowing them.

- Practice your storytelling technique to ensure smooth delivery and confident presentation.

- Incorporate visual aids that enhance your narrative, such as slides showcasing customer testimonials or problem-solution graphics.

Incorporating storytelling into your effective business plan presentation can significantly enhance your pitch. It engages investors on a deeper level, making them more likely to remember and invest in your vision. By leveraging personal experiences, customer narratives, and a clear illustration of the problem and solution, you create a compelling case that can set your business apart in a crowded investment landscape.

How should you handle feedback and objections during the presentation?

Listen actively and acknowledge investor concerns.

One of the most critical aspects of handling feedback and objections during your business plan presentation is to listen actively. This means not just hearing the words spoken by investors but also understanding the underlying concerns and motivations. Acknowledging these concerns demonstrates respect and shows that you value their input, which can foster a more productive dialogue.

Maintain a calm and professional demeanor

Throughout your presentation, it's essential to maintain a calm and professional demeanor, especially when faced with challenging questions or objections. This not only reflects positively on you and your business but also reassures investors that you can handle pressure and navigate potential difficulties. Staying composed allows you to respond thoughtfully rather than react impulsively.

Provide thoughtful and informed responses

When addressing investor questions or objections, ensure that your responses are well-informed and articulate. Use data and examples from your business plan components to back up your claims. This not only reinforces your credibility but also helps investors see the validity of your proposal. Tailoring your answers to resonate with the investors' interests and backgrounds can further enhance your response.

Be open to suggestions and alternative viewpoints

Being receptive to suggestions and alternative viewpoints is crucial during your investor presentation. This openness can lead to constructive discussions that may refine your business strategy or approach. By demonstrating flexibility, you show that you are willing to adapt and iterate, which is a valuable trait in the dynamic world of startups.

Follow up on unresolved questions after the presentation

It's often the case that not all questions can be addressed during your presentation. Following up on unresolved questions shows your commitment to transparency and thoroughness. After your pitch, send a follow-up email that includes answers to any lingering queries investors may have posed. This proactive approach can strengthen relationships with potential investors and further demonstrate your dedication to your business.

- Prepare a list of anticipated objections and practice your responses to build confidence.

- Use real data and case studies from your market analysis to support your answers.

- Encourage an open dialogue during the Q&A segment to foster a collaborative atmosphere.

What follow-up actions should you take after the presentation?

Send a thank-you note to each investor.

Following your business plan presentation, it's essential to express gratitude to the investors for their time and consideration. A well-crafted thank-you note can leave a lasting impression and reinforce your professionalism. Aim to personalize each note by referencing specific points discussed during the presentation. This not only shows your attentiveness but also helps to build rapport.

Provide any additional information requested

During the presentation, investors may ask for further details or clarification on certain aspects of your business plan. It is crucial to follow up promptly with the requested information. This demonstrates your responsiveness and willingness to engage in dialogue. Organize the information clearly, ensuring that it aligns with the interests of the investors. This could include:

- Detailed financial projections for startups

- Market analysis to support your business objectives

- Additional data or case studies that highlight your business plan components

Keep investors updated on your business progress

After the initial presentation, maintaining communication is vital. Regular updates on your business progress can keep investors engaged and informed. Share milestones achieved, challenges faced, and how you are overcoming them. This transparency fosters trust and can keep the investors' interest alive as you move toward further funding opportunities.

Schedule follow-up meetings to discuss further

Proactively scheduling follow-up meetings can provide a platform for deeper discussions. This allows you to address any lingering questions and elaborate on your business plan presentation. During these meetings, you can:

- Present additional visual aids for presentations

- Discuss potential collaboration opportunities

- Gather feedback on your business strategy

Being proactive in scheduling these meetings reflects your commitment and eagerness to build a relationship with the investors.

Maintain ongoing communication to build relationships

Building a relationship with investors goes beyond the initial presentation. Regular check-ins, updates, and sharing relevant industry news can keep you on their radar. Use various communication channels, such as:

- Email newsletters to share progress and insights

- Social media updates for informal engagement

- Invitations to industry events where you can connect in person

By maintaining ongoing communication, you not only keep investors informed but also position yourself as a dedicated entrepreneur who values their partnership.

- Always personalize your thank-you notes to make a stronger connection.

- Be prompt in providing additional information; this showcases your efficiency.

- Regular updates should be concise and focused on key achievements.

- Use follow-up meetings to delve deeper into investor interests and concerns.

- Leverage social media platforms for casual updates and engagement.

- Choosing a selection results in a full page refresh.

Confirm opening of the external link

Business Plan Advice

As a budding entrepreneur, when you think about what relationships you’re going to need to support you on your journey, you probably think about the importance of building better customer relationships or the importance of building relationships with your key resources. However, there is one kind of crucial relationship that’s often overlooked: the relationship with your initial stakeholders. Investor relations, particularly during the very early days, are the very foundation of practically all successful organizations.

Investor Relations

Building a good relationship with investors, right from the very start, is critical, especially if you’re planning to rely on outside investments to launch, develop, and grow your idea from concept to reality. One of the best ways to build a good relationship is to ensure that you’re communicating your message in the very best way; that you’re presenting your business plan in a way that attracts attention, gets investors excited about you and about what you do, and that puts you both on the same page.

But it’s not always as simple as that. The problem is that while you may be offering something unique, investors can’t always see how you differ from the rest. After all, the number of new startups is rising rapidly, with reports suggesting that in 2010, there were 560,588 businesses in the US under one year old . Today, that figure stands at 804,398, so investors are seeing more business plans than ever before.

The secret to standing out, attracting attention, and building the right relationships, with the right people, is creativity; presenting your business plan in an innovative and creative way that not only lets you communicate your idea and share your message but also ensures you’re heard and understood.

Creativity in Investor Relations

Investor relations are already beginning to become more creative. Some entrepreneurs have been boldly moving away from the tried-and-tested business plan and embracing the more modern pitch decks, for example. But this isn’t necessarily the right approach. The truth is that both the traditional business plan and the more condensed lean startup business plan are highly effective ways to get your ideas down in a structured, valuable way. The secret to attracting, engaging, and building relationships with stakeholders isn’t in redesigning the business plan; it’s in redesigning the way that you present this plan to investors.

Here are three simple yet effective ways to mix up your presentation strategy for a bigger impact:

1. Look Beyond Reality

Isn’t realism the foundation of any good business plan? In a way, yes. Investors will always want to see a realistic overview of your financials. But the problem with realism is that when you’re at a point where your idea is just that - an idea - you haven’t really got all that much reality to base your business plan on.

So have a bit of fun with it. Run with it. Rather than just presenting the real facts and figures, and looking at the most likely possibilities, use your presentation as a way to set foot beyond reality and get your potential investors excited not about what you will do, but what you could do. In your presentation, don’t be afraid to ‘go big’, acknowledge the bigger picture, and incorporate fictional aspects alongside your real data to demonstrate the wider potential of your idea beyond the restricted confines of reality.

The best way to present this ‘big picture’ potential is through mind mapping . Why? Because a mind map - a brainstorming diagram that features a central idea surrounded by associated concepts - allows you to go off on tangents without losing sight of the core notion. While other types of brainstorming software like digital whiteboards and online sticky notes can help you to build your business plan, the strong visuals and simplicity of mind maps are great for actually presenting these ideas in a clear, impactful way.

2. Become a Storyteller

The standard business plan consists of a range of facts and figures, all connected through narrative. But the problem with basing your business plan on these facts and figures is that data isn’t unique. Investors may well have heard 5 other business plans earlier in the day, each presenting the same information.

A better and more creative way to present your ideas is by turning the traditional business plan around, building it on narrative, and interspersing this narrative with your data. Why? Because data sets can be seen by anyone. But your story is your story. By presenting your idea in a more personal way, you’re giving your business plan something that no other person could possibly give it: you. So, while facts and figures are important, communicating this data through storytelling is an even more critical factor.

There are a number of different ways to become a good storyteller. One is to use your real-life experiences building your product or service and transform these experiences into a strong narrative. Another way is to create your own protagonist from scratch, walking your potential investors through your journey through the fictional yet relatable and relevant experiences of your target audience.

3. Go Off-Script

Not for the faint of heart, this third creative technique involves presenting your elevator pitch - your quickfire overview of you and your business idea - and nothing else. Instead, following your introduction, you transform what should be a business presentation into one giant Q&A session, going 100% off-script.

Turn the traditional pitch into a new and unique opportunity for your potential investors to take the lead, asking their questions rather than just listening to your answers. One of the biggest problems with pitches today is that they are over-rehearsed, and it shows. When investors ask questions, they want their questions answered. What they don’t want is pre-generated auto-responses that have been molded to try and fit the question. And yet, most of the time, that’s exactly what they’re getting.

While it’s important to practice and to be prepared for practically every scenario, a more creative and authentic way to present your ideas is by listening to what’s being asked and coming up with your own answers to specifically meet these questions in real-time. It’s a nerve-wracking technique without a doubt, but it’s one that helps you stand out through greater transparency, openness, and honesty.

Finding the Right Approach

Standardized presentations are outdated. Why? Because it’s becoming increasingly clear that not all investors are looking for the same thing, so a blanket approach isn’t going to cut it. Research shows that, while some investors prioritize financials , others look more at the market, and some base their decisions on investor fit. Attracting and engaging today’s investors means utilizing different approaches based on each different investor. This highlights how important it is for entrepreneurs to research their audience.

Is an investor creative? Are they quiet, careful, and committed to the bigger picture? Then visual presentation ideas like mind maps could be the key to success. Are they driven equally by emotion as they are by logic? Storytelling could be the solution. Are they more of the spontaneous type? Going off-script could be what it takes to have an impact. Remember: your business idea and data may not be unique…but you are. By taking a creative approach, you’re giving investors something no one else can:

An Easier Way to Prepare Your Business Plan -The Business Model Canvas The Business Model Canvas (BMC) is a one-page business plan that allows you to test and validate the key parts of your business in a manageable format.

Business Plan Presentation Template Use this template when creating a presentation for your business plan.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

👀 Turn any prompt into captivating visuals in seconds with our AI-powered design generator ✨ Try Piktochart AI!

What a Pitch-Perfect Business Plan Presentation Template Looks Like

Most business plan presentations are boring, lack clarity, or fail to capture the excitement of the founder’s vision. Others leave investors yawning instead of writing checks.

The business plan presentation template below is different.

We’ll walk you through the key elements of the template that will not only grab your audience’s attention but also:

- Help you tell your unique business story that resonates with investors and highlight your unique value proposition.

- Build credibility and present a well-structured plan that demonstrates your commitment to success.

- Give you the confidence to pitch your business idea effectively and secure the funding you deserve.

Pro tip: Get your free Piktochart account before you scroll down. This way, you can immediately edit the template below as you read along for the best practices. Alternatively, you can hop over to our AI presentation maker and find more examples of business plan presentation templates.

Ultimate business plan presentation template

Here at Piktochart, we’ve been creating business plan presentation templates for a while now. We’ve learned what works and what doesn’t.

Our design team has also reviewed successful business pitches and researched what seasoned investors seek. Then, we’ve distilled the most impactful elements into an effective business plan template.

This business plan presentation template isn’t just another generic business plan slideshow. It cuts to the chase and delivers the information potential investors are looking for in a clear, concise, and visually engaging way.

For this template, we adhered to Guy Kawasaki’s popular 10/20/30 rule :

- 10 slides (excluding the cover page and table of contents)

- 20 minutes (pitch it for 20 minutes)

- 30-point font (font size for headings and subheadings)

10 must-have slides in your business plan presentation

Below, we highlight the ten slides every business plan presentation needs.

1. Introduction: First impressions count

This introduction slide strikes the perfect balance with its three-panel layout. While others cram everything into one space, this design gives you dedicated zones for company positioning, specialization, and mission statement. The clean diagonal accent also adds visual impact without overwhelming your message. Pro tip : Resist the urge to add more text—this structured format is all you need!

How to do it well

- Clearly state your company name and what you do. A catchy tagline or a short and sweet description can really help people remember you.

- Keep the text minimal and use a large, easy-to-read font. A high-quality picture or graphic can make all the difference too, just make sure it’s relevant to your business and looks professional.

2. Problem and opportunity: Set the stage for your solution

For this second slide, the bold purple backdrop paired with crisp white boxes makes your problem and opportunity story pop. We’ve also added custom icons to break up the text – no more boring bullet points here. Plus, the strategic two-column format two-column format presents challenges and opportunities with perfect clarity – exactly what investors look for.

- Explain the problem in a way that’s easy to understand. Give real-life examples of the pain points.

- Show the potential. Use numbers and stats to prove there’s a big market and lots of room to grow.

- Connect the problem to the opportunity. Clearly explain how your solution fixes the problem and why it’s a winner in the market.

- Use headings, bullet points, and maybe even some visuals to make the info pop. Play around with contrasting colors to highlight the problem and the opportunity.

3. The ultimate solution: Present your value proposition

Notice how this slide’s dual-panel design creates instant visual hierarchy? The dark technical image anchors your product specs, while the lighter panel highlights your value proposition. This balanced layout helps you articulate both what you do and why you’re different – a critical distinction most business plan presentation slides miss.

- Sell the benefits. Don’t just list features – show how your solution makes life better or businesses more successful.

- Use visuals like a demo, screenshots, or diagrams to bring your solution to life.

- Shape your value story based on who’s in the room. Different investors seek different signals. For example, venture capitalists (VCs) want to see market potential, angel investors look for innovative breakthroughs, and strategic investors focus on industry fit. Adapt your unique selling points (USPs) accordingly.

- Show the impact your solution has by using a before-and-after comparison.

- Keep it simple. Make sure everyone gets it, even if they don’t know much about your industry.

4. Market analysis: Show off your market knowledge

Smart market analysis slides let the numbers speak. This three-part structure leads with key metrics that investors scan for: total market size, growth trajectory, and target segment value. Each section uses large display numbers backed by focused context which keeps your market story clear and convincing.

- Show the numbers. Back up your claims with solid market data – market size, growth trends, and your target audience.

- Spot the trends. Point out the key trends that show why your solution is needed right now. This proves you really understand what’s happening in the market.

- Define your ideal customer, what they need, and how your solution is exactly what they’re looking for.

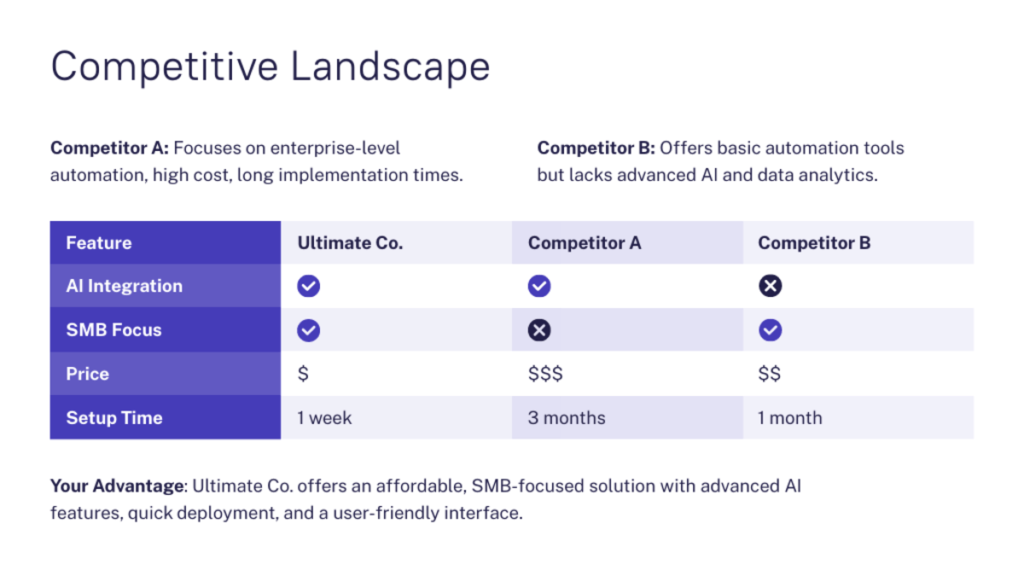

5. Competitive landscape: Showcase your edge

Cut through the clutter with this competitive landscape slide. In this template, the top section primes investors with quick competitor snapshots, while the feature comparison grid below tells your story at a glance. The purple highlights and check marks also make the information skimmable yet thorough.

- Know your rivals. Pick 2-3 of your biggest competitors and show you know their strengths and weaknesses.

- Use a comparison table to clearly show how your solution beats them on features, pricing, or whatever matters most.

- Highlight your competitive advantages. Make it clear why you’re the best choice for your customers.

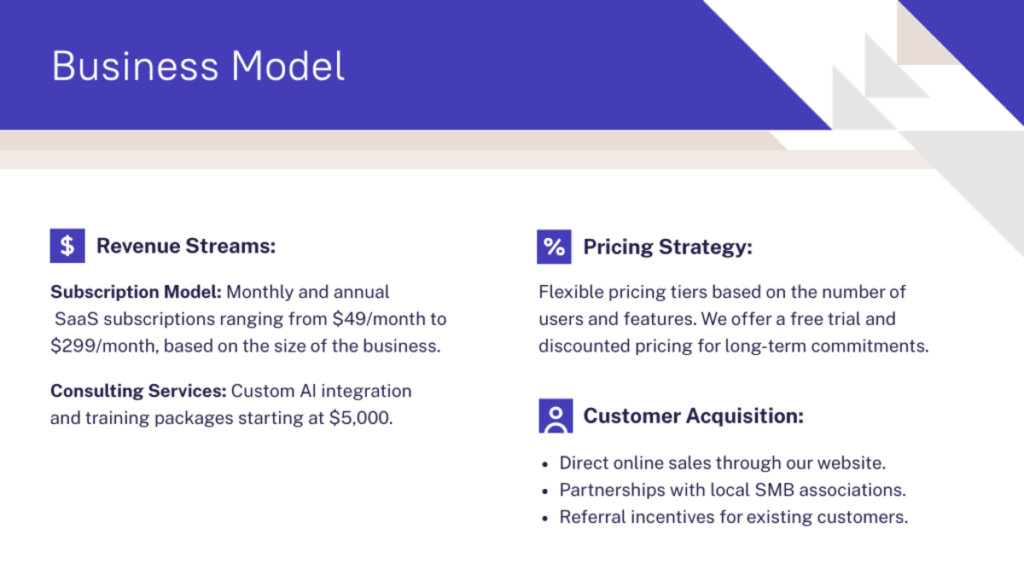

6. Business model: Demonstrate your path to profitability

Here’s a business model presentation slide that doesn’t look like a wall of text! This three-section layout transforms complex revenue details into a clear financial story.

Each segment – revenue streams, pricing, and customer acquisition – gets its own dedicated space, with custom icons providing visual navigation. The clean typography and balanced white space make dense financial information instantly digestible.

- Clearly outline your revenue streams. Describe how your business will make income (e.g., subscriptions, consulting, advertising).

- Define your pricing strategy. Explain how you will price your products or services and why this pricing is appropriate for your target market.

- Share your customer acquisition strategy. Show clients how you will reach and acquire new customers (e.g., online sales, partnerships, referrals).

- Consider using visuals like diagrams or flowcharts to illustrate the flow of revenue and customer acquisition. Keep the layout clean and uncluttered for easy comprehension.

7. Marketing and sales strategy: Your roadmap to customer acquisition

This horizontal timeline layout for this slide shows clear progression through each phase. Custom icons and purple phase markers create clear visual progression, while the diagonal dotted connectors suggest momentum. You’ll notice that each phase gets ample space for both strategy and specifics, which is perfect for showcasing methodical market expansion.

- Use the numbered phases to guide your audience through your strategy.

- Explain the why briefly for each phase. For example, why you’re starting with inbound marketing or why teaming up with industry associations is a smart move.

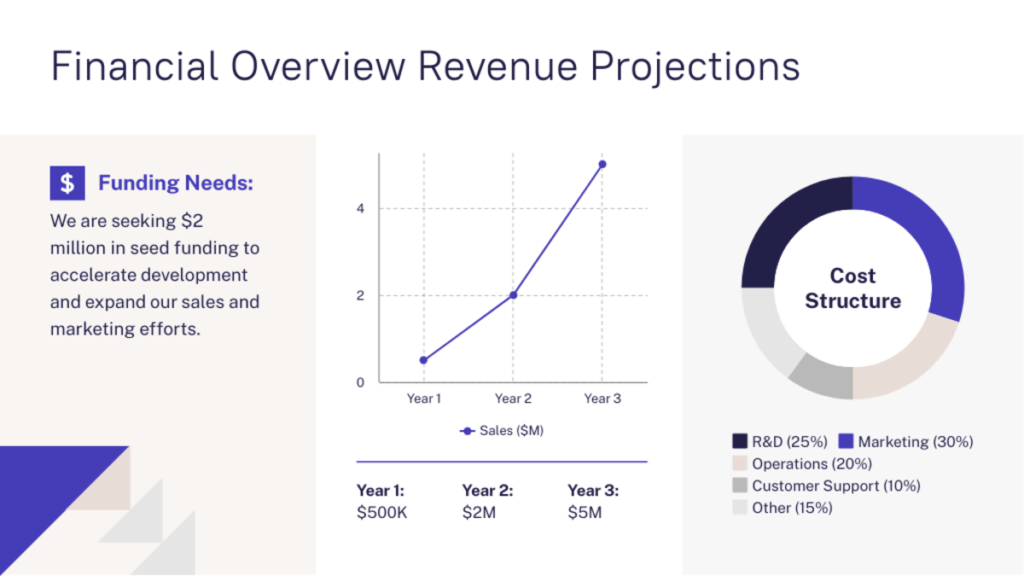

8. Financial overview: Share revenue projections and funding needs

This three-zone layout solves the classic financial slide problem: too many numbers and too little clarity. The clean left panel describes your funding needs upfront, while the center’s growth curve and the right’s cost breakdown pie chart tell your complete financial story. Plus, the purple accents and clean spacing keep complex financials digestible.

- Break down your cost structure. For example, use the pie chart to illustrate how the funding will be allocated. Point out key areas like R&D, Marketing, and Operations. Briefly explain why these areas are prioritized.

- Relate the cost structure back to the revenue projections. For example, explain how investment in R&D will drive product innovation and contribute to future sales growth.

- Visualize the data effectively. Choose chart types that best represent the data. In this case, a line graph effectively illustrates revenue growth, while a pie chart is suitable for showing cost distribution.

- Maintain visual hierarchy. Guide the viewer’s eye through the information by using size, color, and positioning to create a clear visual hierarchy. For example, the funding needs could be emphasized with a larger font size or a contrasting color.

9. The ultimate team: Show the individuals driving the company

Skip the cluttered org chart with this team layout where key executives stand out instantly. Equal sizing and spacing create visual harmony, while purple role titles guide the eye. Each bio area is also perfectly sized: enough to impress, brief enough to remember.

- Use high-quality headshots of each team member to create a personal and engaging connection with the audience. Ensure the images are professionally taken and consistently styled.

- Maintain visual balance by distributing elements evenly. Use white space effectively to avoid a cluttered look. Consider using a grid layout for a clean and organized presentation.

- Be consistent with your typography. Use different font sizes and weights to create visual interest and hierarchy (e.g., larger font for names, smaller for titles).

10. Key takeaways: Recap of your business presentation’s most important points

End your business presentation on a high note with this final slide! Three distinct panels keep key messages clear and memorable, not lost in paragraphs. The supporting image also reminds investors that there are real people behind the business.

- Keep it concise. No need to repeat everything you’ve already said. Just hit the highlights, the big “aha!” moments that you want your audience to remember.

- Focus on the value proposition. Remind everyone why your solution is the best and how it solves the problem you introduced earlier.

- End with a call to action. What do you want your audience to do after the presentation? Whether it’s investing, partnering, or simply learning more, make sure you clearly state your desired outcome.

- Maintain visual balance. Arrange the takeaways in a balanced layout, either vertically or horizontally, with sufficient spacing between each point.

Adapting the business plan presentation template to your industry or size

Not every business fits neatly into the business presentation template we shared. Here’s how to adapt it for different industries or sizes:

Tech startup business presentation

If you’re a tech startup, embrace your geeky side and showcase the technology behind your product with demos and visuals. Highlight your potential for rapid growth and scalability to capture investor interest.

Meanwhile, if you have early users or impressive metrics, flaunt those numbers to build confidence and demonstrate you’re on the right track.

Food and dining business presentation

For food and dining businesses, it’s all about creating a vibe. Use stunning visuals of your space, your mouth-watering menu, and the overall dining experience to transport investors into your restaurant.

And then there’s location. Emphasize why your spot is perfect and who your ideal customer is in that area.

Finally, don’t forget the behind-the-scenes. Show investors you’ve got a handle on costs, kitchen efficiency, and creating a smooth experience for every diner.

Manufacturing business presentation

In manufacturing, it’s all about efficiency and scale. Walk investors through your production process — from your reliable supply chain to your impressive production capacity and rigorous quality control.

Break down your cost of goods sold and how you’ll keep those costs low to maximize profits. Also, map out how you’ll get your products into the hands of eager customers with a solid distribution and logistics plan.

Small business presentation

If you’re presenting a small business, keep it simple and let your passion shine through!

You might not need all ten slides in the template. Focus on the essentials like the problem you’re solving, your unique solution, the target market, and your solid team.

Share your story and why you’re so driven to succeed. This personal touch can resonate with investors. And if you’re serving a local community, highlight what makes that market special and the unique opportunities you’ve uncovered.

Business presentation for complex industries

Some industries are just inherently complex. Whether you’re in fintech, biotech, logistics, or advanced manufacturing, your business model might have layers that need careful explaining.

Don’t let complexity derail your pitch deck ! Break it down into digestible chunks. Use extra slides to explain each piece of the puzzle. For example, if you have multiple revenue streams (like subscriptions, licensing fees, and API access), give each its own slide. Or, if your supply chain is a web of global partnerships, dedicate a slide to visualizing it clearly.

Visuals like flowcharts, diagrams , and other visuals can work wonders in simplifying complex ideas. And most importantly, never lose sight of the big picture. Make sure your core message and value proposition shine through, even with all the added layers.

From idea to investment: Pitch your way to funding with Piktochart

This guide has provided you with a pitch-perfect business presentation template and industry-specific design best practices for a business presentation that effectively communicates your business vision and potential.

It’s also worth noting that your business plan presentation is more than just slides and numbers; it’s an opportunity to tell your story. Showcase your passion and inspire confidence in your investors.

Now, grab our template and make it your own. We’re rooting for you and your business! Don’t forget to get y o ur Piktochart free plan if you haven’t yet and pick your favorite from our presentation template library .

Business plan presentation: Frequently asked questions

How long should a business plan presentation be.

Aim for the sweet spot – around 20 minutes. This is enough time to hook your audience, cover the essentials, and leave them wanting more. A shorter presentation also leaves more time for questions and discussion, where you can shine and build connections.

What’s the difference between a business plan and a business plan presentation?

A business plan is the full story of your business where every detail is meticulously laid out. Meanwhile, a business plan presentation shares the business plan’s most exciting and compelling parts. It’s designed to capture attention.

How do you present a small business plan?

When presenting a small business plan, keep in concise and focused on what matters most to investors.

In most cases, you might not need a 10-slide business plan presentation. Prioritize the following essentials:

- The problem: What issue are you tackling?

- Your solution: How do you solve it uniquely?

- The market: Who are your customers, and why will they love you?

- The team: Why are you the right people to make this happen?

Other Posts

7 Best Practices to a Standout Research Presentation

7 Sales Presentation Examples for Successful Pitches

How to Make a Presentation (Guide With Tips & Templates)

How to Present a Business Plan to Potential Investors

Helping ideas to grow into measurable success. InnMind Expert in Metaverse, Crypto, Marketing Growth.

More posts by Val Baev.

Being able to sell your business plan to potential investors effectively is undoubtedly a fundamental skill for a startup founder.

Unfortunately, doing it correctly is not very intuitive. You can easily go overboard on the details too early when your audience is not yet interested enough, or you can showcase too little. Either way, such a mistake could cost you a potential investor.

This article would give you a solid backbone of info, which should help you avoid such basic mistakes that can slow down your fundraising process .

1 Judge the Level of Interest

You need to adeptly match the information you are presenting with the level of interest of the people you are communicating your business plan to.

People who don’t know much about your project won’t have the interest and patience to read a full 30-page document. At the same time, people who are familiar with your project and business and want to make a serious commitment would expect such details.

Regrettably, this means that one document wouldn’t be enough.

It helps to imagine the process as a sales funnel. From least-interested to most-interested, people should receive the following business plan communication:

2 Elevator pitch

You should be able to summarize the whole business in a few sentences to people you’re just meeting. It pays dividends to polish this presentation, as you would have to give it constantly to all kinds of stakeholders in your business. You can also use writing services like Trust My Paper , where experts will help you create a quality business plan early in your career.

3 Pitch Deck

Short pitch deck, lean canvas, or business plan executive summary: the short pitch deck is the industry-standard way to present a startup idea to potentially interested parties. That said, the short pitch deck is great for meetings, but it suffers a bit when you send it by email for people to read, as it is short on text. Because of this, the Lean Canvas and the business plan executive summary could do a better job on such occasions (or even better – you can combine the short pitch deck with one of the other two documents). These documents have the benefit of being succinct but at the same time giving more information than the few-sentence long elevator pitch.

4 Detailed Pitch Deck

An online presentation made especially to send by email. It has the same structure and contains the same information as the short pitch deck, but it is more text-heavy and detailed. It could also be used for 15 to 40 min presentations instead of the standard 5 to 10-minute pitches. Once again, committing 40 minutes to your project suggests your audience is already relatively interested.

5 Business Plan

Finally, the full business plan. It is useful only to people who intend to commit to the project – usually investors, but also partners, co-founders, etc. Keep in mind that even though the business plan is usually used as a tool to attract investors, its main purpose is to give the founding team clarity of the path ahead.

Sell the Core Business Idea Efficiently

Whether you use a business plan or a pitch deck, the central principles of convincing a startup investor of the viability of your project remain the same.

- Clarity is paramount . Complexity is usually counter-productive because it risks confusing your audience. Moreover, the more complex the plan, the higher the chance it would go wrong when executed.

- Start with the problem you are tackling (make sure it’s a real problem) and the solution you are proposing.

- Showcase the (hopefully big) upside of the project by talking about the total addressable market and your possible market penetration.

- Give evidence – ideally traction numbers sufficient to convince the audience that the story you are telling is founded in reality.

- Showcase the competence of the team – demonstrating deep domain knowledge and ideally, experience is paramount.

- Talk about competition and your competitive advantages . Saying there’s no competition is usually a sign of a bad understanding of the space, so do your research diligently.

Finally, finish with the ask. In a business plan, you have more space to explore what you are looking for – investors, partners, etc., and what you need the resources for.

If you cover the points from above to a satisfying degree, then you are off to a great start to convince potential investors and partners.

Structure Your Business Plan Meticulously

Keep in mind that the business plan isn’t necessarily a document that’s meant to be read from A to Z. Usually people would skim-read it, and then they would use it as a reference document every time they need specific information. This means that it needs to be structured logically to allow people to easily find the information they are looking for even before they’ve read the whole document.

The business plan structure is not set in stone, but people expect to find specific pieces of information there, so being too creative with the structure is counter-productive.

A good business plan structure is the following:

- Executive Summary : a summary of the whole plan, can be sent as a separate document as discussed above;

- Opportunity : talk about the problem, solution, target market, segments, and possibly competition;

- Execution : marketing and operations plan; milestones are helpful to illustrate the road ahead; success metrics are also a great idea;

- Company Structure : cap table, management team, hiring plan for open/perspective positions;

- Finance : financial projections – P&L and ideally net present value projections; needed funding; appendix: anything else, plus pictures and videos supporting the story.

Presenting a business project to investors isn’t as straightforward as one would think, so it pays dividends to invest the needed time to understand what the investor expects to see and to develop the needed documentation that would allow you to build a convincing case.

That said, the pitch deck and the business plan are just a framework – needless to say, the important thing is the content, so make sure you have worthwhile things to say in your business plan.

Subscribe to InnMind

Subscribe to InnMind using the links below to stay up to date with upcoming events, releases, and news from the Web3/Cryptocurrency/NFT/Metaverse world of startups and investment funds:

Website | Twitter | Telegram | VC Pitching Sessions | Youtube | LinkedIn

Read other posts in our blog

Subscribe to InnMind: Blog for Web3 Startup Founders

Get the latest posts delivered right to your inbox

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

How to present a business plan to potential investors

Table of Contents

Specify the problem your business solves

Tell a story in your presentation, do your homework, have confidence and rehearse your presentation, save time on your business finances with countingup.

Presenting your business plan can be a scary prospect for business owners. Laying your hard work bare to be examined by someone who doesn’t know you or your business can feel intimidating.

This article will help to prepare you to present a business plan to potential investors, through the following steps:

- Share the problem your business solves

When writing your business plan you should have identified a gap in the market that your products/services occupy. This proves there is a viable market and audience who need your business to fix an issue they have.

Investors will be unlikely to be interested in the business if you cannot prove that your company fulfils a need for customers. When you only have between ten to twenty minutes to sell them on your business, investors want to see quickly that a business is sustainable and will be viable long term.

When planning your presentation, lead with the pain point for the target customer, and how your business solves it.

Next, illustrate the problem through statistics on the current market. What products or services are out there currently? Show how your business has the edge over your competitors, or what benefits your company can offer a customer when they buy from you over somewhere else.

To help you prepare, read our guides on how to write up a competitor analysis as well as the market trends part of your business plan.

No one is as passionate about your business as you are. You need to convey that to your potential investors.

You may have told people the story of how you started your business a hundred times over, but these investors will be hearing it for the first time. Be personable, and make them excited to work with you through the passion you have for your venture.

The numbers you’ve gathered in your business plan will speak for themselves but you need to tell a story with them. Create your presentation around why you want to achieve certain goals, not just the how . This is where your enthusiasm and expertise can shine through, for investors to see why you care so much about what you’re doing. They need to buy into you as a business owner and operator, as well as the business idea itself.

How many times have you seen someone fumble their numbers on Dragons Den? This is where entrepreneurs get caught out, and investors will be unlikely to want to work with a business owner that doesn’t know their figures well enough.

Do your homework before you present the business plan to any potential investors. Learn your market analysis and your financial figures inside out and back to front, because investors are likely to question you on these during the presentation.

Leave your financial figures until near the end of your presentation because the numbers need context. Include your past performance, your current performance, seasonal trends (is your business more popular at certain times of the year), and your projections for the future.

Be realistic about your sales projections and forecasting figures. Don’t be tempted to overpromise to impress your potential investors, because the truth will come to light when they do their due diligence before you receive any capital.

If you have not started trading yet you can find out more about forecasting in our other blogs . If you already have sales figure to hand, here is how to create a very basic projection for a product-based business:

- Calculate how many units of a product you sell each month.

- Understand if you have seasonal dips or peaks and adjust the monthly figure appropriately for these months.

- Then add up the total for the year.

If you provide services, then you can do the same by showing how much money will be coming in from contracts or clients you have already won. Calculate how much you’ll be making from each client over the year. Do the same for any customers that are in the pipeline for your business (clients that you are in the process of trying to win). This will also help you find out how many clients/projects you need to win to keep a good amount of cash flow .

Be modest when it comes to your predictions. Set realistic goals that you will be able to sustain because the worst thing you can do is promise an investor that you can make them ‘X amount by next year’ and not be able to deliver.

Exuding confidence and presenting with impact is a skill you will have to learn to present a business plan to potential investors. Making eye contact and using open body language does not come naturally to everyone, but it’s important to look assured when you’re presenting your business plan.

A way to practice this confidence is to record yourself in the weeks or days leading up to the presentation. Video yourself to examine your body language, or record audio so you can listen to the cadence of your voice and identify where you need pauses or more information.

As cringeworthy as this task might feel, it will make a massive difference to the way you present. Seeing yourself from another perspective will be invaluable in identifying areas to improve.

Another thing to practice is being interrupted. In a real investor meeting, you are likely to be stopped and asked to expand on certain figures or areas. Don’t let this trip you up because you only practised the presentation in one long continuous flow.

To plan for this scenario, present the business plan to a friend or colleague and have them ask you questions throughout. This will prepare you for a variety of questions at any point in your presentation.

Whilst you are preparing to present your business plan to potential investors, the Countingup app can help you keep on top of your business finances. The business current account with built-in accounting software helps you save hours on accounting admin, so that you can focus on growing your business. Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

What are the advantages and disadvantages of setting up a private limited company.

Ready to launch your new business? You’re probably wondering whether to set up

Tax advantages of setting up a limited company

When setting up your own business, you’ll have to choose a particular legal

How to set up a limited company

Starting your own business is an exciting time and no doubt you’re eager

Best Side Hustle Ideas To Make Extra Money In 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

How to register a company in the UK

There are over five million companies registered in the UK and 500,000 new

Personal finance vs business finance: How to keep your accounts separate

The main difference between a personal account and a business account is that

Business insurance from Superscript

We’re partnered with insurance experts, Superscript to provide you with small business insurance.

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

How to throw a launch party for a new business

So your business is all set up, what next? A launch party can

How to set sales goals

Want to make manageable and achievable sales goals for your business? Find out

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to Present a Business Plan to Potential Investors

By Fernando Berrocal

Being able to properly market your business plan to potential investors is an essential skill for any startup entrepreneur . When your audience isn't yet engaged, you can easily go overboard on the specifics, or you can show off too little of your startup when your audience expects more. In either case, making a mistake like this might lose you a potential investor who was already interested. In this post, we'll provide you with a strong foundation of information that should assist you to avoid common mistakes that might obstruct your fundraising efforts.

Determine the Amount of Enthusiasm: You must be able to match the material you're delivering to the degree of interest of the individuals you're presenting your business plan to. People who are inexperienced with your project won’t have the patience to read a big booklet. Individuals who are familiar with your idea and business and want to make a significant commitment, on the other hand, would anticipate such information. Unfortunately, this means that a single document will not be enough. It's helpful to think about the process in terms of a sales funnel. The business plan message you present should fit into one of these categories in order of least to most interested.

Elevator Pitch : To people you've just met, you should be able to convey the entire business in a few phrases. It's worthwhile to polish this presentation because you'll be giving it to a variety of stakeholders in your business regularly.

Short Pitch Deck, Lean Canvas , or Executive Summary of a Business Proposal: The brief pitch deck is the industry standard for presenting a business concept to potential investors. However, while the short pitch deck is wonderful for meetings, it loses a little when sent through email for people to read because it is text-heavy. As a result, the Lean Canvas and the executive summary of the business plan may be more appropriate in these situations. These documents have the advantage of being brief while still providing more information than a one-sentence elevator pitch.

Detailed Pitch Deck : A presentation designed to be emailed. It has the same structure as a short pitch deck and provides the same material, but it is more text-heavy and detailed. Instead of the standard 5 to 10-minute pitches, they might be utilized for 15 to 40-minute presentations. Again, devoting 40 minutes to your project indicates that your audience is already intrigued.

Full Business Plan: It's only beneficial to those who plan to invest in the initiative — often investors, but also co-founders, and others. Keep in mind that, while the business plan is typically used to attract investors, its primary function is to provide clarity to the founding team about the way forward.

- The basics of persuading a startup investor of the viability of your concept remain the same whether you use a business plan or a pitch deck.

- Complexity is typically counterproductive since it might cause your audience to get confused. The more complex the strategy, the more likely it's to fail when put into action.

- Start with the issue you're dealing with and the solution you're suggesting:

- Demonstrate the project's potential by discussing the total addressable market and your potential market penetration .

- Give evidence, ideally, enough traction figures to persuade the audience that the tale you're delivering is true.

- Demonstrate the team's competency by exhibiting extensive domain knowledge and, preferably, experience.

Finally, make the request. You have more room in a business plan to discuss what you're searching for – investors, partners, and so on – as well as what you need the resources for. If you can satisfactorily address the problems listed above, you'll be ok on your way to persuading potential investors and partners.

Business Plan should be well-structured: People usually scan through business plans and then use them as a reference resource if they require particular information. This implies that it must be organized rationally for individuals to easily find the information they need. The following is an excellent business plan structure:

- A Summary, also known as an Executive Summary, of the whole plan. It can be delivered as a separate document.

- Discuss the problem, the solution, the target market, the segments, and possibly the competitors.

- Execution of Marketing and Operations Strategy ; milestones are useful for illustrating the path ahead; success measures are also a good idea.

- Cap table, management team, and hiring plan for open/prospective roles are all part of the business structure.

- Financial predictions such as profit and loss and net present value estimates.

In summary, presenting a business concept to investors isn't as simple as it looks, so take the time to learn what the investor expects to see and prepare the necessary documents to make a strong case. However, the pitch deck and business plan are only a framework; the substance is what matters, so make sure you have something useful to say in your business plan.

Ready to bring your startup to the next level? Apply to MassLight’s next batch . MassLight supplies capital and a dedicated tech team. We take equity in return. Have questions? Refer to our FAQ page .

.png)

Keep in touch.

Started in 2000 in Washington DC, Masslight has served the DMV for 18+ years. We serve enterprises and startups with full-stack development and long-term project management services.

Schedule a Meeting

[email protected].

Subscribe to our newsletter

Receive new articles and resources directly on your inbox. Fill your email below to join our email newsletter today.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Successfully Pitch Your Business Idea to Investors

Caroline Cummings

8 min. read

Updated May 10, 2024

If you’re an entrepreneur, you need to know how to pitch your business. Even if you’re not planning to pursue funding, having a solid elevator pitch ensures that you know your business inside and out. Which comes in handy if or when you eventually decide to seek out investment.

- How to make a pitch for investors

Creating a successful pitch starts with a thorough business plan. From there it’s up to you to identify what makes your business valuable and worth investing in. You may have 5-pages of proven financial history and a deep analysis of how you stack up against the competition across multiple industries, but you simply can’t cover it all.

Because, when your pitching to angel investors and venture capitalists for the first time, you’ll often only have around 10-minutes to make your case. Here’s how to make that quick pitch successful.

1. Create a presentation

First, take the time to put together your pitch deck . The goal is to create a deck that is easy for you to work off of and gets investors excited about your business.

Keeping that in mind, you should have a short version that you can speak to within 10-minutes as well as an extended version that includes everything you’d like to give potential investors access to.

You can use our free pitch deck template for Powerpoint to get started. If you need help putting your pitch together, check out this list of tools that can help you put together a professional-looking presentation.

2. Practice your pitch

You need to practice your pitch. Not being able to quickly speak to each element of your business makes every other tip on this list virtually useless.

Too many entrepreneurs think that just by knowing their business they can quickly and succinctly explain its’ value. And having a killer pitch deck with eye-popping visuals will be enough to fall back on. So they go into pitch meetings unprepared.

Instead of being able to say, “I only need 10 minutes of your time,” and actually only taking 10 minutes, you’ll soon find yourself rambling 20 minutes in having only made it through slide 5. Take the time to practice, simplify your messaging, and only keep elements that build up your business. Leave everything else on the cutting room floor.

3. Outline the problem with a story

Begin your pitch with a compelling story. It should address the problem you’re solving in the marketplace. This will engage your audience right out of the gate. And if you’ve done any testing try to include actual data here.

If you can relate your story to your audience, in this case, the investor, even better. What industries have they invested in previously? What pain points do their previous entrepreneurial endeavors have? Do some research about the investor, so you have a good sense of what they care about and can tailor your story to them.

4. Your solution

Share what’s unique about your product and how it will solve the issue you shared in the previous slide.

Keep it short, concise, and easy for the investor to explain to others. Avoid using buzzwords unless your investors are very familiar with your industry. Again, if you’ve done any testing beforehand, plugin results here to give your solution more credibility.

5. Your target market

Don’t say that everyone in the world is potentially your target market , even if it could be true one day.

Be realistic about who you’re building your product for and break out your market into TAM, SAM, and SOM . This will not only impress your audience, but it will help you think more strategically about your roll-out plan.

If you can, try and develop a user persona or your ideal customer when speaking about your target market. This can help investors visualize the potential customer base and displays that you’ve thought intently about who your business will serve. It’s also much easier to speak to a named individual in a quick pitch, rather than a broad demographic.

6. Your revenue or business model

Investors tend to care about this slide the most. How will you make money ? Be very specific about your products and pricing and emphasize again how your market is anxiously awaiting your arrival.

7. Your successes: Early traction and milestones

Early in the presentation, you want to build some credibility. Take some time to share the relevant traction you’ve made.

This is your opportunity to blow your own horn. Impress the investors with what you and your team have accomplished to date (sales, contracts, key hires, product launches, and so on). You’ve likely mentioned bits and pieces of this early on, but this is the point where you create a full snapshot of your business.

But don’t just leave it at what you’ve done, be sure to speak to where you’re going. Show them a roadmap of next steps, additional milestones and even mention how funding will help achieve them.

8. Customer acquisition: Marketing and sales strategy

This is usually one of the most skipped sections of an investor pitch and a full business plan. How will you reach your customers? How much will it cost? How will you measure success?

Your financials should easily allow you to calculate your customer acquisition costs. But you should also mention how you intend to reach customers, which channels you’ll be advertising on, and even present an example of messaging. You’ve done your research, you know your customer, why not show investors what that will look like in action.

9. Your team

Investors invest in people first and ideas second, so be sure to share details about your rock star team and why they are the right people to lead this company.

Also, be sure to share what skill-sets you may be missing on your team. Most startup teams are missing some key talent—be it marketing, management expertise, programmers, sales, operations, financial management, and so on. Let them know that you know that you don’t know everything.

10. Your financial projections

Show what you’re projecting in revenue (per product) over the next three to five years. You must back up your numbers by sharing your assumptions. You’ll see investors taking out their smartphone calculators to make sure your numbers make sense, so give them the information they need to see that your calculations are accurate.

If your financial chart shows “hockey-stick growth,” be sure to explain what happens to cause those inflection points. Now it can be incredibly easy to spend a ton of your time explaining financials but keep in mind that you need to speak to them quickly. If investors want to hear or know more, add your full financials to the extended pitch deck or offer to answer questions after you’ve finished presenting.

11. Your competition

Again, this is a very important part of your pitch, and many people omit this section or don’t provide enough detail about why they’re so different from their competitors.

The best way to communicate your value proposition over your competitors’ is to show this slide in a competitive matrix format —where you list your competitors down the left side of the page, you have your features/benefits across the top, and place checkmarks in the boxes for which company offers that service. Ideally, you have checkmarks across the top for every category, and your competitors lack in key areas to show your competitive advantage.

12. Your funding needs

Clearly spell out how much money has already been invested in your company, by whom, ownership percentages, and how much more you need to go to the next level (and be clear about what level that is). Will you need to raise multiple rounds of financing? Is the investment you’re seeking a convertible note, an equity round, or something else?

Remind the audience why your management team is capable of managing their investment for growth. Tell investors how much you need, why you need the money, what it will be used for, and the intended outcome.

13. Your exit strategy

If you’re seeking large sums of investment capital (over $1M), most investors will want to know what your exit strategy is . Are you planning on getting acquired, going public (very few companies actually do), or something else? Show you’ve done some due diligence on this exit strategy, including the companies you’re targeting, and why it would make sense three, five, or ten years down the road.

14. Follow-up

Investors will want you to be able to back up your claims. Have a well-thought-out business plan on-hand to share, so investors can read more if they’d like to. The intention, after all, is that you deliver a powerful pitch, and by the end, their hands are out asking for either your executive summary or your complete business plan.

15. Take feedback and refine your pitch

No matter the outcome of your pitch, whether you receive funding, another meeting, or rejection, look for areas to improve. Don’t be afraid to ask for feedback and take that into account for the next time you pitch. Now if the investor isn’t willing to provide any, don’t push the issue. It is their time you’ve just spent and are asking more of, so it’s a fine balance to achieve.

If you can, have another team member there to take notes and review with them after the fact. Look for weak-points, areas you stumbled over, and slides that led to negative reactions from the investor. Keep refining, practicing, and executing even if you think you’ve found the perfect pitch.

You’ll really never know how good your pitch is until you actually do it. Don’t stress yourself out, and treat every investor pitch as a learning experience for you and your business. You’ll only continue to get better and better and can apply those learnings to every area of your business.

An entrepreneur. A disruptor. An advocate. Caroline has been the CEO and co-founder of two tech startups—one failed and one she sold. She is passionate about helping other entrepreneurs realize their full potential and learn how to step outside of their comfort zones to catalyze their growth. Caroline is currently executive director of Oregon RAIN . She provides strategic leadership for the organization’s personnel, development, stakeholder relations, and community partnerships. In her dual role as the venture catalyst manager, Cummings oversees the execution of RAIN’s Rural Venture Catalyst programs. She provides outreach and support to small and rural communities; she coaches and mentors regional entrepreneurs, builds strategic local partnerships, and leads educational workshops.

Table of Contents

Related Articles

5 Min. Read

How to Respond When You Don’t Know the Answer to an Investor’s Question

Do You Know How to Pitch Your Startup in Social Situations?

7 Min. Read

5 Sure-fire Ways to Bomb Your Investor Pitch

3 Min. Read

5 Lessons to Learn From “Shark Tank” About Pitching

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

IMAGES

VIDEO

COMMENTS

A business plan provides the structure for thinking through these things and documents your answers so you're prepared for the inevitable questions investors will ask about your business. Even if investors never ask to see your business plan, the work you've done to prepare it will ensure that you can intelligently answer the questions you ...

Learn the business plan presentation for potential investors with our expert guide, including structure, content, and delivery tips. ... How can one effectively handle investor questions during a presentation? The key is preparation; anticipate possible questions based on your content and research thoroughly beforehand. Stay calm if you're ...